Interest Protocol: The DeFi Sensation on BSC and Sui Network

Discover the DeFi sensation on BSC and Sui Network with Interest Protocol - the future of decentralized finance. Join the revolution now!

1. Introduction

Interest Protocol is one of the lending platforms on Sui Blockchain that allows users to swap and lend crypto, fiat, commodities, and assets from other chains.

Interest Protocol consists of three core synergistic products:

- AMM DEX

- Lending Protocol

- Synthetics Protocol

2. Main features

2.1 DEX

Swap

The first and most common feature of exchange is the ability for users to swap / interchange crypto tokens. DEX supports two types of trading algorithms denoted as stable and volatile. Therefore, the user does not need to be concerned because the DEX will always locate the most profitable deal for the user.

To trade, a user specifies the number of tokens they want to sell. The contract will determine how many tokens the trader can purchase. DEX employs the automated market-maker model, with the algorithm determining the price. A trader must indicate how much they are willing to lose in relation to the spot price. Slippage is a proportion that indicates how much risk a trader is willing to take. A 5% slippage, for example, allows the market to execute trades that are 5% more expensive than the spot price.

Pool

Pools are markets with two coins that enable algorithmic trading. Users deposit tokens on Pools in order to gain swap fees. They must supply both tokens to the Pool in the proper ratio. These users are referred to as Liquidity Providers. They make liquidity available for other customers to trade with.

The creation of Pools is permission-less. The requirements are to provide two different tokens and choose a trading algorithm (volatile or stable).

It is prudent to use the stable algorithm for pegged assets such as stablecoins pegged to USD and the volatile algorithm for uncorrelated assets such as ETH and BTC. Users, however, have the option to do otherwise.

Users who contribute liquidity to a Pool are rewarded with LP Tokens. They are minted based on the quantity of tokens contributed to the Pool in comparison to the number of tokens currently in the Pool. Certain LP Tokens can be staked in Farms in order to earn Interest Tokens. Remember that in order to withdraw your tokens from the Pool, you must first exchange them for LP Tokens.

There is no guarantee that one will receive the same number of tokens when withdrawing. The difference between the number of tokens deposited and withdrawn is called impermanent loss.

2.2 Dinero Market

Dinero Markets allow users to borrow stablecoin using cryptocurrencies as collateral. The loans have no maturity as long as the user remains below the maximum loan-to-value ratio determined by the market.

Borrowing

Dinero Markets are one-sided markets. The deposited funds are not lent out to others users. It allows the markets to deposit the tokens in third-party DeFi protocols such as Farms and Lending Protocols to accrue rewards while borrowing.

Key Features

- Dinero Markets do NOT charge deposit fees: This feature indicates that users can deposit their collateral tokens without incurring any fees. It could be an attractive feature for users who are looking for a cost-effective way to deposit their assets on a lending platform.

- Users can only borrow Dinero: It suggests that users can't borrow any other cryptocurrency or fiat currency on Dinero Markets. The platform has a specific focus on Dinero, which could be useful for users who are looking for a simple and straightforward way to borrow funds.

- Contracts use Chainlink Feeds to price the collateral tokens: It implies that the platform uses Chainlink's decentralized oracle network to determine the price of the collateral tokens deposited by users. Chainlink is a reliable oracle solution that provides accurate and transparent price data, which could increase the platform's overall trustworthiness.

- The collateral covers underwater positions: This feature suggests that if the value of the collateral tokens deposited by users falls below a certain threshold, they could still cover the underwater positions. It could be an attractive feature for users who are looking for a platform that protects their collateral against sudden price drops.

- Constant interest rate: This feature suggests that the platform offers a fixed interest rate on Dinero loans, which could be useful for users who prefer predictable and stable returns.

- Collateral tokens may earn profits through third-party Dapps: This feature implies that users can earn additional profits by using third-party decentralized applications (Dapps) while their collateral tokens are deposited on Dinero Markets. It could be an attractive feature for users who are looking for ways to maximize their returns.

Loan To Value

The loan-to-value ratio is a critical factor in borrowing and lending platforms such as Dinero Markets. It determines the risk of liquidation for borrowers and is affected by three key factors: collateral amount, collateral USD price, and loan amount. Users can reduce their loan-to-value ratio by depositing more collateral or repaying a portion of their loan.

However, they must also monitor their loan-to-value ratio during bear markets as a decrease in the collateral USD price can increase their risk of liquidation. Dinero Markets' constant and predictable interest rates can help borrowers manage their borrowing costs and make informed decisions about their borrowing activities. Overall, understanding the loan-to-value ratio is essential for users to manage their risks and maximize their returns on lending platforms.

Interest Rate

The interest rate determines the cost of borrowing Dinero. For example, a market with an interest rate of 10% means that if a user borrows 100 Dinero, he must repay 110 Dinero one year later.

Cost of Loan = Interest Rate * Duration * Principal

Liquidations

Loans are subject to liquidation when a position’s loan-to-value ratio increases above the market’s loan-to-value ratio.

Let us assume a user is borrowing 100 Dinero from a market with a liquidation fee of 5%. If such a user gets liquidated, he will lose 105 USD in collateral, losing 100 USD to cover the 100 Dinero and 5 USD as a penalty that is rewarded to the liquidator.

Any user can liquidate a position underwater. There are two options available:

- Liquidators have the option to burn their own Dinero to cover the loan, and as a reward, they will get the same value in USD in collateral tokens plus a reward fee paid by the borrower.

- The second option does not require the liquidator to have enough Dinero to cover the loan. The contract will sell enough collateral to cover the underwater position plus a reward. However, the cost of the slippage will be incurred by the liquidator.

2.3 Synthetics

Loan To Value

The loan-to-value ratio determines the health of the position in overcollateralized markets. On Interest Protocol synthetic markets, it determines the following:

- How much collateral the user can withdraw

- How many synthetic tokens the user can mint

- If the user position is healthy or underwater

Incentives

Minters of synthetic tokens enjoy a myriad of benefits:

- No fees on transfers

- Rewarded with transfer fees

- Rewarded with Interest Tokens

Liquidations

A liquidation can be started by anyone. The protocol closes an underwater position during a liquidation event by converting enough collateral to equal the value of the user-created synthetic tokens. Only when an account LTV exceeds the market LTV can liquidations take place. The user may freely remove his collateral following a liquidation event and retain the artificial tokens indefinitely.

3. Tokenomics

Interest Protocol has two tokens

- Dinero is an overcollateralized stablecoin minted by contracts. It has an elastic supply. It is minted when users get loans and burned when borrowers repay them.

- Interest Token is a governance token with no maximum supply and a fixed minting rate. It is distributed via farms to specific LP tokens as a reward for providing liquidity to the protocol.

Interest Token distribution is not final. Consider the figures below a rough draft

- Liquidity Incentives: 40%

- Team: 18%

- Treasury: 10%

- Community Growth 10%

- Seed: 5%

- Security & Bounties: 5%

- Private Sale: 4%

- IFO: 3%

- Airdrop: 3%

- Advisors: 2%

Fund Raising Plan

Use of Funds: $3,100,000

- Equipment: 2%

- Security: 16%

- Operating expenses: 6%

- Wages and salaries: 54%

- Marketing: 22%

⇒ Q2 2023: Seed raise & expand team

⇒ Q3 2023: Launch lending markets

⇒ Q4 2023: Launch on Sui Network

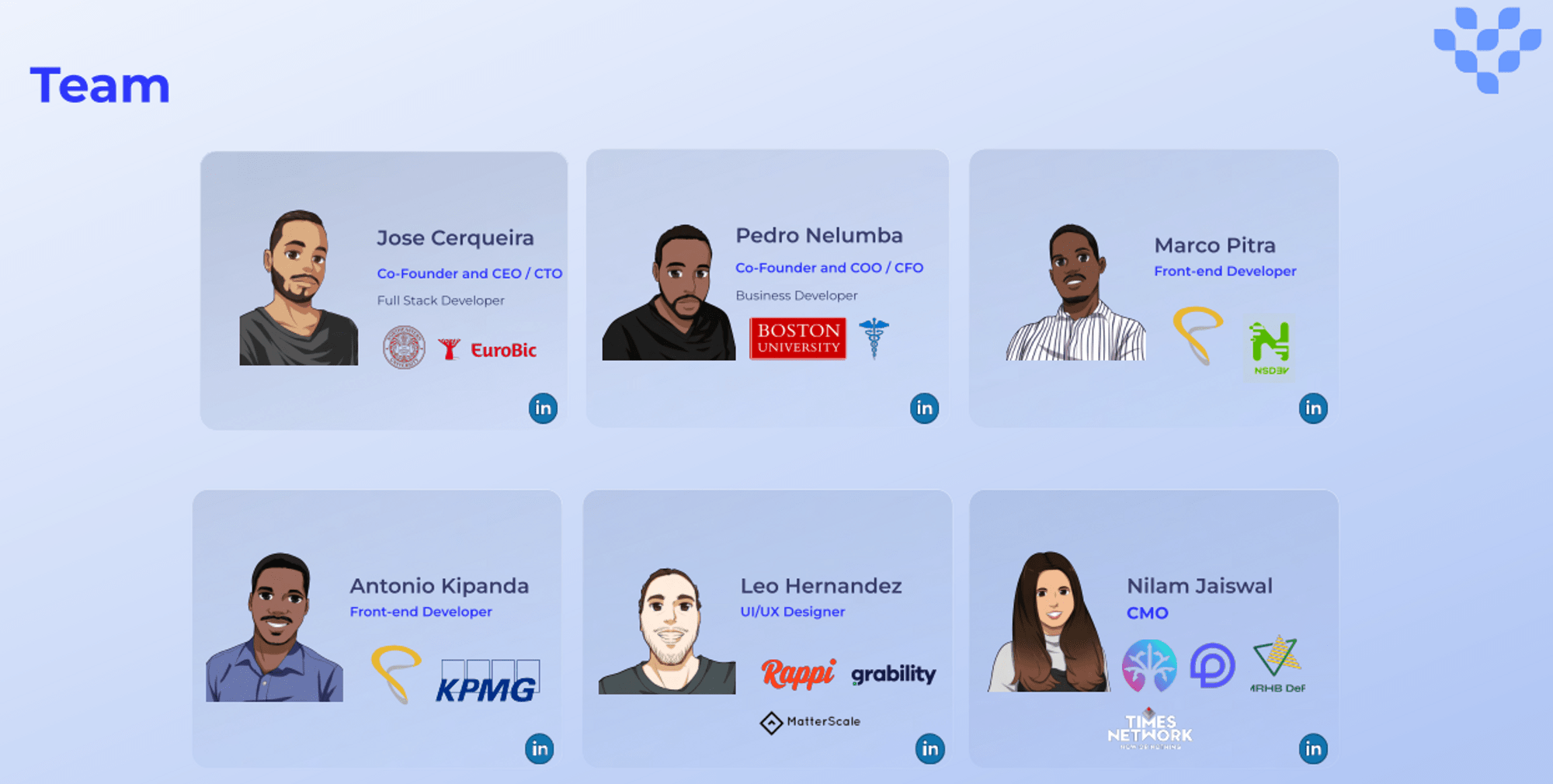

4. Team

Interest Protocol is a European-based team of tech entrepreneurs with a combined experience of 10 years in the crypto industry. The team values security above all else and prioritizes shipping slowly but securely, in contrast to the popular mantra of "Move fast and Break Things.” Among them are typical members such as

- José Cerqueira (Co-Founder & CEO): Previously at Banco EuroBIC. 6 years of software development. 6 years in the crypto industry. Responsible for the smart contract development of Interest Protocol.

- José P. Nelumba (Co-Founder & CFO): Crypto advocate since 2017. Co-founder of a medical emergency tech company that has saved over 1000 lives. Responsible for fundraising and managing the Interest Protocol finances.

- Nilam Jaiswal, the marketing manager, has been actively involved in the crypto market for the past three years and has managed end-to-end marketing for over 20 projects.

5. Partners & Backers

Interest Protocol is communicating with the BNB chain & Sui Blockchain operations team to attract more users. After the public sale, Interest Protocol plans to work closely with Certik and Chainlink.

Besides, Interest Protocol has cooperated with many projects to jointly develop DeFi ecosystem, and technology integration such as Martian Wallet, Ethos Wallet, and Redstone

6. Roadmap

The current tasks the development team is working on can be found **here.** Some tasks are not on the roadmap: UI optimizations, bug fixes, etc…

Done

- Volatile + Stable SWAP

- Masterchef Farms

- Dinero ERC20 lending markets

- Dinero LP tokens lending markets

- Stable Vaults

- Deploy DEX v1 on Sui Dev net

- Deploy DEX v2 on Sui Dev net

Ongoing & Upcoming features in 2023

- Deploy Farms on Sui Dev net

- Sui Lending Protocol

- Seed Round

- Private Sale

- Public Sale

- Concentrated Liquidity on Sui DEX

- Audits (Certik/Peckshield/etc...)

- Main net Deployment (BNB Chain)

- Deploy on Sui Main net

- Dinero PCS LP tokens lending markets

- Dinero BSW LP tokens lending markets

- Interest Bearing Stable Vaults

- Interest Bearing Token Dinero Markets

- Ethereum Expansion

- DAO

7. Official links

- Twitter: https://twitter.com/interest_dinero

- Websites: https://www.interestprotocol.com/

- Discord: https://discord.com/invite/interestprotocol

- Telegram Channel: https://t.me/interestprotocol

- Medium: https://medium.com/@interestprotocol

- Github: https://github.com/interest-protocol/

8. Summary

The project already launched the DEX Interest Protocol on the Sui Blockchain in January. However, the initial version is limited and is only for testing simple swaps. In addition, the development team listened to the community and started coding to release all the requested features on V2. Besides, the project has a team with many years of experience in the blockchain field and has outstanding backers. Promises to explode in the near future. Here is all the information about the project. Because this is of a new project, you should consider it carefully before making an investment decision.

In addition, there are many Dapps on Sui Blockchain and Sui DeFi Protocols, learning now will help you grasp the extremely useful protocols working on Sui.