Top 7 Lending Platforms On Sui Blockchain

Boost your investments on Sui Blockchain with our top 7 lending platforms. Earn high returns & leverage the power of decentralized finance.

Discover the power of decentralized finance with the Sui Blockchain's top 7 lending platforms. In this article, we showcase the most reputable, user-friendly, and profitable platforms available today. Whether you're an experienced investor or just starting out, these platforms provide a unique opportunity to earn high returns while leveraging the innovative technology of blockchain. Join us as we explore the world of lending on Sui Blockchain and uncover the top lending platforms that can help you take your investments to the next level.

1. OmniBTC

OmniBTC is a lending platform on the Sui Blockchain that seeks to provide users with a seamless cross-chain DeFi experience. At the heart of this system is the DOLA Protocol, a decentralized omnichain liquidity aggregation protocol that allows for fully composable cross-chain DeFi transactions. With the use of DOLA Protocol and integration with other DEXs and Bridges, OmniBTC offers user-friendly omnichain financial applications such as OmniSwap, OmniLending, and PSC.

The goal of OmniBTC is to connect and unify all on-chain liquidity and provide users with the best cross-chain experience possible. OmniBTC has already integrated with several DEXs and omnichain interoperability protocols such as Wormhole and LayerZero and is currently focused on Sui and Aptos.

OmniBTC official links: Twitter | Website | Discord

2. ABEL Finance

ABEL Finance is a cross-chain lending platform built on Aptos and Sui that offers seamless lending services to users. The platform supports a variety of secured assets, such as Coin and "AMM LP Coin" and NFT. One of the unique features of ABEL Finance is its cross-chain lending capabilities, which allow for the efficient transfer of multi-chain assets. The platform also offers LP Coin holders the ability to lend other Coins by pledging their LP, instead of destroying it to obtain liquidity.

ABEL Finance provides mining possibilities for Coin holders, and holders of a single currency can earn interest income and liquidity by supplying Coin to provide airdrop rewards. Additionally, excess liquidity is regularly invested in compound and other capital pools to generate secondary income. The platform is fully decentralized, and the community has autonomy over its operations. ABEL Finance has implemented CompoundV2 using the MOVE language and offers official treasury insurance.

ABEL Finance official links: Twitter | Website | Discord

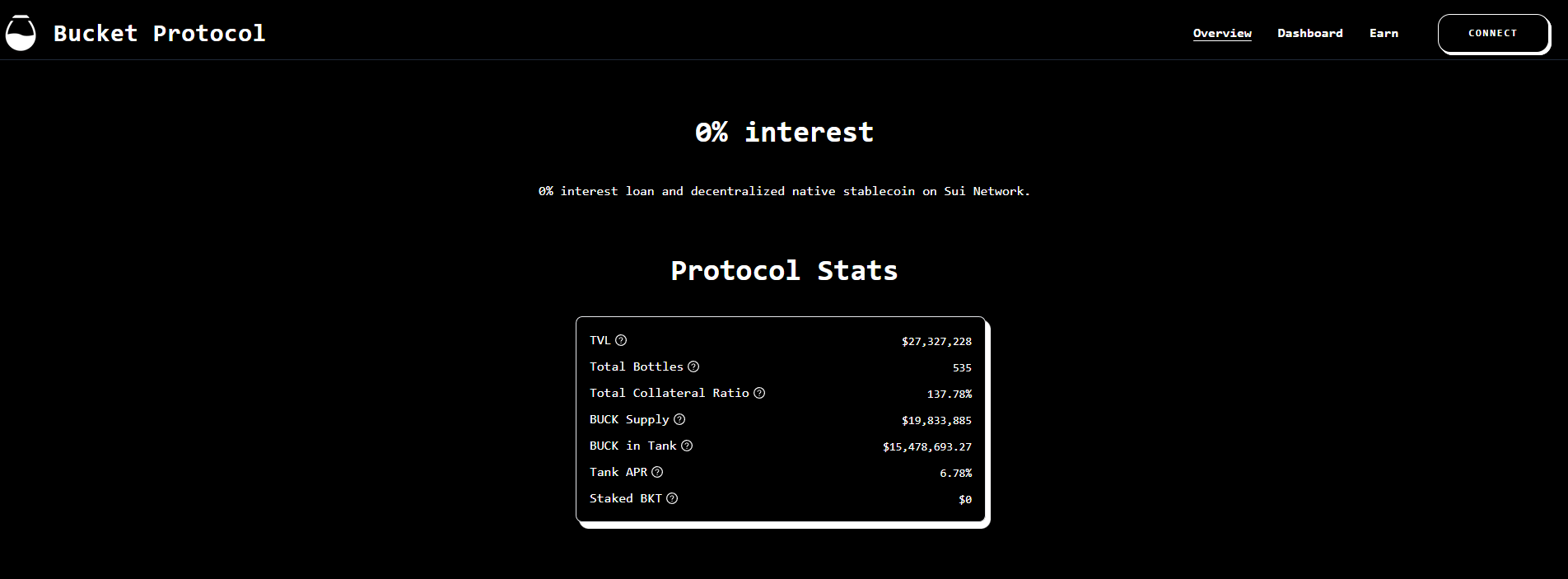

3. Bucket Protocol

Bucket Protocol provides 0% interest loan and native stablecoin ($BUCK) backed by multiple types of over-collateralized crypto assets such as $SUI, $BTC, $ETH and also LSD in the future. In order to assure $BUCK strongly pegged to $1, we’ve also designed efficient liquidation mechanism, tiered oracle system, and flashloan service. Our main goal is to establish a robust and fundamental DeFi engine on Sui Network.Bucket Protocol provides 0% interest loan and native stablecoin ($BUCK) backed by multiple types of over-collateralized crypto assets such as $SUI, $BTC, $ETH and also LSD in the future. In order to assure $BUCK strongly pegged to $1, we’ve also designed efficient liquidation mechanism, tiered oracle system, and flashloan service. Our main goal is to establish a robust and fundamental DeFi engine on Sui Network.

Bucket Protocol official links: Twitter | Website

4. Interest Protocol

Interest Protocol is a cutting-edge DeFi protocol on the Sui blockchain that allows users to trade, farm and borrow. Its DEX features two unique trading formulas to accurately price assets. Stable markets maintain the price of two pegged assets such as BUSD and USDT, while volatile markets price uncorrelated assets like BTC and ETH. Liquidity providers on Interest Protocol’s platform can also offset impermanent loss by borrowing Dinero, a stablecoin, using their LP tokens as collateral.

Best of all, loans with LP tokens as collateral have no cost, and collateral tokens are placed on our farms to earn Interest Tokens. Interest Protocol prioritizes security and adopts a slow but secure approach in development to ensure the safety of our users' funds. Join Interest Protocol and experience DeFi like never before.

Interest Protocol official links: Twitter | Website | Discord

5. Scallop

Scallop is a next-generation interest rate machine that operates as the leading Premium Bonds protocol on Solana and is set to expand to Rust/Move blockchains such as Aptos and Sui. It provides a seamless user experience where users can deposit or withdraw tokens on our on-chain program asset pool, which utilizes lending, staking, and stable pool liquidity mining protocol to generate yield. A verifiable random function is called every day to pick a winner in each pool, who will receive all of the yields.

The remaining yields will be kept in the Scallop treasury and will be governed by the community. The Scallop Tank user dashboard and Scallop Decorations on-chain collectibles are unique features that make Scallop stand out from other DeFi protocols. Scallop Decorations interact with Scallop protocol and appear in Scallop Tank, giving users a more immersive experience. Security and ease of use are our top priorities, and we strive to provide users with a transparent and secure platform to maximize their earnings.

Scallop official links: Twitter | Website

6. ShylockFi

ShylockFi is a next-generation lending platform on the Sui blockchain that allows instant liquidity for NFT collections through a dynamic orderbook. With ShylockFi, lenders can provide liquidity for NFT collections and borrowers can take out a loan by putting up their NFT as collateral. Borrowers can keep a wrapped version of their NFT in their wallet and will receive the actual NFT back upon repayment.

If a borrower defaults, the lender gets to keep the NFT. Lenders can browse collections and name their price, with the current best offer shown to borrowers. At the end of the loan period, lenders receive the total loan amount, including interest. ShylockFi also allows users to quickly borrow against their NFTs by accepting a loan offer, which creates a secure contract that holds the NFT as collateral.

ShylockFi official links: Twitter | Website

7. Wisp Swap

Wisp Swap is an advanced AMM DEX and protocol that offers low transaction fees and maximizes capital efficiency for users and liquidity providers. Built on the Sui network, Wisp Swap provides a comprehensive suite of financial products including trade, lending, staking, yield farming, and launch. The platform is distinguished from others by four key components. Firstly, the Concentrated Liquidity Market Maker (CLMM) increases depth to handle larger volumes with less capital by allocating liquidity within a specified price range. Secondly, the Impermanent Loss (IL) Insurance Pool covers liquidity providers against impermanent loss in both directions, alleviating opportunity costs.

Thirdly, the Decentralized Limit Order Book (DLOB) is a permissionless system that routes orders through multi-sourced liquidity mechanisms, improving capital efficiency for retail and institutional traders. Finally, the Decentralized Autonomous Organization (DAO) ensures community participation and governance by aligning community members with the project's goals and passing the governance torch and treasury management over to them.

Wisp Swap official links: Twitter | Website | Discord

Wrapping up

In conclusion, the Sui Blockchain offers a wealth of opportunities for investors seeking high returns and decentralized finance solutions. The lending platforms we have highlighted in this article represent the best of the best, providing a reliable and profitable way to invest in this innovative technology. With the power of blockchain behind you, you can enjoy a new level of financial freedom and security. So why wait? Start exploring these top lending platforms on Sui Blockchain today and take the first step towards achieving your investment goals.

Besides the information about the lending platforms on Sui, you should also have knowledge about the Dapps on Sui and Sui Blockchain DeFi Protocol. Suipiens articles will give you all the information you need.