Explained 101: Crypto Venture Capital Financing

Explore the landscape of venture capital financing in the cryptocurrency domain, breaking down complex concepts into digestible insights in this article.

What is Venture Capital Financing?

Venture capital (VC) is a form of financing that institutional investors provide to entrepreneurs and startup businesses, usually at the expansion stage of their businesses.

Imagine a pool of institutional investors extending a helping hand to startups and entrepreneurs in need of capital for expansion. This is the essence of venture VC financing. Unlike traditional bank loans, VC financing involves backing businesses that might not have established revenues yet, embracing higher risks for potentially higher rewards.

Venture capitalists, or VCs, typically receive an equity stake in return for their investment. But it's not just about money; VCs bring strategic guidance, industry expertise, and networking opportunities to the table. For emerging businesses, VC investment is a lifeline, fueling product development, market expansion, and operational scaling.

VC financing involves stages: early-stage financing for product development, later-stage funding for market expansion, and seed investment. Each venture's financial commitment varies based on growth stage, industry, and potential.

How does Crypto Venture Capital operate?

In the cryptocurrency world, venture capital financing operates much like its traditional counterpart. The distinction lies in the startups benefiting from this funding - they operate within the cryptocurrency landscape.

Crypto venture capital firms invest in projects related to cryptocurrencies, blockchain technology, decentralized finance (DeFi), and innovative distributed ledger applications. From new cryptocurrencies to smart contracts and decentralized applications (DApps), the spectrum is broad.

Instead of owning stocks, crypto VCs often invest in tokens issued by the project. These tokens can serve various purposes, such as utility tokens granting platform access or security tokens conferring ownership rights.

These firms might participate in token sales, acquiring tokens early on. Due diligence is crucial; it involves scrutinizing a project's technology, market demand, token economics, and regulatory compliance.

Beyond funding, crypto VCs offer strategic guidance, regulatory support, business development, marketing, and community building. Successful exits - when a project grows rapidly, gets acquired, or lists tokens on exchanges - mark the culmination of their investments.

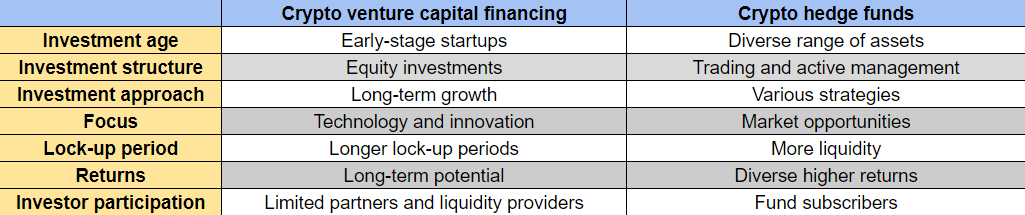

The Differences between Venture Capital and Hedge Funds

Crypto venture capital financing and crypto hedge funds are two distinct investment avenues. While hedge funds actively manage portfolios of cryptocurrencies and tokens, venture capital financing focuses on early-stage equity investments. Hedge funds use trading strategies, arbitrage, and algorithmic trading to generate returns.

The future ahead for Crypto Venture Capital

Recent regulatory charges against major crypto exchanges emphasize the need for careful investment consideration. Regulatory scrutiny could influence VC financing strategies, leading to enhanced due diligence.

In response to these regulatory challenges, crypto venture capital firms are likely to fine-tune their due diligence processes. This could involve a deeper evaluation of a project's regulatory compliance, risk assessment, and potential legal implications. As the crypto space continues to evolve, venture capitalists may need to bolster their legal and regulatory analysis teams to ensure that their investments align seamlessly with the evolving regulatory landscape.

Furthermore, the charges against crypto exchanges may spark a greater dialogue between industry players and regulators. Collaborative efforts to establish clearer regulatory frameworks could help create a more stable and conducive environment for venture capital financing. This collaboration might lead to the development of guidelines that address both investor protection and innovation, striking a delicate balance between fostering growth and ensuring compliance.

Conclusion

Crypto venture capital financing is a dynamic force driving innovation in the cryptocurrency space. As regulations and technologies evolve, VC firms will adapt, fostering growth while prioritizing compliance and transparency. This journey is a testament to the intricate interplay between innovation, risk-taking, and strategic foresight in the world of crypto financing.

As we look ahead, it's evident that the convergence of venture capital and the crypto space will continue to redefine traditional finance. The journey is still unfolding, and with every investment, strategic partnership, and regulatory adaptation, the legacy of crypto venture capital grows stronger. It's a legacy built on innovation, collaboration, and the unwavering pursuit of a financial landscape that knows no boundaries.

Be sure to check out Suipiens' website and social media channels to stay up-to-date on all things about Sui Blockchain!