Top 5 Decentralized Exchanges On Sui Blockchain

Our list of the top five decentralized exchanges on the Sui Blockchain will provide you with all the most useful information about this new blockchain.

Introduction

Ready to get your hands on some of the best decentralized exchanges you can find? With DeFi becoming increasingly popular and many users having success with decentralized finance, it's time to look at Sui Blockchain which has now become a leading platform for these kinds of transactions. This upcoming blog post will explore five of the absolute best DEXs that are available on this blockchain. If you want to be part of the ever-growing world of crypto trading and stay ahead of the curve in terms of developments relating to blockchain technology then read on as we explore our list!

What Is A Dex (Decentralized Exchange)?

Decentralized exchanges (or DEXs) are cryptocurrency exchanges that can operate for crypto assets without relying on outside services. They enable direct communication between dealers. While DEX performs similar tasks to conventional centralized platforms, it also offers a direct peer-to-peer trading system based on smart contract execution.

This kind of transaction requires that all parties participating in the transaction retain ownership of their private keys and digital assets, keeping them separate from any middlemen or custodians. In other words, a DEX is a platform that allows users to discover counter orders for their buy and sell orders without relying on a central organization to store and exchange assets.

Top 5 Decentralized Exchanges On Sui Blockchain

Here are the top 5 DEXs on Sui Blockchain:

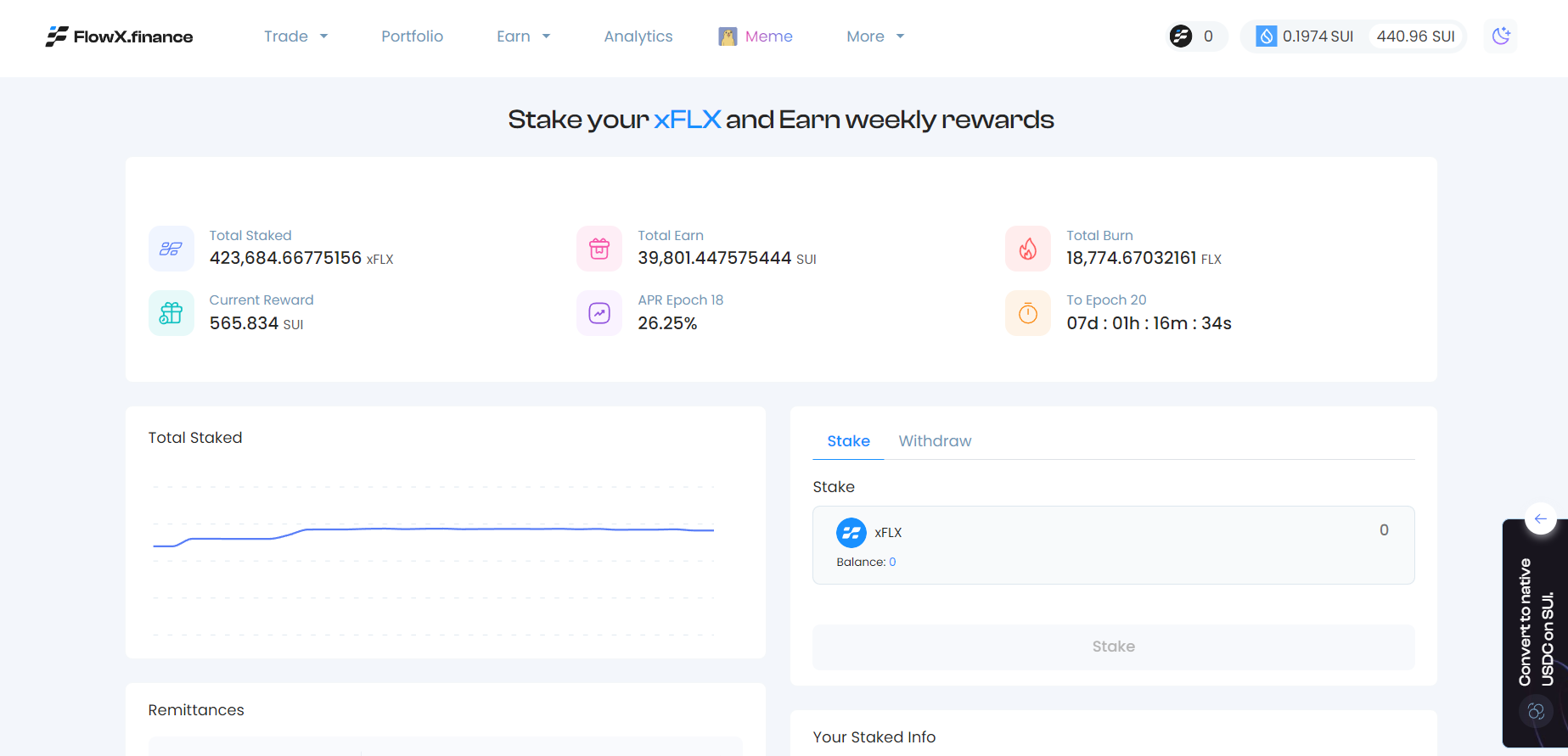

FlowX Finance

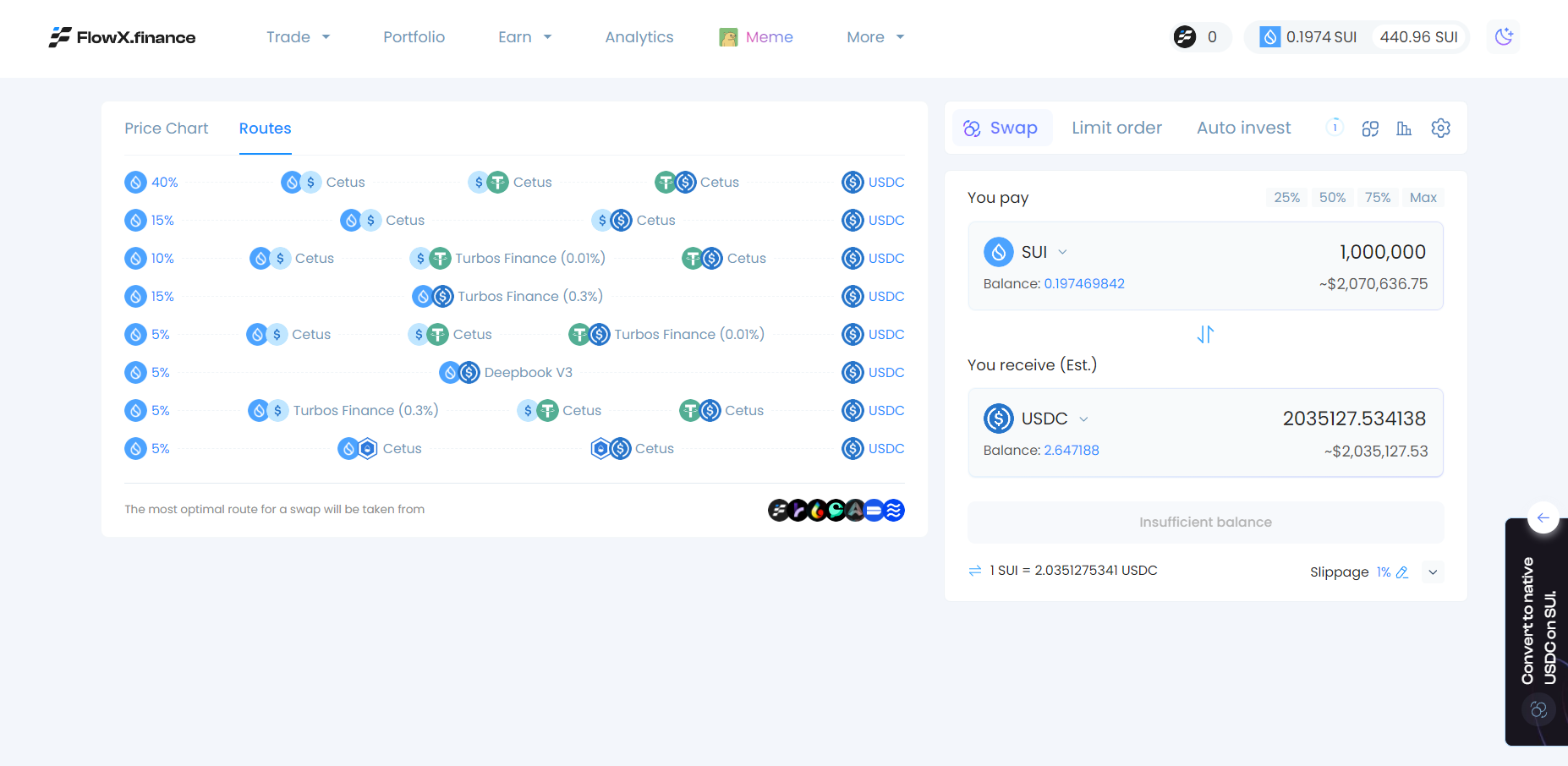

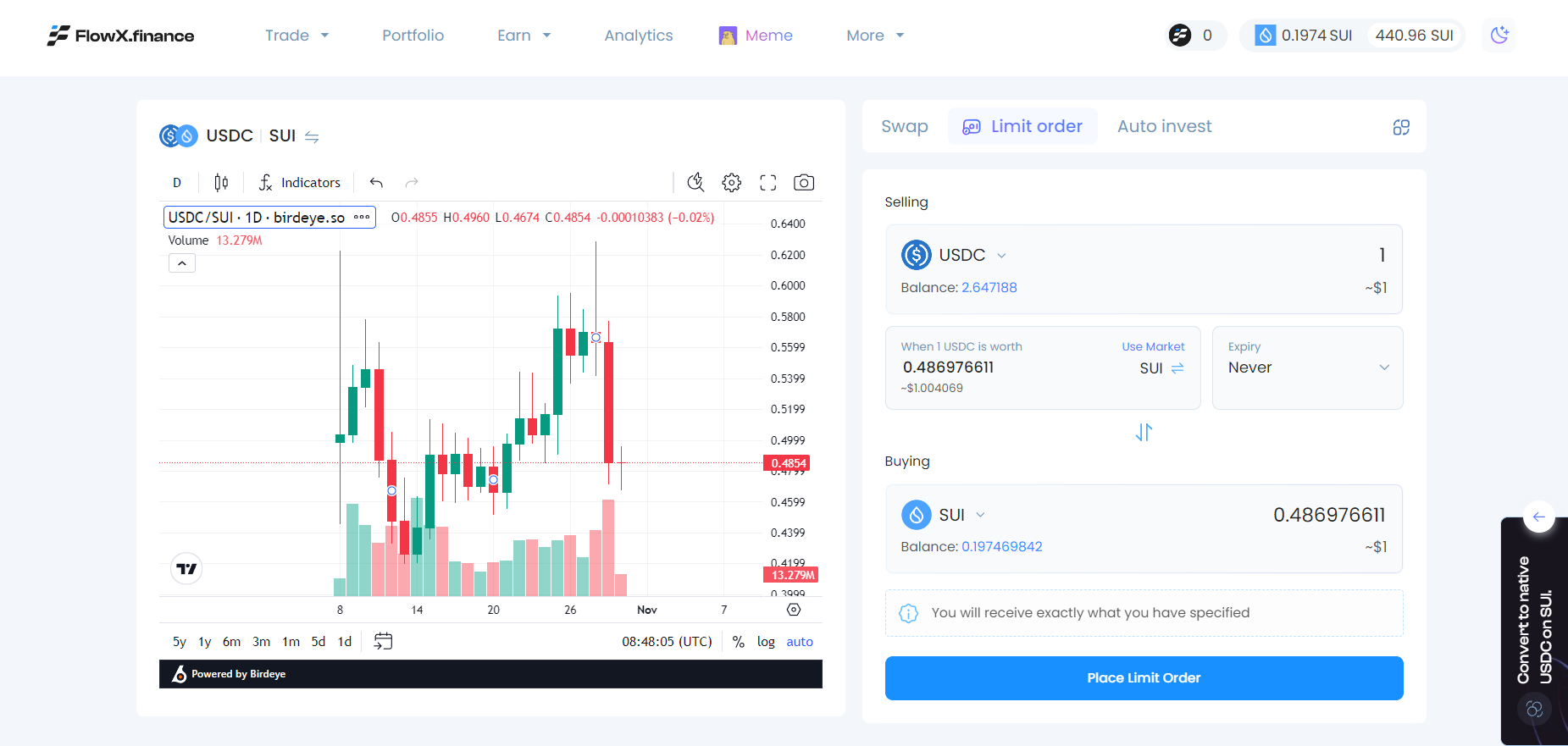

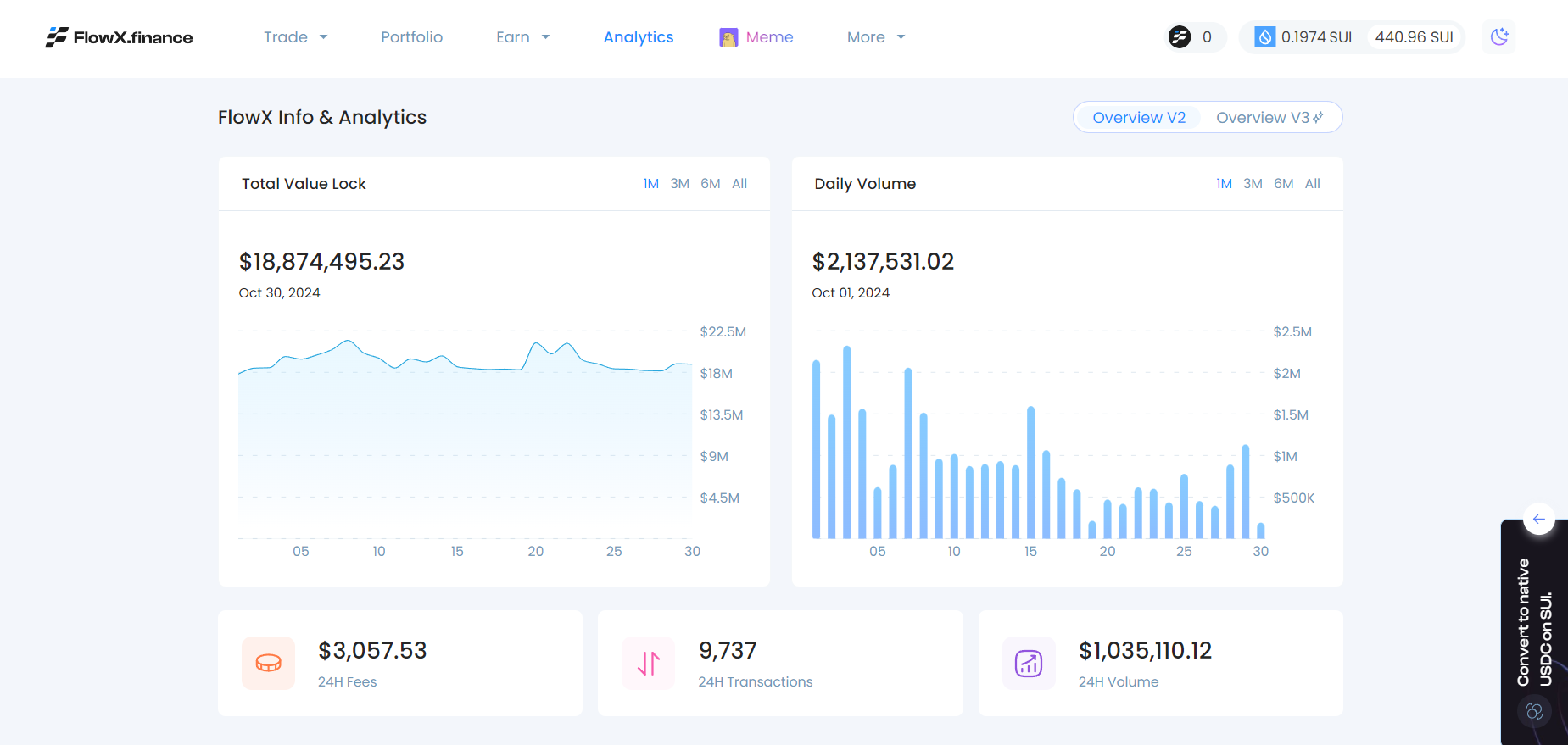

FlowX Finance is an ecosystem-focused decentralized exchange (DEX) built on the Sui blockchain. It is the ultimate destination for all trading needs, designed to provide a seamless, user-friendly experience.

For users, they can enjoy a smooth trading experience with the best rates aggregated from all AMMs on SUI. The platform offers an intuitive UI and allows users to participate in various vital services in DeFi, such as token swapping, liquidity contribution, yield farming, and joining IDO campaigns on FlowX launchpad.

FlowX Finance stands out by prioritizing the improvement of the DeFi user experience with a variety of advanced features. Our platform offers a multi-token swap function, a liquidity management dashboard, position migrating, and a decentralized exchange aggregator.

By pooling liquidity from various DEXs, FlowX Finance optimizes user trading by providing better prices, lower transaction costs, and reduced slippage compared to trading on any single DEX. With FaaS, FlowX provides new projects with a convenient and efficient way to launch their token's liquidity pool. By utilizing FlowX's FaaS, projects can reduce their contract creation costs and reach a wider user base.

FlowX Finance also provides listing and market-making services, making it easy to operate farming campaigns with Farming as a Service features.

FlowX official links: Website | Twitter | Discord

Some images about FlowX Finance:

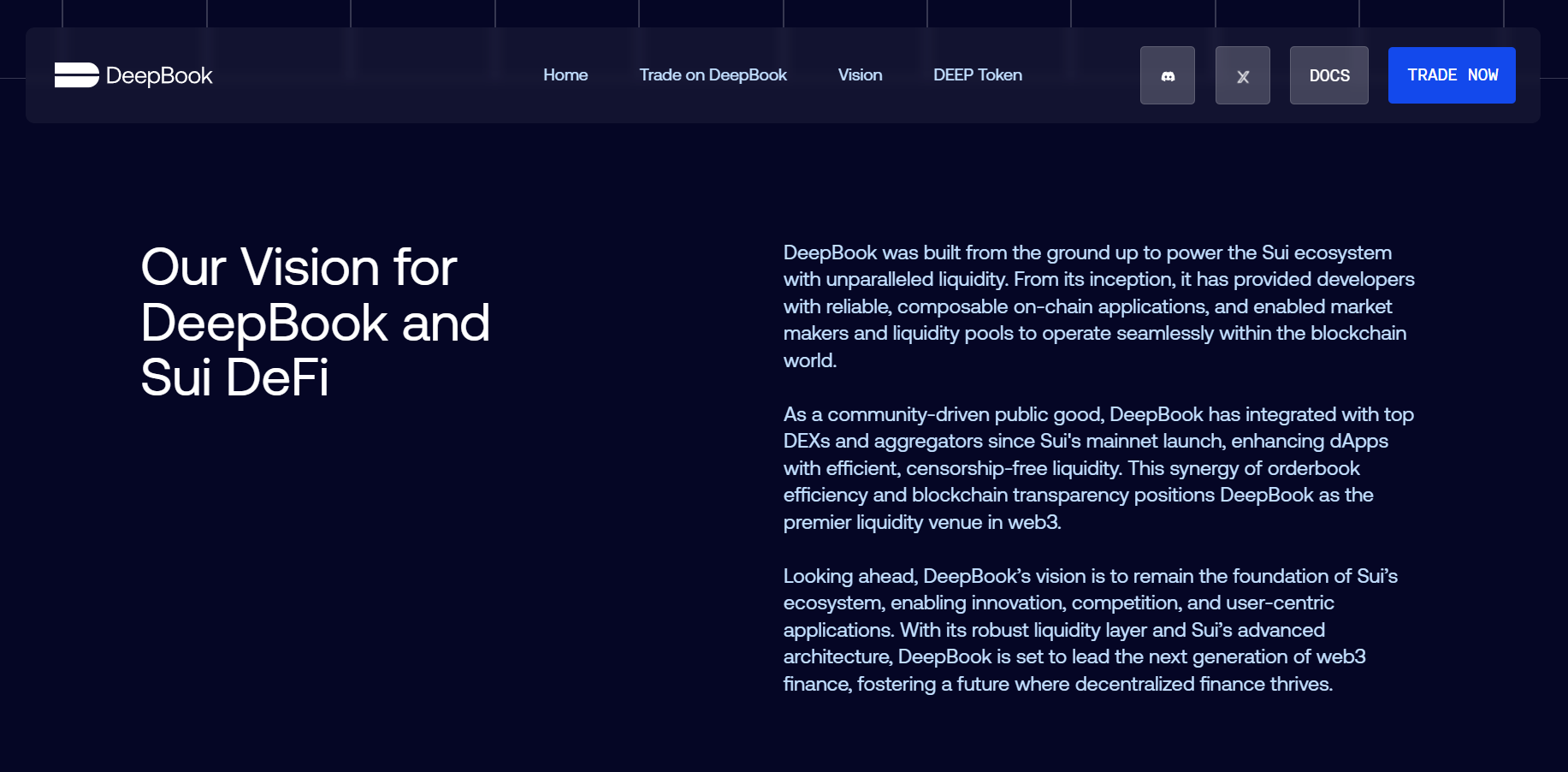

DeepBook

DeepBook is a next-generation decentralized central limit order book (CLOB) built on Sui. DeepBook leverages Sui's parallel execution and low transaction fees to bring a highly performant, low-latency exchange on chain.

As Sui's first native liquidity layer, DeepBook provides token trading activity. Token exchanges leveraging the layer can feature transparency, a full range of trading options, and customer privacy. DeepBook operates as a decentralized and permissionless environment to support token trades.

The latest version delivers new features including flash loans, governance, improved account abstraction, and enhancements to the existing matching engine. This version also introduces its own tokenomics with the DEEP token, which users can stake for additional benefits.

DeepBook does not include an end-user interface for token trading. Rather, it offers built-in trading functionality that can support token trades from decentralized exchanges, wallets, or other apps. The available SDK abstracts away a lot of the complexities of interacting with the chain and building programmable transaction blocks, lowering the barrier of entry for active market making.

DeepBook official links: Website | Twitter | Discord

Some images about DeepBook:

Cetus

Cetus is a pioneer DEX and concentrated liquidity protocol built on the Sui and Aptos blockchain. The mission of Cetus is building a powerful and flexible underlying liquidity network to make trading easier for any users and assets. It focuses on delivering the best trading experience and superior liquidity efficiency to DeFi users through the process of building its concentrated liquidity protocol and a series of affiliate interoperable functional modules.

All the major tools and functions on Cetus are basically built with a permissionless standard. It allows users or other applications to utilize its protocols for their own use cases at any time. No matter it’s to set up a new trading pool, or to allocate incentives to rent liquidity from the public.

Cetus is building a highly-customizable liquidity protocol based on CLMM. Through flexible composition of swap, range order and limit order, users can almost conduct all kinds of complex trading strategies that could be achieved on a CEX. Besides, liquidity providers are also able to execute various Maker strategies using CLMM to maximize their liquidity efficiency.

Cetus embraces the concept of “Liquidity As A Service”, so it emphasizes the ease of integration when building its products. Developers and applications can easily access the liquidity on Cetus to build their own products such as liquidity vault, derivatives, leveraged farming, etc. A new project team can also easily set up a swap interface on its own front end by integrating Cetus SDK, which will help them access the liquidity of Cetus and even the whole market real quick.

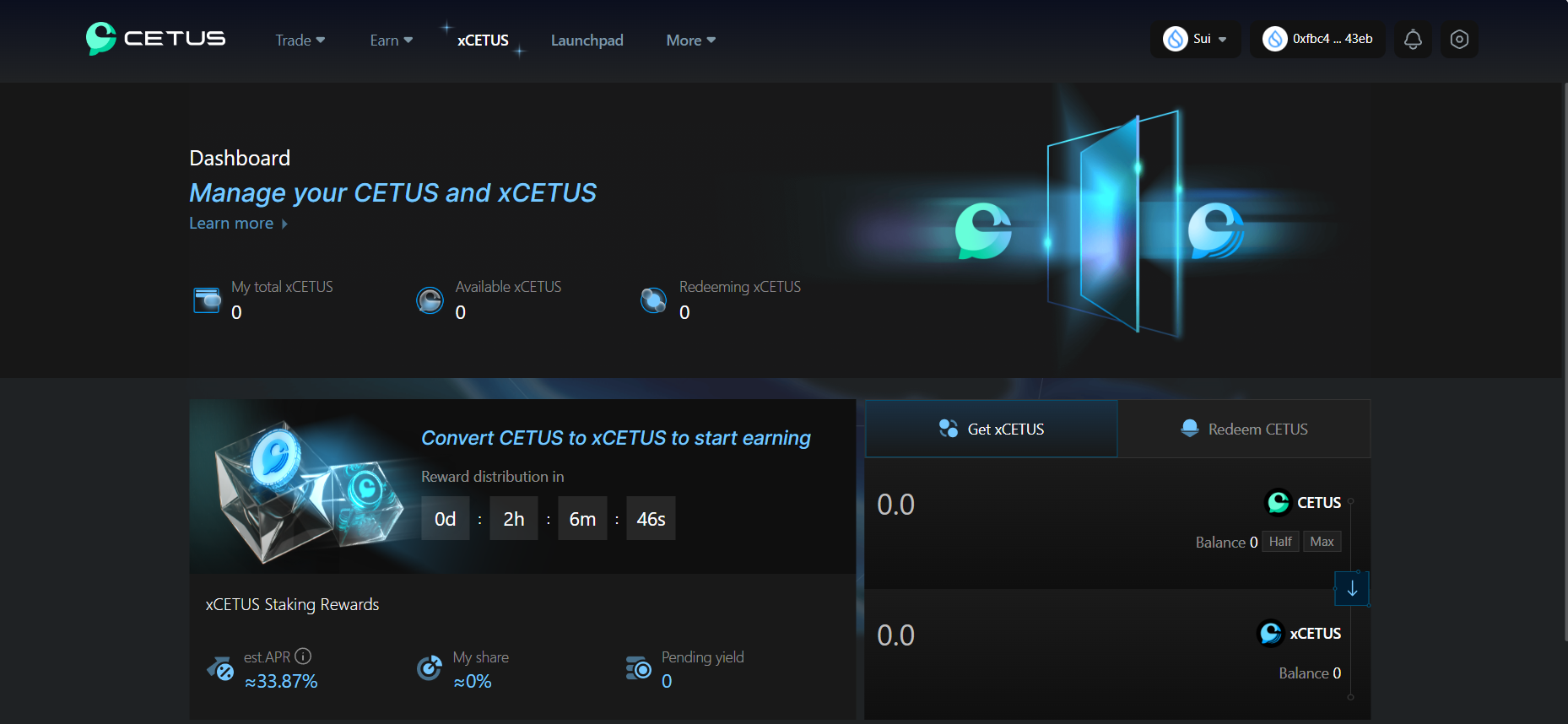

Cetus adopts a double-token model fueled by CETUS and xCETUS. Long term and dynamic incentivization sustained by protocol earnings is implemented to reward those active participants of the protocol. It wants to make sure the real contributors of the protocol can be effectively incentivized by the scientific token economy.

Cetus official links: Website | Twitter | Discord

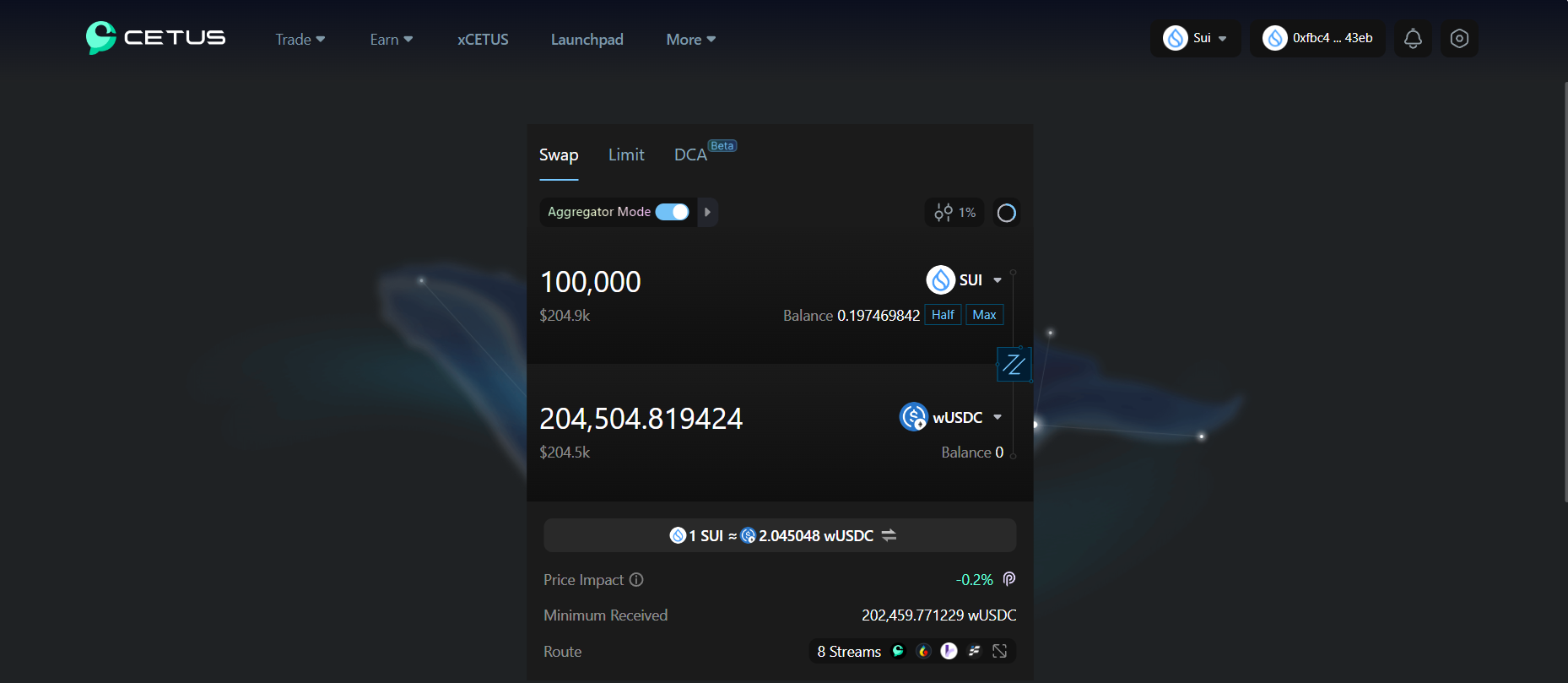

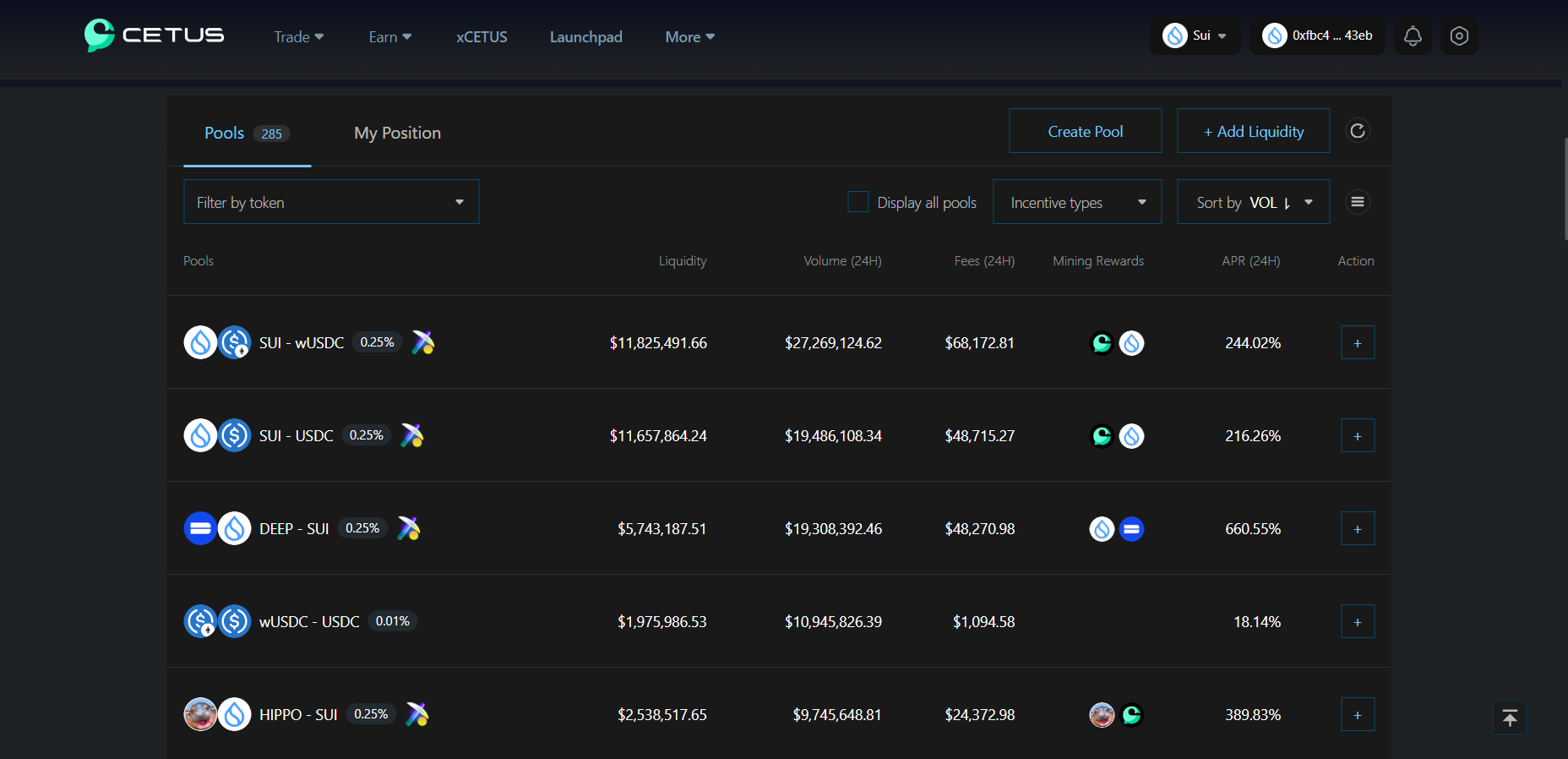

Some images about Cetus:

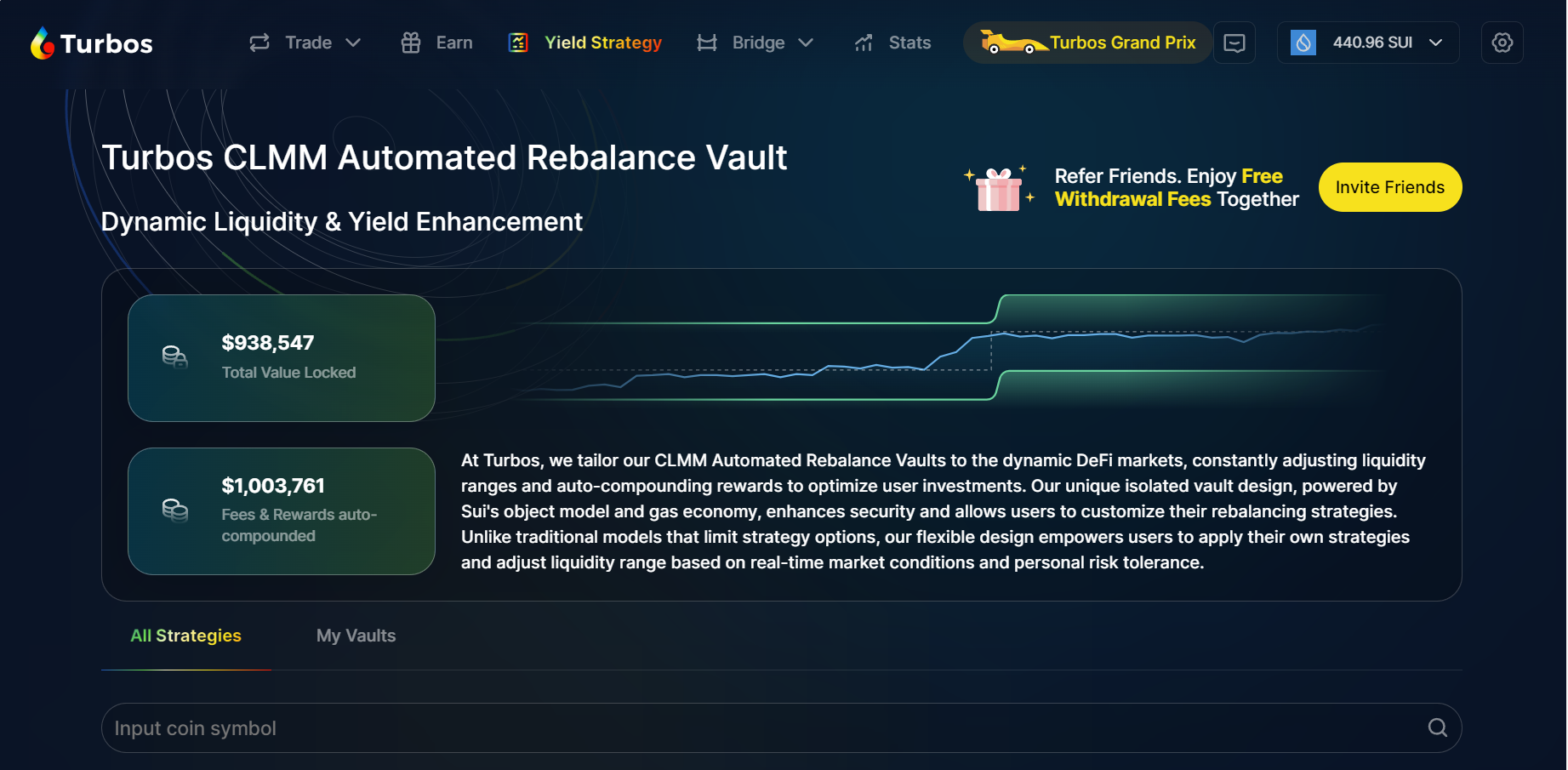

Turbos

Turbos is a non-custodial decentralized exchange (DEX) built around the Concentrated Liquidity Market Maker (CLMM) model on the Sui Network. Turbos brings a universal notion of digital asset ownership and unprecedent horizontal scalability to decentralized finance (DeFi).

Founded in June 2022, Turbos is supported by Mysten Labs and is backed by experts in DeFi and cryptocurrency trading, including Jump. Turbos’ mission is to make DeFi accessible to the next billion Web3 users and to serve as a pivot between Sui ecosystem projects and the market.

Building on Sui, Turbos makes use of Sui to empower the trading requirements of additional users. They are dedicated to developing into a derivatives trading hub in the Sui ecosystem, offering customers decentralized trading of perpetual contracts and zero-slippage swap services.

Users are able to do business in a more secure and productive trading environment thanks to Turbos, a significant and busy decentralized perpetual exchange built on Sui Blockchain. Its objective is to establish a project that is genuinely community-driven, where each and every one of users is actively influencing our future.

Turbos official links: Website | Twitter | Discord

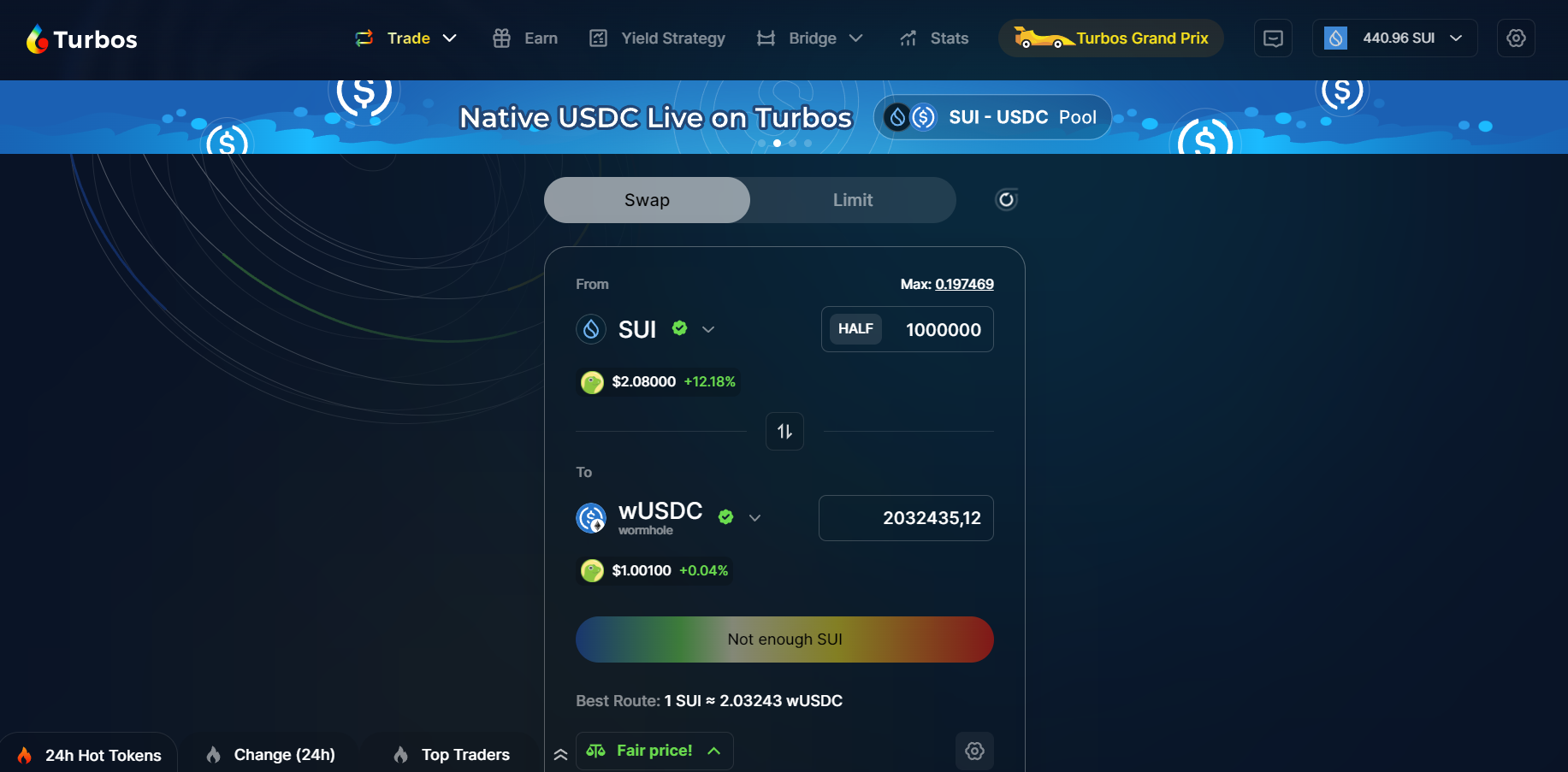

Some images about Turbos:

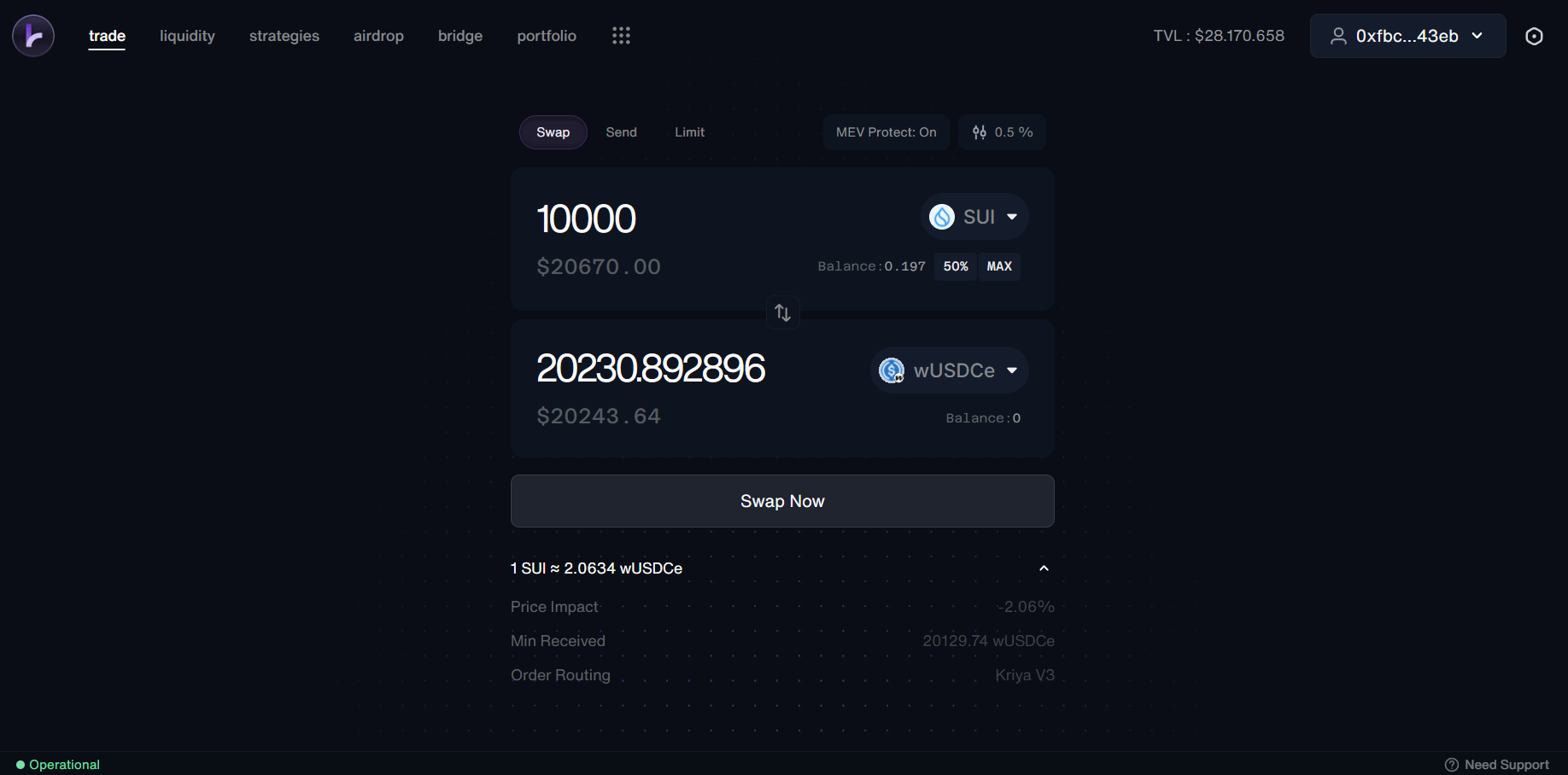

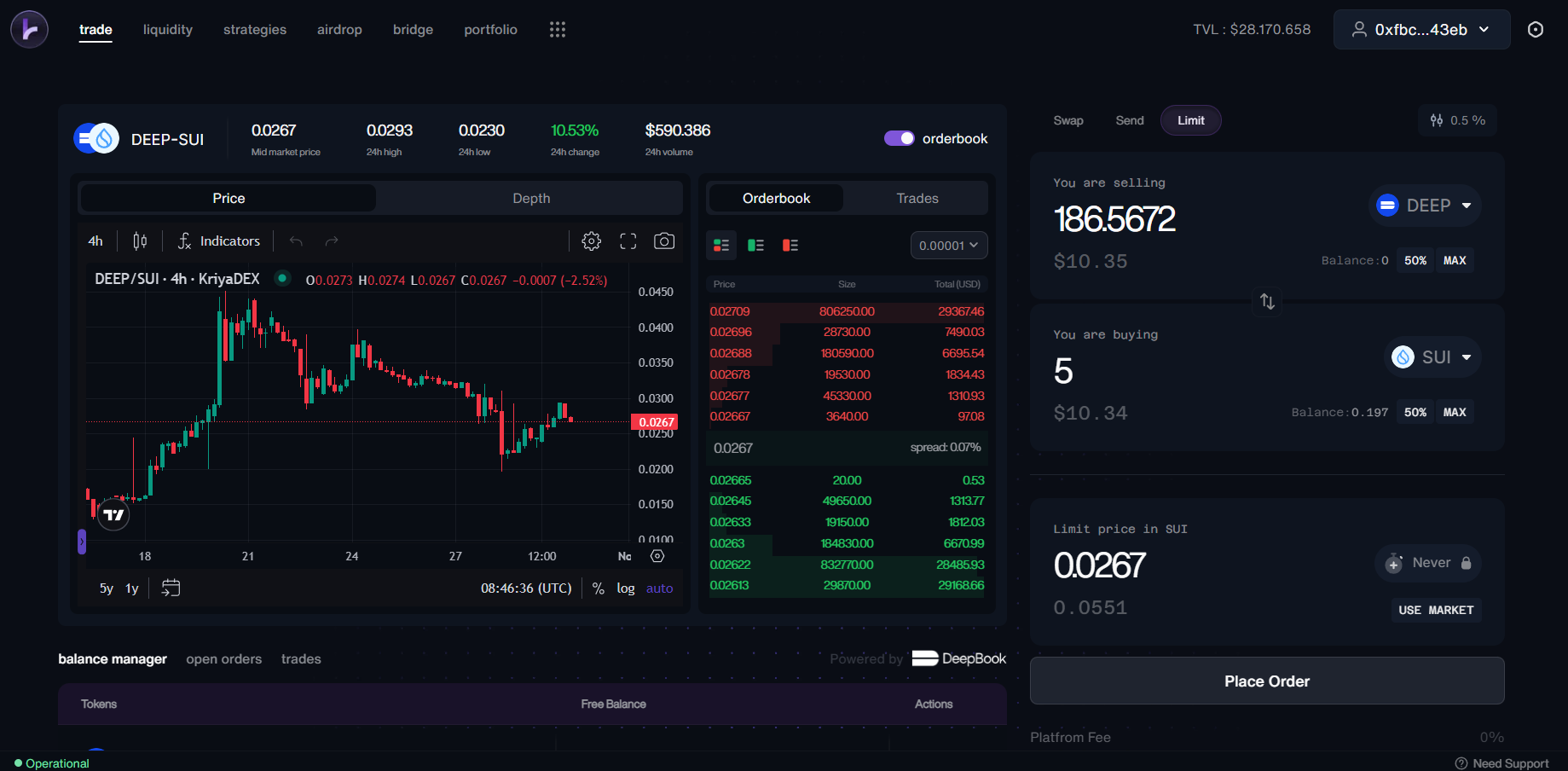

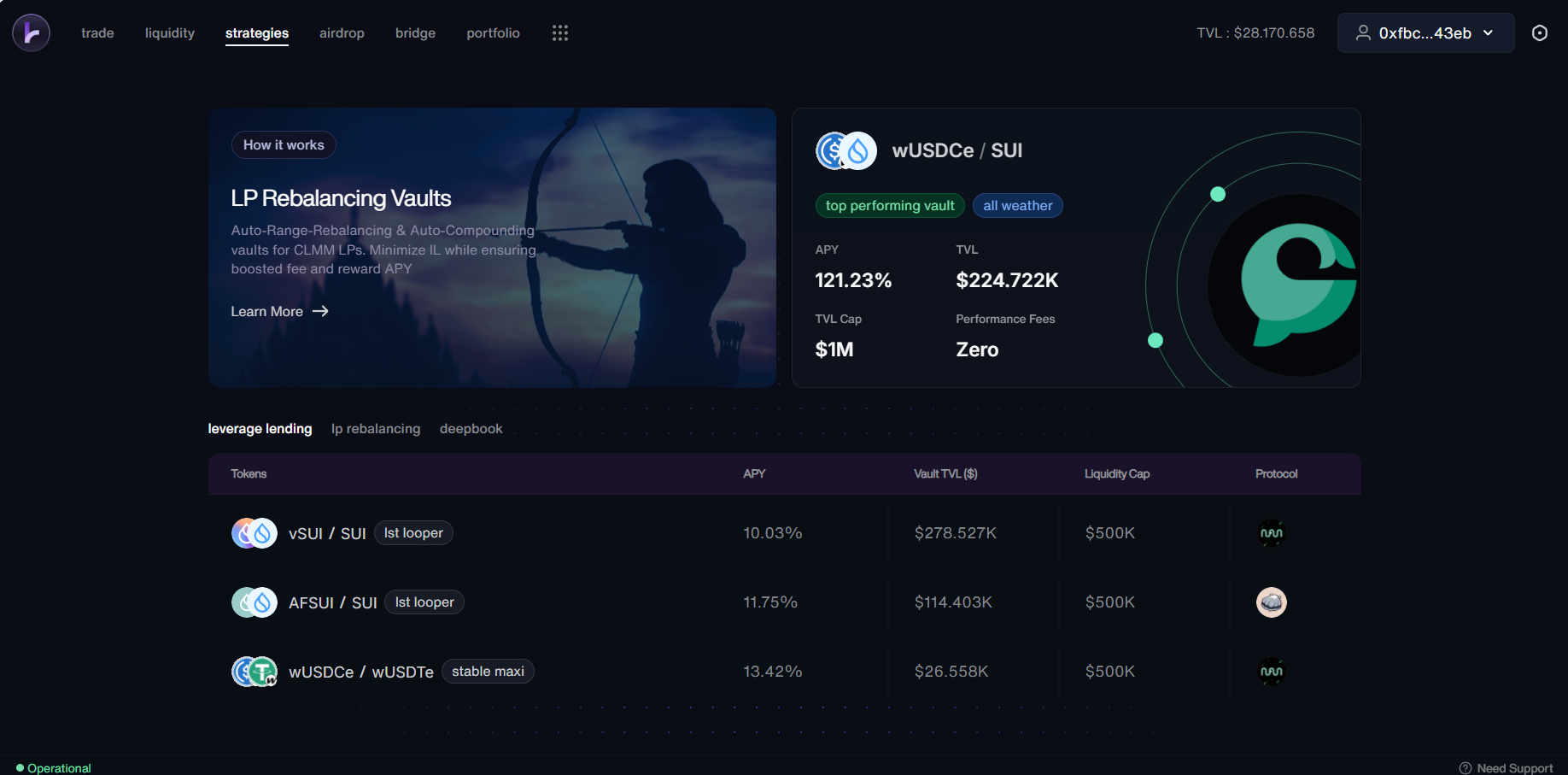

Kriya

Kriya is a one-stop decentralized finance (DeFi) protocol on the Sui Network, delivering a complete suite of financial products tailored to institutional and high-net-worth users. The platform features native Automated Market Making (AMM) for swaps, advanced limit order functionality, strategy vaults, and leveraged perpetuals—all designed to meet the needs of an evolving DeFi landscape.

The Kriya Suite offers a vertically integrated set of DeFi products. This suite aims to aggregate liquidity within a new ecosystem, increase capital efficiency, and enhance the user experience to match the quality of centralized finance (CeFi). From low-beta, linear products to more advanced, high-beta, under-collateralized derivative products, KriyaDEX builds sustainable liquidity from the ground up, ensuring the platform grows with the needs of both retail and institutional investors.

Kriya believes that by making DeFi more efficient, accessible, and scalable, they can support the needs of institutions and large-scale investors as they enter the decentralized space.

Kriya official links: Website | Twitter | Discord

Some images about Kriya:

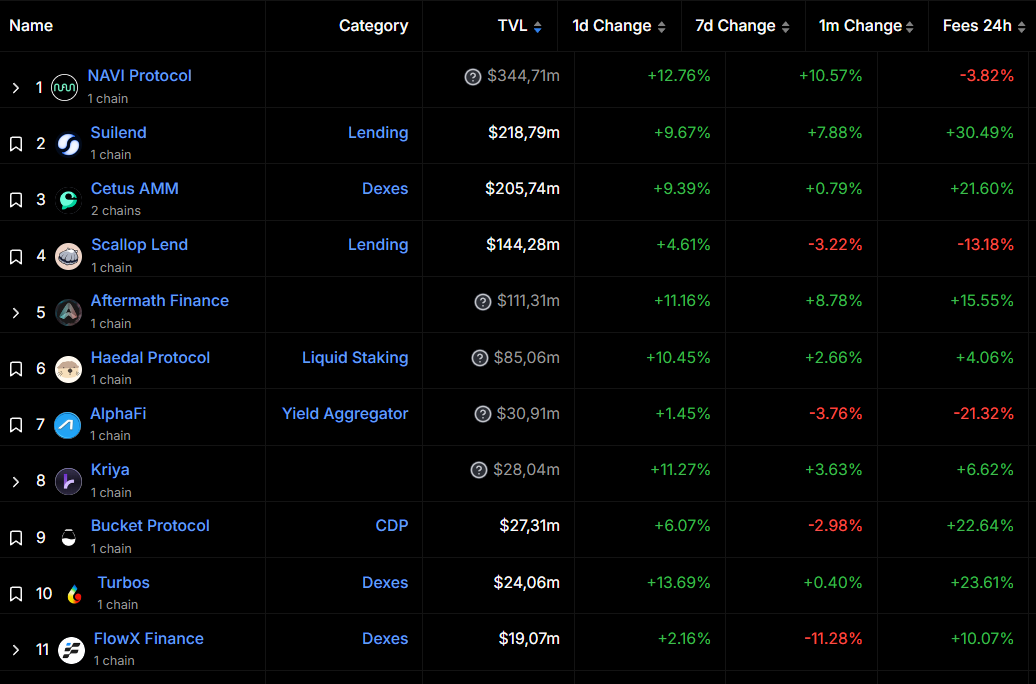

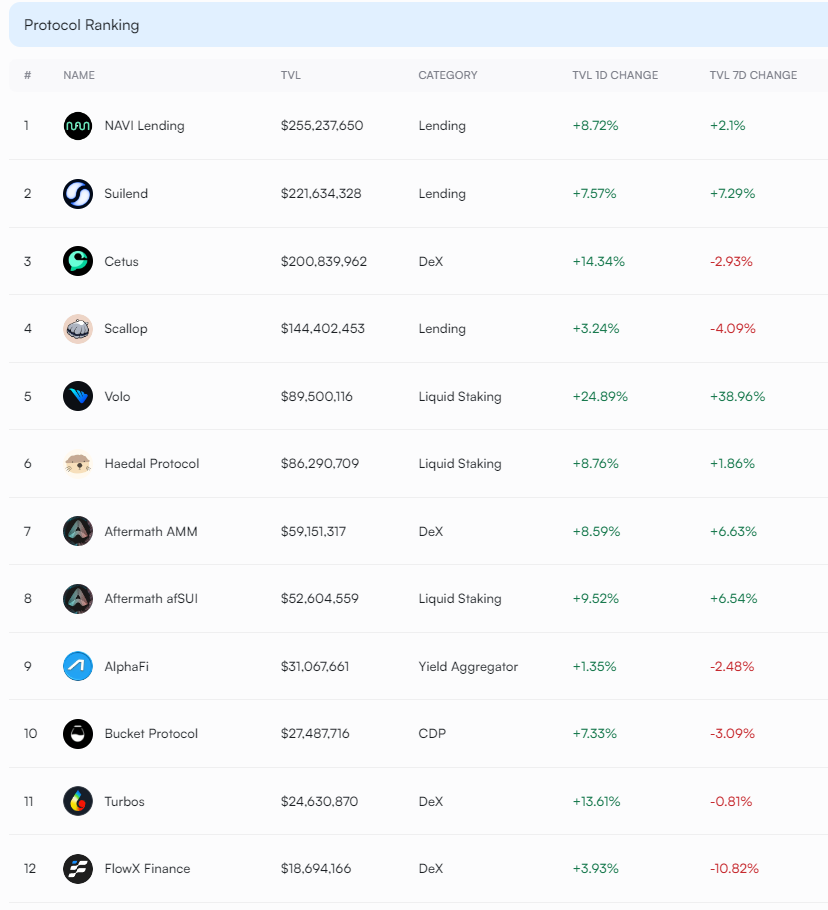

Other Metrics about DEXs on Sui Blockchain

Final Thought

The Sui Blockchain offers a unique decentralized exchange platform that is different from other platforms currently available. In this article, we have listed the best decentralized exchanges on the Sui Blockchain in 2022. We hope you find this information helpful in your search for the best platform to trade on. Watch for our upcoming postings as we introduce further Decentralized Exchanges running on the Sui Blockchain.

Besides the information about the DEXs on Sui, you should also have knowledge about DEX Aggregators on Sui, Dapps on Sui and Sui Blockchain NFT marketplace. Suipiens articles will give you all the information you need.

Be sure to check out Suipiens' website and social media channels to stay up-to-date on all things about Sui Blockchain!