Aur Protocol - experiment Store of Value Asset on Sui

Discover Aur Protocol on Sui: a fair-launched, hard-capped AUR token mined on-chain with a unique store-of-value design.

Aur Protocol is an on-chain mining protocol designed to create and distribute AUR, a new store-of-value asset native to the Sui Network. Instead of pre-mining tokens for insiders or selling allocations to VCs, Aur Protocol uses a fully on-chain, gamified mining system to distribute AUR directly to users.

In this article, we will cover:

- What the AUR token is

- How AUR mining works

- The Motherlode and Refining mechanisms

- Why AUR is designed as a potential store-of-value on Sui

AUR Token Overview

AUR is the native token of Aur Protocol and is designed as a store-of-value (SoV) asset on Sui.

Tokenomics

- Maximum supply: 10,000,000 AUR

- Initial supply: 0 AUR

- Contract Address: 0xcc3ac0c9cc23c0bcc31ec566ef4baf6f64adcee83175924030829a3f82270f37::aur::AUR

- TGE: 03:00 UTC, 12-12-2025

- Emission rate: on average, around 1.5 AUR per minute

At launch, there is no pre-mint and no initial circulating supply. All AUR entering circulation are mined on-chain through the Aur Protocol.

With data from NoodlesFi at time of publish:

- AUR price: $0.766

- Circulating supply: 23,503 $AUR

- Market cap: $17,973

How AUR Mining Works

AUR mining is implemented as a gamified on-chain system.

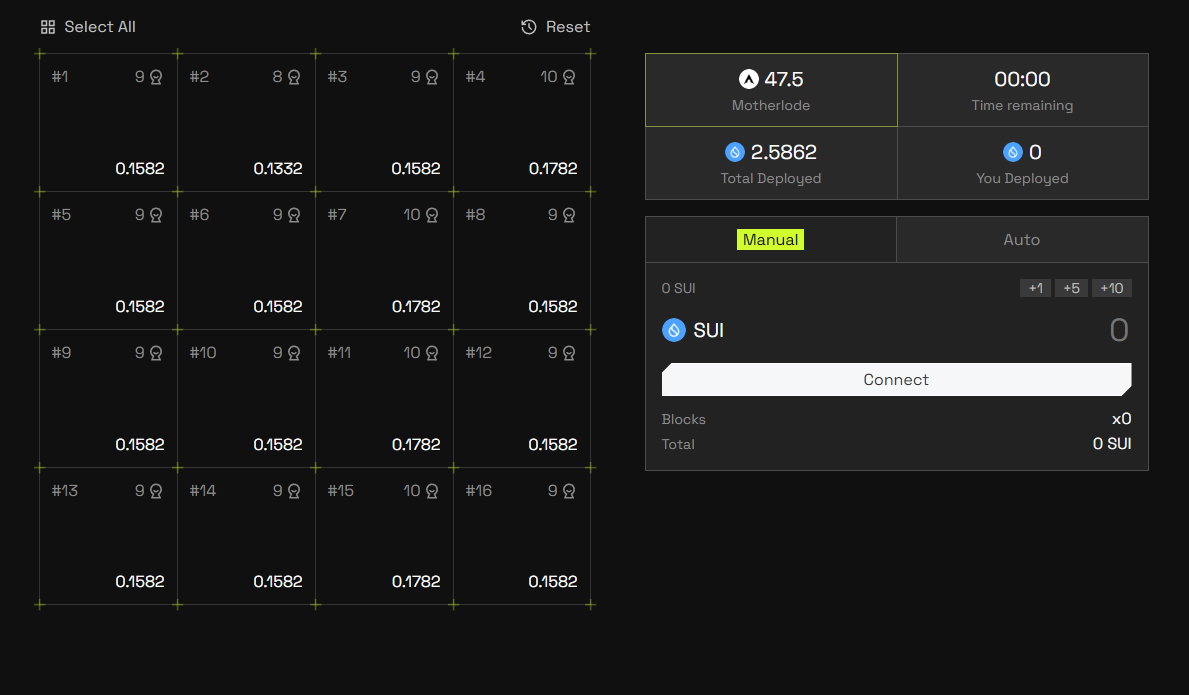

The mining grid

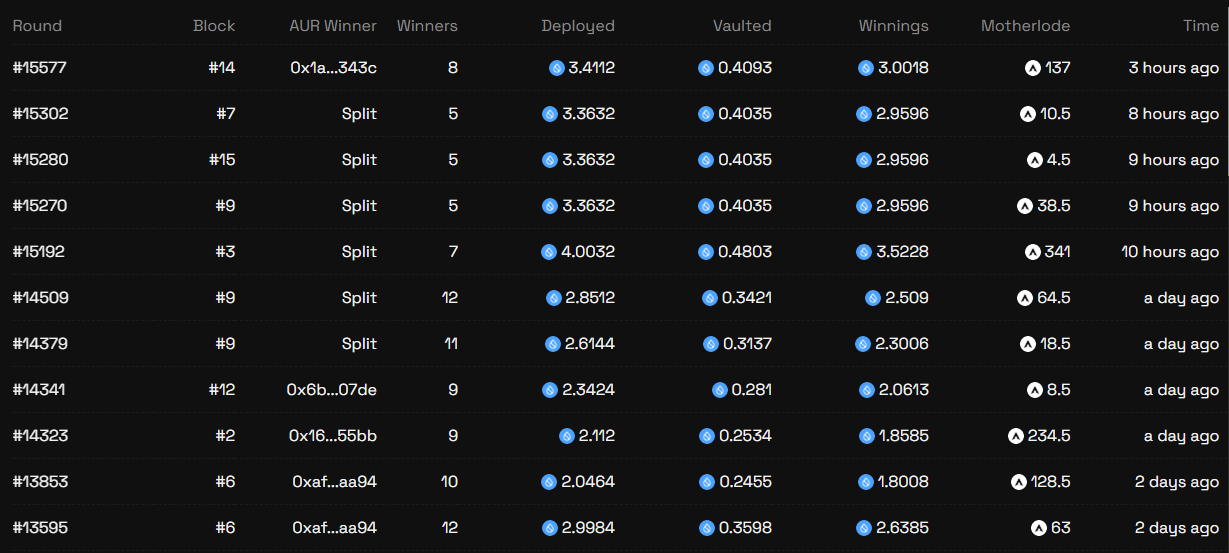

- Each mining round is 1 minute.

- There is a grid of blocks 4×4 that players can chose.

- Miners stake SUI into any block they want in that round at https://aur.supply

At the end of each round:

- A Random Number Generator (RNG) on Sui selects one winning block.

- All miners who staked SUI into that winning block receive:

- All SUI staked in the round (from both winning and non-winning blocks),

- 1 AUR as an additional reward.

Rewards are proportional to stake within the winning block. If you staked more SUI in the winning block, you receive a larger share of both Sui and Aur reward.

Protocol fee and revenue distribution

Aur Protocol charges a 12% fee on the total amount of SUI staked in each round. That fee is distributed as:

- 6% – Used to buy back AUR on the market

- 5% – Distributed to AUR liquidity providers (LPs)

- 1% – Used for operations and marketing

Example:

- You stake a total of 10 SUI, spread evenly across all blocks.

- No matter which block wins, your share of the pot will be equivalent to 8.8 SUI + 1 AUR (because 12% of the SUI goes to protocol fees).

In this example, the 12% fee can be seen as the cost of mining that 1 AUR.

Why this design matters

This model allows Aur Protocol to:

- Self-fund through user activity

- Continuously buy back AUR and support liquidity

- Incentivize liquidity providers without using pre-allocated tokens

The protocol does not need large initial capital or VC funding. It is powered by its own users and on-chain game mechanics.

Motherlode: The Jackpot Mechanism

To reward long-term miners and keep the game engaging, Aur Protocol introduces Motherlode – a jackpot-style reward pool.

How Motherlode works

- After each round, 0.5 AUR is added to a special pool called Motherlode.

- In every round, there is a 1/256 chance that the winning block will also hit the Motherlode.

- If Motherlode is hit:

- The entire accumulated AUR in the Motherlode pool is distributed to miners in the winning block,

- Using the same AUR distribution rules as that round.

- After distribution, the Motherlode pool resets to zero and starts accumulating again.

This mechanism:

- Rewards miners who stay active over many rounds

- Adds a layer of unpredictable upside (jackpot-like)

- Makes the mining experience more exciting and engaging

Refining: Rewarding Long-Term Holders

Aur Protocol also includes a mechanic called Refining to reward miners who have low time preference and strong conviction.

How Refining works

- When a miner claims their AUR rewards to a personal wallet, they pay a 10% Refining fee in AUR.

- This 10% fee does not go to the team or the protocol treasury.

- Instead, it is redistributed proportionally to miners who have not yet claimed their AUR.

Example

- Alice has mined 100 AUR and decides to claim.

- She pays 10 AUR as a Refining fee and receives 90 AUR in her wallet.

- Bob has 100 unclaimed AUR and Claire has 400 unclaimed AUR.

- Together they hold 500 unclaimed AUR.

- Bob receives 20 AUR, Claire receives 80 AUR from Alice’s 10 AUR fee, according to their share.

This means:

- Miners who delay claiming their AUR rewards

- Accumulate extra AUR from those who claim early

Refining behaves like a one-sided staking system:

- If you do not claim, you reduce sell pressure and gain more AUR over time.

- The longer you stay, the more you benefit from early claimers.

More detail about Aur mechanism at Aur document

Why Aur Protocol Can Be a Store-of-Value on Sui

For a coin to have a realistic chance of becoming a store-of-value (SoV) – like BTC or even DOGE – it should meet several conditions:

1. Fair mining and distribution

- Everyone should be able to participate in mining with low barriers.

- The mining mechanism should be based on solid game theory, so no single player can dominate without paying a proportional cost.

2. Fully on-chain, self-sustaining system

- A SoV asset should not rely on a centralized operator.

- It should run entirely on smart contracts or code, with rules visible and enforceable on-chain.

3. Hard cap on supply

- A maximum supply creates scarcity and limits long-term inflation.

Most coins today do not meet these criteria.

How other Sui tokens compare

- Many memecoins like LOFI or HIPPO are not fairly mined: They are often created intentionally and distributed to a small group before being sold widely to the community.

- Protocol tokens like CETUS or BLUE may have a hard cap and Buyback mechanisms. But they still depend heavily on a team and VC funding/ large investors holding large portions of supply.2

In many ways, buying these tokens is closer to buying equity in a company than holding a neutral, community-distributed store-of-value asset.

What makes AUR different?

Aur Protocol is designed with:

- Fair launch:

- Initial supply is 0.

- No team allocation, no VC, no private sale.

- All tokens are mined over time via open participation.

- Controlled emission:

- AUR is not mined all at once.

- Emission is gradual (~1.5 AUR per minute on average).

- Anyone can join mining as long as they accept the rules of the game.

This creates an environment where anyone who believes in AUR has a fair opportunity to acquire it as a store-of-value asset on Sui, by:

- Mining AUR directly

- Providing liquidity and earning protocol revenue

- Accumulating over time

Conclusion

Store-of-value assets are special. They often do not have strong intrinsic utility in the traditional sense. Their value is shaped by: Scarcity + Fairness of distribution + Resilience against manipulation or intentional destruction.

History has already shown how powerful SoV assets can be: BTC, LTC, DOGE experienced massive growth in environments where traditional finance was heavily influenced (or manipulated) by large institutions.

Choosing a store-of-value is not just a technology decision. It is a decision to step outside the existing money game and opt into a different set of rules.

AUR is mean OUR

If you want to explore or participate in this experiment, mine some $AUR at: https://aur.supply/

Follow Aur X: https://x.com/aursupply

Join Aur Telegram: https://t.me/aursupply