Understand The Concerns Surrounding $SUI Supply Manipulation

The Korean Financial Supervisory Authority's inquiry into SUI token's circulating supply raises questions about its manipulation.

What Happened?

In a recent event, Congressman Min Byung-deok raised concerns regarding the manipulation of SUI token's circulating supply. The Director of the Korean Financial Supervisory Service (FSS), Lee Bok-hyun, has promised to investigate this matter and shed light on the situation. This news comes via the blockmedia news agency and was discussed during the National Assembly inspection.

During the assembly, a member of the Democratic Party of Korea criticized Lee Bok-hyeon for granting licenses to list "Burger Coins," particularly SUI, on exchanges while failing to protect investors. Min Byung-deok pointed out that the circulating supply of SUI tokens has had an adverse impact on its price, which has struggled to increase. Additionally, he accused the Sui Foundation of engaging in the staking process, subsequently releasing tokens into the market. This increased circulation, resulting in a price decline.

In response to these criticisms, FSS governor Lee Bok-hyun acknowledged the gravity of the situation if Min Byung-deok's claims were accurate. He pledged to investigate these allegations thoroughly, including inspections of exchanges through the Digital Asset eXchange Alliance (DAXA).

Just In: According to blockmedia, the director of the South Korean Financial Supervisory Service responded to a question that if SUI team is manipulating the circulation through staking or improper disclosure, it must be corrected. He will check it after confirming it with the…

— Wu Blockchain (@WuBlockchain) October 17, 2023

Sui Foundation's Response

The Sui Foundation promptly denied these allegations, emphasizing their commitment to transparency and compliance. In an emailed statement to CoinDesk, a spokesperson for the Sui Foundation clarified, "The Sui Foundation wants to address unfounded and materially false statements surrounding the supply of SUI tokens. Contrary to recent conjecture, there has never been any sale of SUI tokens by the Foundation after the initial Community Access Program (CAP) distributions."

The spokesperson also stressed, "In addition, Sui Foundation has and remains committed to cooperating with DAXA and its member exchanges in the spirit of full compliance and transparency. The circulating supply schedule displayed on the Sui Foundation's public website and available through the public API endpoints is accurate."

We want to address some inaccuracies that have been reported today.

— Sui Foundation (@SuiFoundation) October 17, 2023

Sui Foundation has been and remains committed to cooperating with DAXA and its member exchanges in the spirit of full compliance and transparency.

The unfounded and materially false statements surrounding the…

Impact On $SUI Token Price

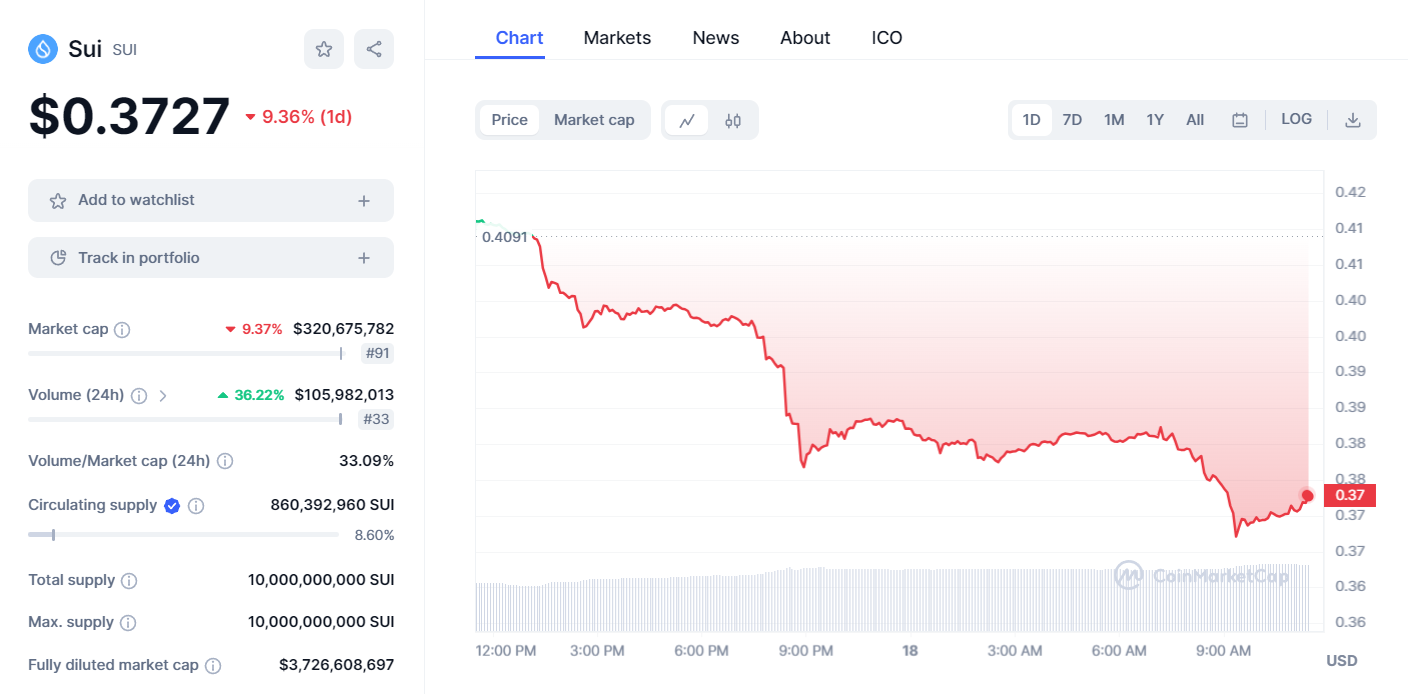

However, immediately after the event, the value of SUI tokens experienced a sharp decline, plummeting nearly 15% from $0.43 to $0.369. In the Korean market, SUI is listed on five exchanges, including Upbit, Bithumb, Coinone, Kobit, and Gopax.

It's crucial to note that approximately $336 million worth of tokens have been unlocked since the token's issuance. Out of this, $72 million has been allocated to stake subsidies, $129 million has been earmarked for the community reserve, and $139 million has been distributed through the community access program. Series A and Series B investors are expected to access their tokens in May 2024, with $290 million worth of tokens scheduled to be unlocked.

Wrapping up

The concerns surrounding $SUI token's circulating supply and its potential manipulation raise essential questions about transparency, regulation, and the cryptocurrency market's responsiveness to news. As the Korean Financial Supervisory Authority investigates these allegations, investors and the broader crypto community will be watching closely.

Transparency and adherence to regulations are crucial for the long-term success of cryptocurrency projects. Whether the allegations against the Sui Foundation are substantiated or not, this incident underscores the need for vigilance and due diligence in the cryptocurrency space. As the crypto market continues to evolve, regulatory bodies will play a vital role in maintaining trust and stability in the ecosystem. Stay tuned for further developments in this ongoing investigation from Suipiens!

Be sure to check out Suipiens' website and social media channels to stay up-to-date on all things about Sui Blockchain!