FlowX Finance: The Ultimate DEX and Liquidity Aggregator on the Sui Blockchain

Discover FlowX Finance, the premier ecosystem-focused decentralized exchange on the Sui Blockchain. With advanced features like DEX Aggregator, yield farming, a dual-token model, and a seamless user experience, FlowX Finance is designed for DeFi users, liquidity providers, and project developers alike. Explore how FlowX combines innovation with community-centric growth to redefine decentralized finance on Sui.

FlowX Finance has become a top choice among Sui degens, redefining decentralized trading on the Sui Blockchain. With an ATH of $50 million in TVL, a vibrant community of 33,000+ users, and an impressive $800 million+ in trading volume, FlowX is raising the bar for DeFi platforms on Sui.

By aggregating liquidity from all AMMs on Sui, FlowX guarantees the best trading rates with minimal slippage. Its intuitive interface bridges the gap for both DeFi newcomers and seasoned traders, delivering a seamless and user-friendly experience.

Why are degens flocking to FlowX as their ultimate trading gateway? Let’s dive into the platform’s innovative features and community-driven growth that continue to make it a standout in the DeFi space.

Core Features of FlowX Finance

FlowX Finance stands out as a multifaceted decentralized exchange with a suite of powerful features designed to enhance user experience and trading efficiency.

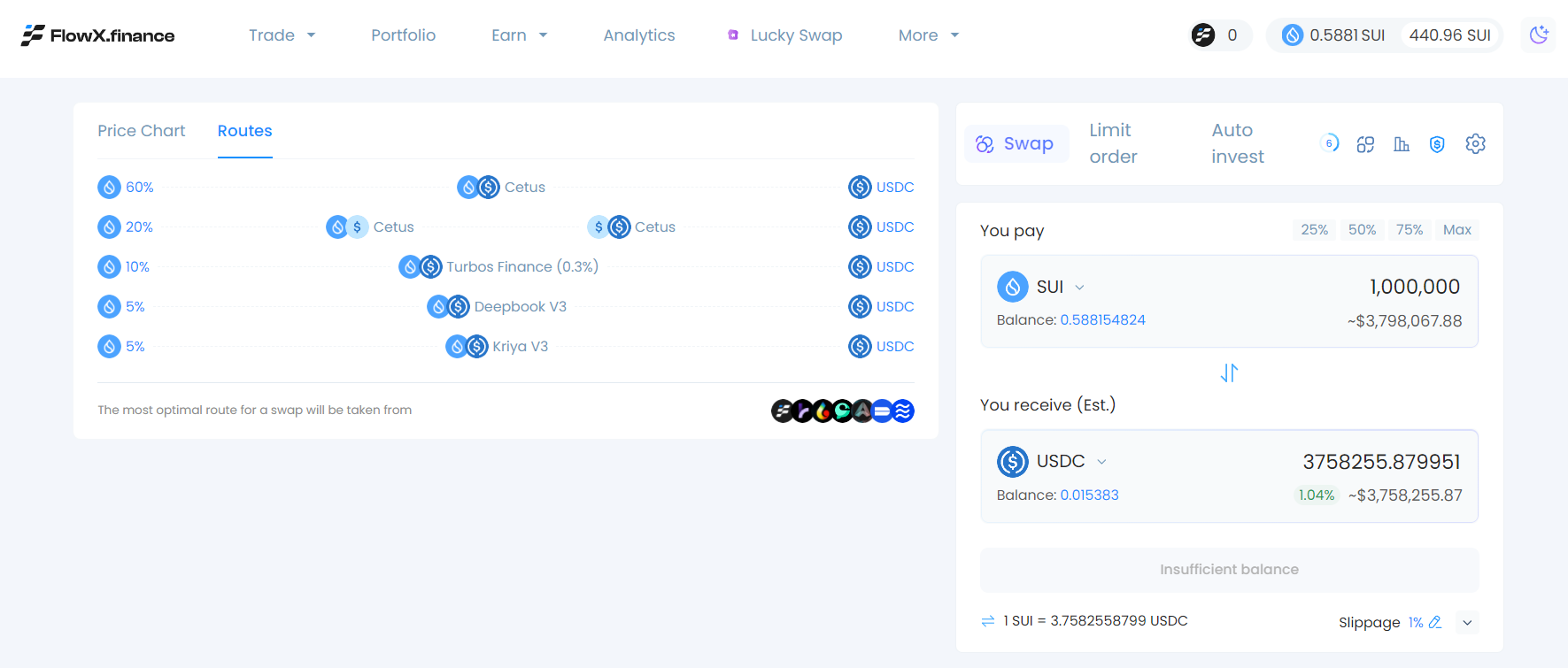

DEX Aggregator

At the heart of FlowX is its DEX Aggregator, which unites liquidity across all AMMs on the Sui Blockchain. This aggregation allows FlowX to source liquidity from the entire ecosystem, giving users the best possible trading rates and significantly reducing slippage. FlowX uses advanced algorithms to split orders and optimize trades by routing them through pools with the highest liquidity, minimizing price impact. By offering access to deep liquidity across multiple platforms, FlowX ensures users experience faster, more cost-effective trades, positioning it as the leading aggregator on Sui.

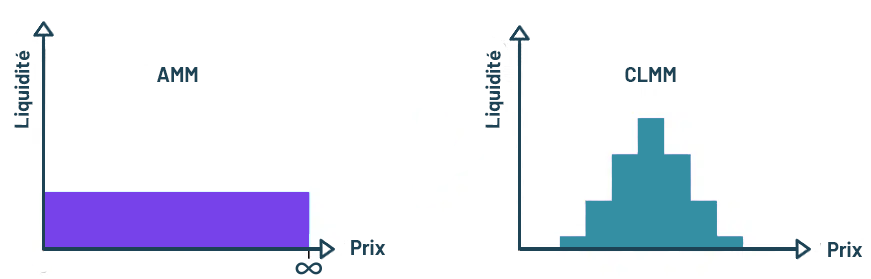

Decentralized Exchange with AMM and CLMM Models

FlowX is not just a DEX Aggregator; it also functions as a DEX with dual models—Automated Market Maker (AMM) and Concentrated Liquidity Market Maker (CLMM). The AMM model provides a simple, straightforward trading environment, while the CLMM option gives liquidity providers (LPs) more control, enabling them to concentrate liquidity around specific price ranges to maximize efficiency. This dual model allows FlowX to cater to a wide variety of trading strategies and user preferences, making it a highly flexible and versatile platform for traders and LPs alike.

Intuitive User Interface

FlowX Finance is designed with user experience as a top priority, providing an intuitive and visually appealing interface that simplifies complex DeFi activities. The platform’s easy-to-navigate UI allows users of all experience levels to engage in token swapping, yield farming, and portfolio management with ease. FlowX’s interface is optimized for quick learning and accessibility, ensuring users can move seamlessly between different features, from trading to managing assets, making it a perfect fit for both newcomers and seasoned DeFi veterans.

FlowX for DeFi Users: Enhancing the Trading Experience

FlowX Finance delivers an optimized trading experience for DeFi users by combining cutting-edge features that prioritize liquidity, efficiency, and control.

Swap + Aggregator

The FlowX Swap and Aggregator features are designed to give users the best possible trading experience by aggregating liquidity across all AMMs on the Sui Blockchain. By employing advanced algorithms, FlowX splits orders strategically, sourcing liquidity from the best pools to minimize slippage and ensure competitive pricing. This feature makes FlowX the top aggregator on Sui, offering users reliable access to a deep liquidity pool for any token. Without added transaction fees, users benefit from fast, efficient trades that leverage the entire Sui ecosystem.

FlowX Lottery - Lucky Swap

FlowX Lottery is an exciting new addition to the FlowX ecosystem. Traders can earn tickets through their activity on FlowX and enter a daily draw held at 12:00 UTC. To win, your ticket must match the winning number, unlocking prizes from the pool. Tickets can be earned in four ways: trading, staking xFLX, holding NOVAGEN NFTs, or inviting friends. This feature adds a thrilling layer of engagement, turning everyday trading into a chance to win big rewards for FlowX users.

Check it now: https://flowx.finance/lucky-swap

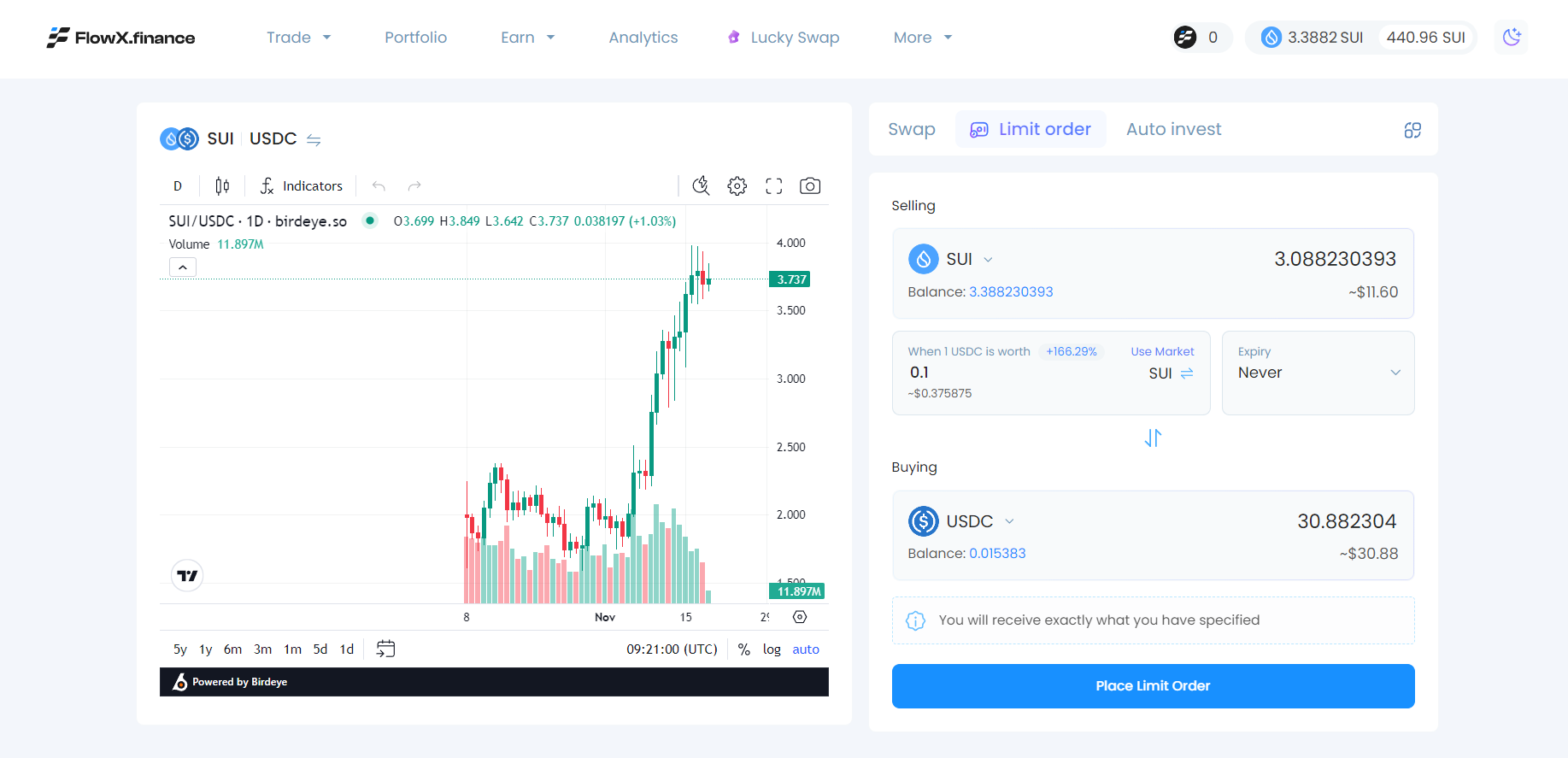

Advanced Features for Traders

In addition to its core aggregator, FlowX enhances the trading experience with advanced swap options tailored for convenience and flexibility.

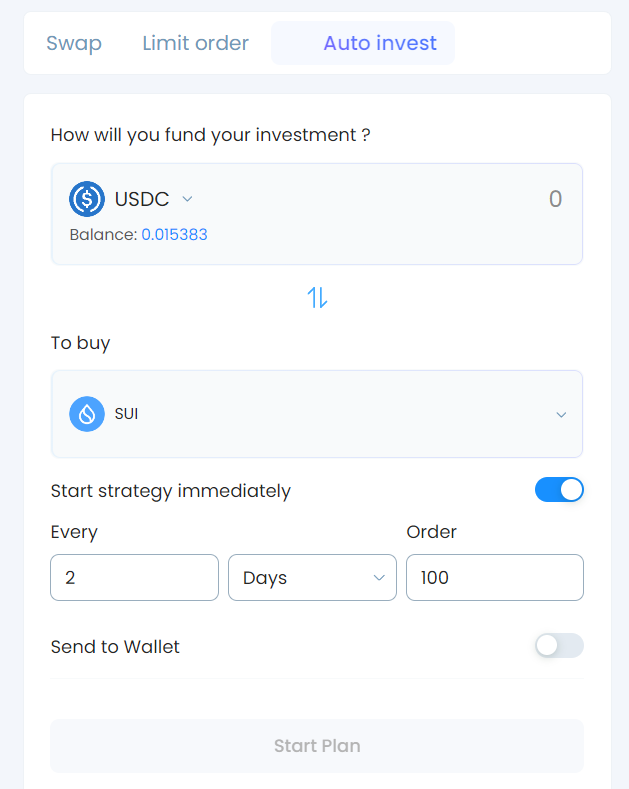

- Limit Order: Users can set limit orders to buy or sell tokens at a specified price, ensuring trades are executed only when market conditions align with their desired price. This feature gives users greater control over their trading strategy and helps them avoid market volatility.

- Auto Invest (Dollar-cost Averaging): For those interested in dollar-cost averaging or long-term accumulation, the Auto Invest feature enables users to schedule periodic buy/sell orders. This feature is ideal for users looking to build their portfolio consistently over time without manually adjusting trades.

Together, these tools make FlowX a top choice for DeFi users looking to maximize their trading efficiency, control, and liquidity.

FlowX for Liquidity Providers

FlowX Finance offers robust incentives and management tools for liquidity providers (LPs), making it a powerful platform for users interested in yield farming and long-term passive income.

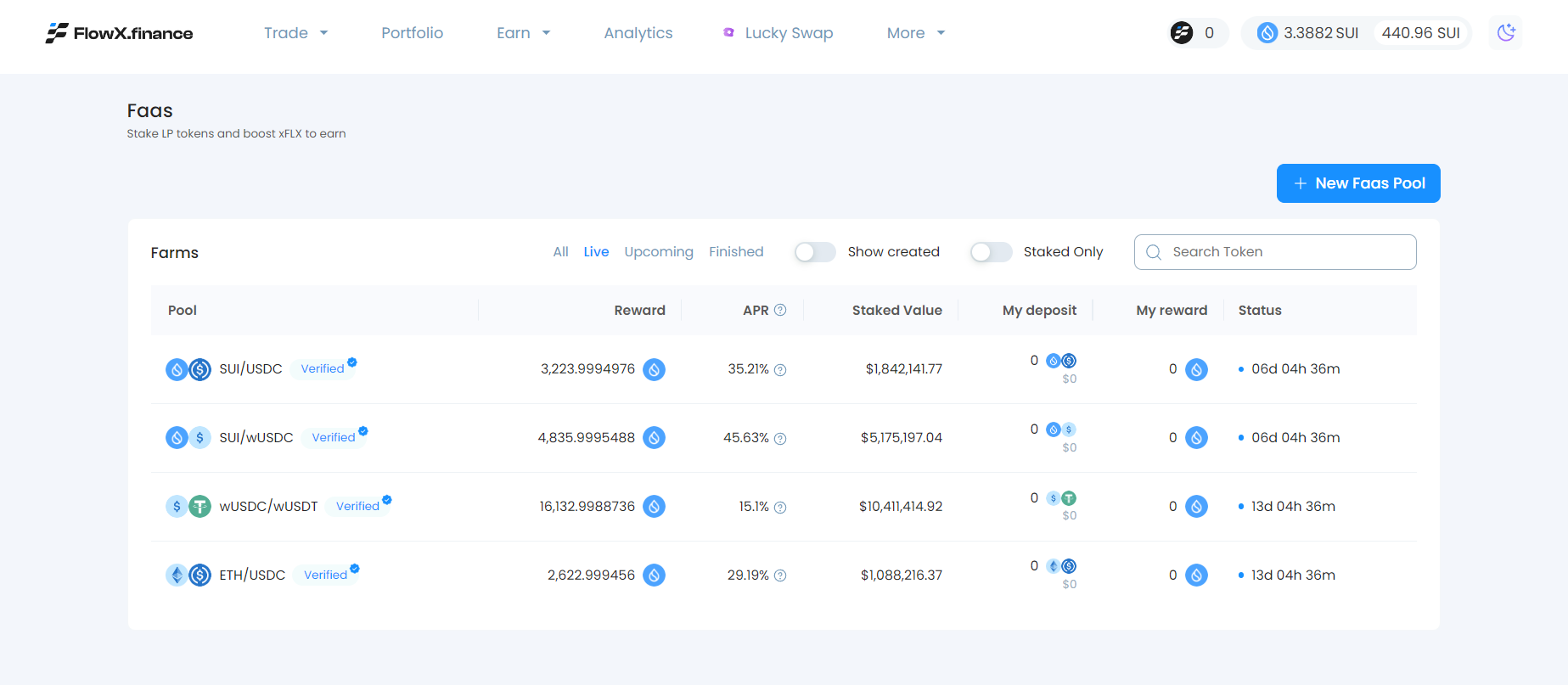

Yield Farming

FlowX’s yield farming program allows LPs to earn rewards by providing liquidity for various token pairs, with incentives distributed in SUI tokens. This opportunity not only compensates LPs for their contributions but also encourages a more vibrant, liquid trading environment on the platform. By farming on FlowX, LPs can maximize their asset utility, gaining passive income while supporting the overall liquidity of the DEX.

Portfolio Management

FlowX’s portfolio management tools give LPs the ability to monitor and optimize their liquidity positions effectively. The platform enables LPs to track their contributions in real-time, evaluate returns, and manage liquidity pools, allowing for a more dynamic approach to yield farming. With these tools, LPs can make data-driven decisions to optimize their positions in FlowX’s AMM and CLMM pools, empowering them with insights to improve their earning potential.

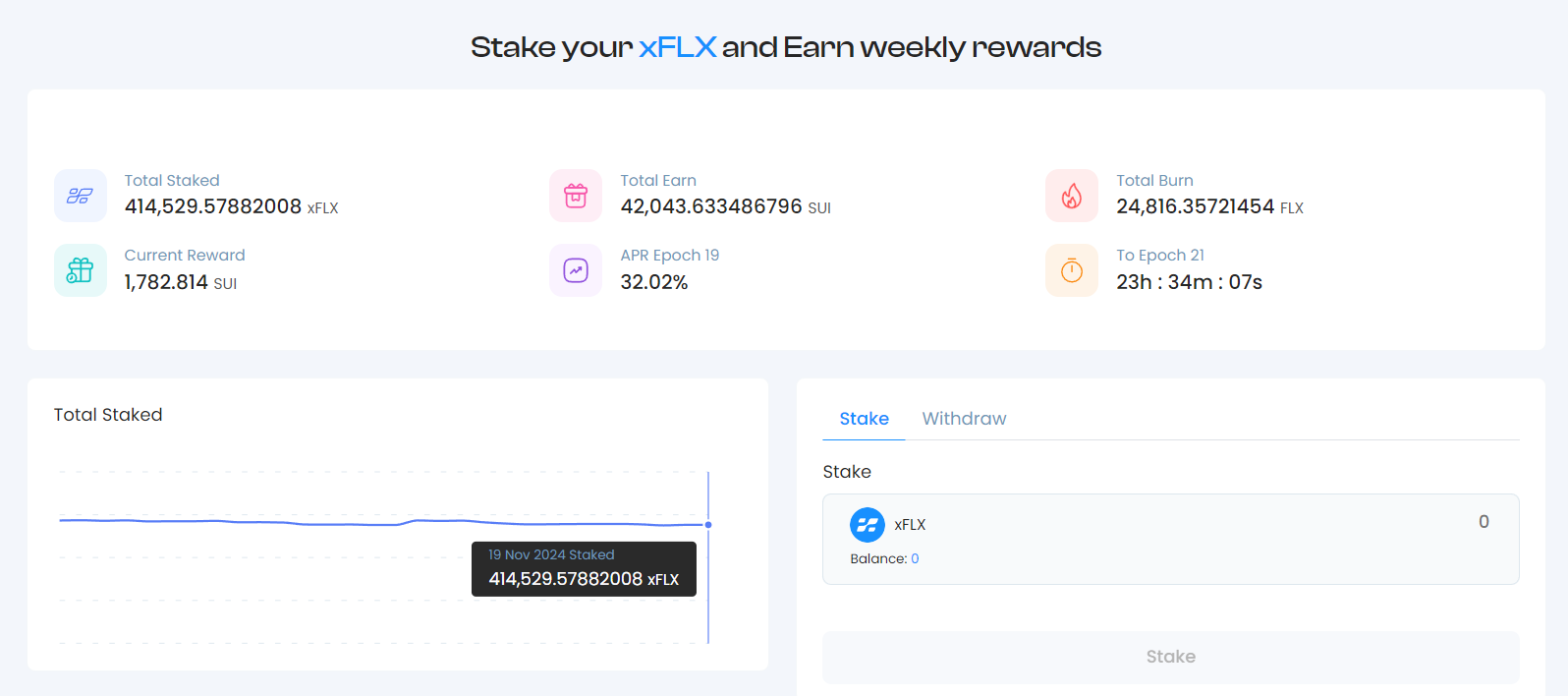

Stake to Earn with xFLX

FlowX operates with a dual-token model, where xFLX serves as the governance and staking token. Those who stake xFLX can earn a share of FlowX’s revenue, benefiting from a steady APR and unique deflationary mechanics. Staking xFLX provides long-term value through revenue-sharing and a deflationary model that reduces the circulating supply of FLX, enhancing the token’s scarcity. This setup offers stakers not only rewards but also a long-term growth opportunity, with FlowX’s sustainable, non-inflationary staking model designed to increase xFLX’s value over time.

FlowX for Project Developers and Builders

FlowX Finance offers comprehensive support for project developers and builders within the Sui blockchain ecosystem, providing essential tools to attract liquidity, engage communities, and grow project visibility. With FlowX’s unique launchpad options, custom farming solutions, and flexibility, developers can seamlessly establish a robust foundation for their tokens and ecosystems.

Launchpad

FlowX’s Launchpad provides multiple approaches for project developers looking to launch new tokens. It supports various models, including Fixed Price and Price Discovery models, allowing developers to choose the format that best suits their project's vision and community needs. By using FlowX’s launchpad, projects can gain early exposure to the Sui community while securing essential liquidity, helping them scale quickly and establish a trusted presence on the blockchain.

Farming as a Service (FaaS)

Through its Farming as a Service offering, FlowX enables projects to create custom yield farms tailored to their tokens. This feature lets developers incentivize liquidity providers by offering token rewards, making it easier to attract liquidity and engage community members. With this flexibility, projects can establish a loyal user base and drive trading activity, bolstering liquidity depth and token utilization. FlowX’s FaaS solution is instrumental for early-stage projects aiming to accelerate their growth on Sui.

Community-Centric Fundraising and Tokenomics

FlowX Finance champions a community-funded model, allowing users to participate directly in its growth. By bypassing traditional venture capital, FlowX fosters a decentralized, user-driven approach to development and capital raising. Through strategically designed pre-sale and public sale rounds, the platform enables supporters to invest in FlowX’s vision, enhancing community loyalty while avoiding external VC pressures that can sometimes prioritize rapid returns over long-term sustainability. This model has fueled strong organic growth and empowered the FlowX community to take ownership of its success.

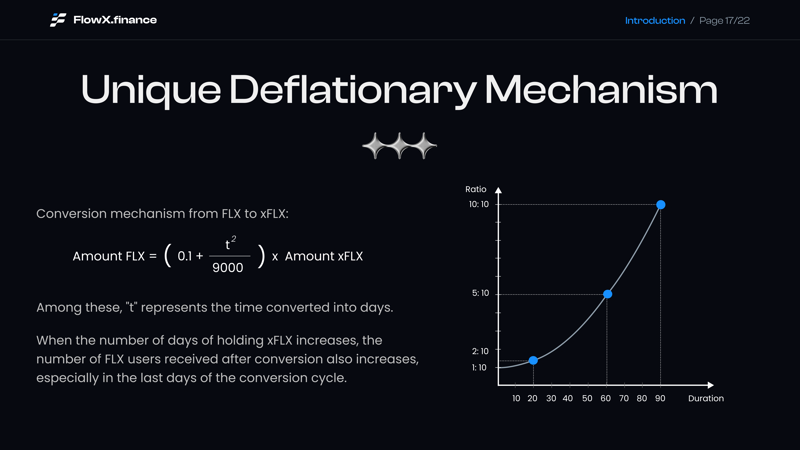

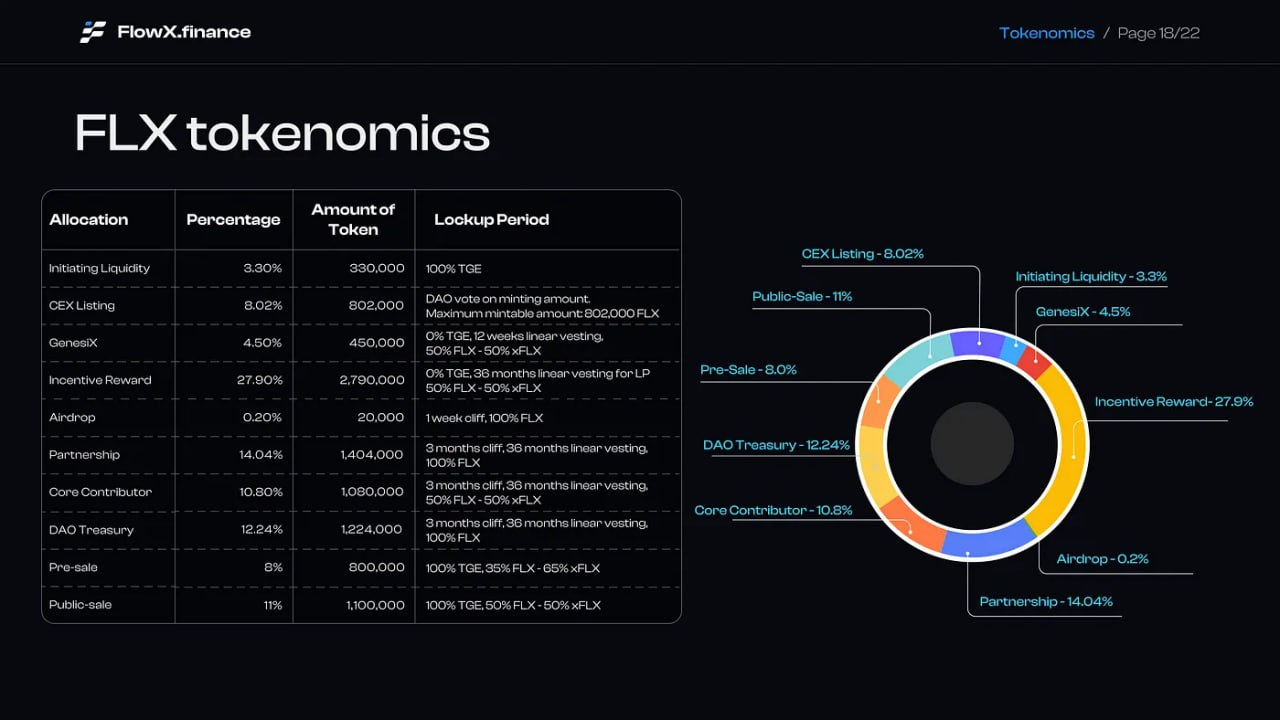

FlowX’s unique dual-token model comprises two complementary tokens: FLX and xFLX, each with distinct roles.

FLX serves as the utility and trading token, enabling users to engage with platform features and transactions. Additionally, FlowX incorporates a buy-back mechanism that bolsters FLX value through periodic repurchases, driving demand and reducing circulating supply over time.

xFLX is the governance and staking token, designed for long-term holders and those committed to FlowX’s future. Staking xFLX rewards participants with passive income, driven by FlowX’s non-inflationary staking model that ensures sustainable rewards without diluting the token value. Through xFLX, users participate in governance decisions, actively shaping FlowX’s roadmap and strategic direction.

By focusing on community-based funding and a thoughtfully structured tokenomics model, FlowX delivers an inclusive, sustainable ecosystem that aligns incentives across traders, liquidity providers, and governance participants, cementing its position as a leading DeFi solution on Sui.

Key Partnerships and Ecosystem Positioning

FlowX Finance’s strategic partnerships with industry leaders such as the Sui Foundation, DeepBook, Scallop, BirdEye, etc., bring significant depth and versatility to its platform. These collaborations provide FlowX with critical infrastructure and resources, allowing it to leverage the latest advancements in decentralized finance and expand its reach. For example, DeepBook enhances FlowX’s order book capabilities, while BirdEye’s analytics power advanced insights for traders. These partnerships collectively strengthen FlowX’s functionality, enhancing the trading experience for users and liquidity providers alike.

Scallop Swap V2 is now LIVE🔥

— Scallop (@Scallop_io) August 22, 2024

Scallopers can now seamlessly swap for their favourite Sui tokens while enjoying the best swap rates, with zero swap fees!

Scallop Swap V2 is integrated @AftermathFi, @FlowX_finance and @7k_ag_ to provide the best rates for our users.

🐚How It… pic.twitter.com/3NvMOlSePH

Fully integrated into the broader Sui ecosystem, FlowX operates seamlessly alongside other Sui-based applications and tools, supporting the ecosystem’s growth while expanding its user base. FlowX is compatible with popular wallets like OKX, Gate.io, Bitget, and Web3 Binance Wallet, allowing for easy and secure access across various DeFi and trading functionalities. This integration makes FlowX not only an ideal choice for Sui Network users but also a central player within Sui’s decentralized application ecosystem. Through these partnerships and ecosystem support, FlowX is well-positioned to attract a diverse range of users and projects, promoting further growth and innovation on Sui.

Let's welcome our new frens to the #BitgetWallet fam 🩵 Here's the newest integrations from last week!@PredX_AI @FlowX_finance @StargateFinance @HaedalProtocol @RhoMarketsHQ @flapdotsh

— Bitget Wallet 🩵 (@BitgetWallet) August 6, 2024

Which projects do you wanna see us integrate next? ☁️ pic.twitter.com/SPTxNAhYXr

Unique Value Proposition: What Sets $FLX Apart?

FlowX Finance distinguishes itself through a community-centric funding model that emphasizes independence from traditional venture capital pressures. By focusing on community-backed capital raising, FlowX fosters a decentralized, user-driven ecosystem that prioritizes sustainable growth and avoids the high-stakes, high-pressure demands often associated with VC funding. This model ensures that FlowX remains committed to the community’s needs, creating a more resilient and stable foundation for long-term success.

👀Since allowing $xFLX staking, we distributed 50% of the platform's revenue to our $xFLX stakers.

— FlowX Finance 🏄 (@FlowX_finance) July 31, 2024

But that's not all! 🤯 Starting from Epoch 12, the remaining 50% of the revenue will be utilized to buy back $FLX daily through the Auto-invest and burn to reduce the supply of… pic.twitter.com/tFWXVsLVWY

FlowX also implements a robust revenue and burn mechanism that adds continuous value for token holders. Revenue from platform activities is reinvested in token buy-backs, which are then burned to reduce the total supply of $FLX tokens. This process not only strengthens the token’s scarcity but also drives incremental value for $xFLX holders through revenue-sharing incentives. The result is a deflationary model that rewards active participants, increases token value over time, and offers long-term benefits for FlowX’s loyal community. Together, these mechanisms solidify FlowX as a forward-thinking, user-aligned platform that uniquely benefits its contributors and participants.

Conclusion

FlowX Finance stands out as a comprehensive solution for DeFi users, liquidity providers, and project developers alike. By combining a powerful DEX aggregator with advanced trading features, user-friendly interfaces, and a commitment to community-driven growth, FlowX redefines the DeFi experience on the Sui Blockchain. Its dual-token model, innovative yield farming, and community-centric fundraising empower users with tools for sustainable financial growth and active ecosystem participation.

For users, LPs, and developers looking to leverage the future of DeFi, FlowX offers a unique blend of accessibility, efficiency, and rewarding opportunities. Explore FlowX today and experience how a truly community-focused platform can elevate your DeFi journey.

FlowX’s official links:

📍Website: https://flowx.finance/

📍Twitter: https://x.com/FlowX_finance

📍Discord: http://bit.ly/flowx-discord

📍Docs: https://docs.flowx.finance/

Be sure to check out Suipiens' website and social media channels to stay up-to-date on all things about Sui Blockchain!