Exploring NAVI - the One-stop Liquidity Protocol on Sui

Discover NAVI Protocol - your ultimate guide to decentralized lending and borrowing on Sui Blockchain in this article.

In the developing landscape of blockchain and cryptocurrency, innovations continue to surge forward, and one such great development is the NAVI Protocol. This decentralized Lending & Borrowing protocol, nested within the Sui Network ecosystem, has caught the crypto community's attention with its promise of simplicity, security, and user-centric design.

What is NAVI Protocol?

At its core, NAVI Protocol is designed to simplify the process of lending and borrowing in the blockchain realm. Unlike traditional financial systems, NAVI cuts out the middleman, enabling users to directly engage in these activities without the need for intermediaries.

The heart of NAVI's functionality lies in its liquidity pools, created for each supported digital asset. Users can deposit their assets into these pools and, in return, receive Navi receipt tokens, affectionately known as nSUI tokens, representing their ownership share in the pool. These tokens serve as collateral, which can be leveraged to borrow other assets from the pool. The loan amount is determined by the mortgage rate, a dynamic metric adjusted based on supply and demand.

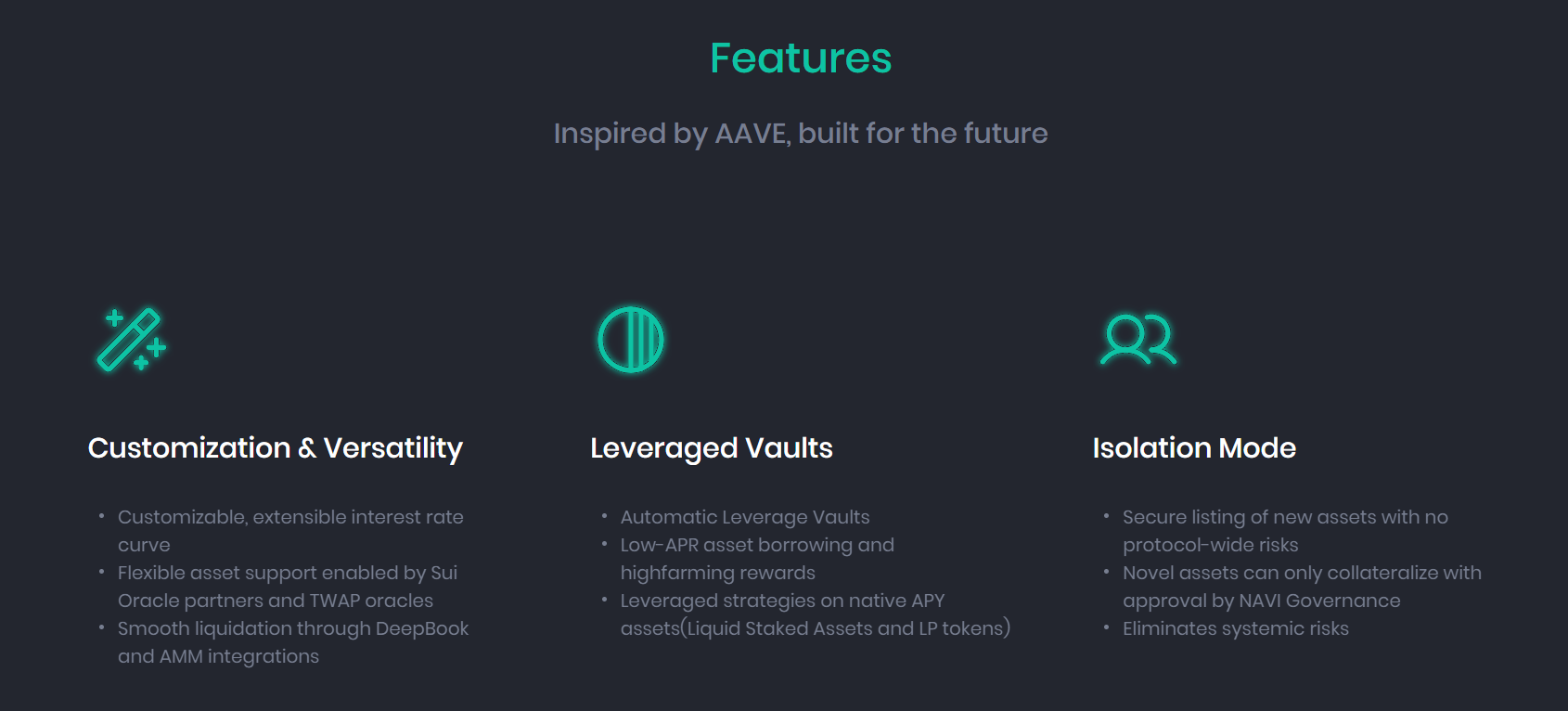

NAVI Protocol stands out for its flexibility, allowing users to integrate a wide array of digital assets. Moreover, it's fortified with advanced security features that not only protect users' capital but also mitigate systemic risks.

The goal of NAVI Protocol is to enhance the user experience within the burgeoning Sui DeFi ecosystem and leverage the advantages offered by the Move Virtual Machine (VM).

How Does NAVI Protocol Work?

For lenders, NAVI simplifies the process into three steps:

- Users select a suitable pool for their assets and deposit them into NAVI.

- NAVI Protocol issues a token representing the loan.

- When users wish to retrieve their assets, they return the representative tokens to NAVI in exchange for their funds.

On the flip side, for borrowers, the process unfolds as follows:

- Collateral is deposited to receive representative tokens from NAVI Protocol.

- These representative tokens then serve as a gateway to borrow assets from the platform.

- NAVI Protocol employs a third-party Oracle to calculate the liquidation price.

- To reclaim the collateral, borrowers repay the borrowed sum along with interest.

Highlights of NAVI Protocol

- Secure and Reliable Oracle: NAVI Protocol's Oracle sets it apart from other Lending & Borrowing platforms. It aggregates prices from diverse sources, including centralized Oracle price providers (Supra and Pyth) and prominent cryptocurrency exchanges (Binance, OKX, Bybit, Coinbase). Utilizing the TWAP (Time-weighted average price) algorithm, NAVI Oracle calculates the average price from these sources, ensuring a secure, reliable, and scalable price feed for all supported assets. This fosters a heightened sense of security for users, as their loans are backed by a robust Oracle.

- Integration with Deepbook: NAVI Protocol has ambitious plans to integrate with Sui Foundation's Deepbook, tapping into deep liquidity reserves and delivering an optimal trading experience for users.

- Liquidity Enhancement: The platform also incorporates a mechanism where liquidators can acquire collateral at a discount on the decentralized exchange (DEX). This feature contributes to maintaining stability within the lending pools.

- Multiple Oracle Providers: NAVI Protocol employs multiple Oracle providers to guarantee a secure and scalable price feed for all supported assets. These oracles play a pivotal role in furnishing precise pricing data while implementing stringent security measures for the platform.

- Diverse Asset Support: NAVI's future roadmap includes support for exotic assets and yield-bearing tokens, broadening the protocol's diversity. Furthermore, NAVI intends to integrate with various other decentralized exchanges (DEXs) and develop additional Oracle providers.

NAVI Token

At the heart of NAVI Protocol lies its governance system, which empowers NAVI token holders to actively participate in shaping the protocol's future. This extends to setting interest rates, adding new assets to the protocol, and modifying collateralization ratios.

Utility & Governance

- Staking: NAVI token holders have the opportunity to stake their native tokens, receiving rewards in the form of trading fees from the perpetual exchange and interest income from the lending platform. The rewards are proportionate to the amount of native tokens staked, incentivizing long-term commitment to the ecosystem.

- Governance: Token holders wield considerable influence in the governance of NAVI Protocol. The decentralized governance process ensures the platform's evolution and future direction are steered by its community.

- Fee Collection and Distribution: NAVI Protocol collects fees from both the perpetual exchange and the borrowing and lending platform. A portion of these fees flows into the pockets of stakers, while the remainder is allocated to the platform's treasury and other purposes, as defined by the platform's design.

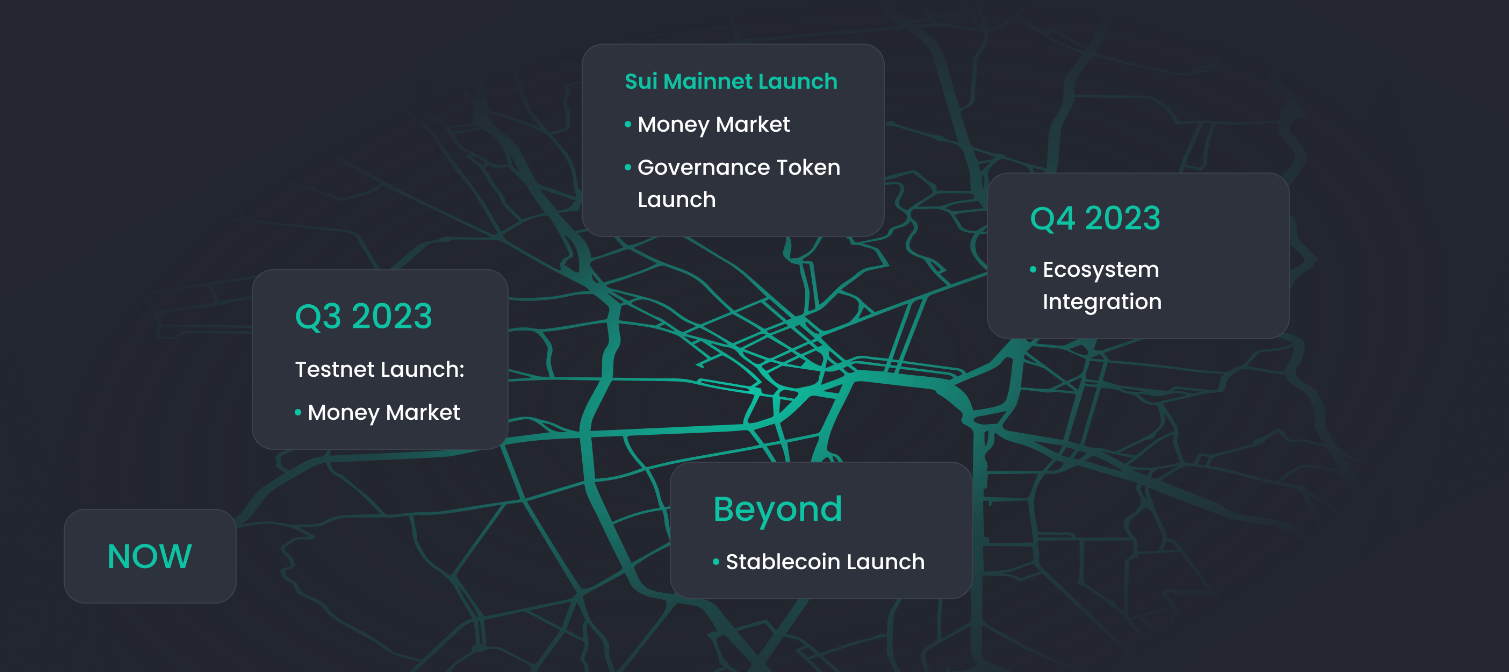

Roadmap

The roadmap for NAVI Protocol outlines its journey towards maturation:

Phase 1 (Q2 2023)

- Launch of liquidity protocol, initially supporting SUI, USDT, USDC, wrapped ETH, and wrapped BTC.

- Introduction of the leveraged vault UI.

Phase 2 (Q3~Q4 2023)

- Integration with Sui Foundation's Deepbook to harness deep liquidity reserves and provide users with an optimal trading experience.

- Launch of NAVI token.

- Establishment of a decentralized autonomous organization (DAO) and governance functionality.

- Staking facility for NAVI tokens within the liquidity protocol.

Phase 3 (2024)

- Launching NAVI PRO

Investors

NAVI Protocol has some notable investors like Mysten Labs, Coin98, Gate.io Labs, and ViaBTC.

Partners

Among NAVI Protocol's esteemed partners, you'll find leading projects and platforms within the Sui network. These partners include Typus Finance, Cetus Protocol, DeepBook, MoveBit, Turbos Finance, Martian, MSafe, KriyaDEX, Suiet/Sui Wallet, and OtterSec.

Official links

- Website: https://www.naviprotocol.io/

- Twitter: https://twitter.com/navi_protocol

- Discord: https://discord.gg/R6Xkbee8Xq

- Telegram: https://t.me/navi_protocol

Wrapping up

In conclusion, NAVI Protocol stands as a beacon of innovation within the ever-expanding DeFi space. Its commitment to simplicity, security, and user-centric design sets it apart, and its vision for the future promises even greater advancements. As blockchain and cryptocurrency continue to redefine finance, NAVI Protocol is poised to play a pivotal role in shaping the decentralized financial landscape for years to come.

Be sure to check out Suipiens' website and social media channels to stay up-to-date on all things about Sui Blockchain!