Sui Testnet Wave 2 Recap (Part 2)

Welcome to Sui Testnet Wave 2 recap! This will be a 3-part series. Let's move on to part 2 - The Tokenomics Suinami.

In Testnet Wave 2, Sui tested and validated Sui's tokenomic model, analyzing the response and behavior of validators in a simulated environment resembling Mainnet's economic conditions. The results exceeded our expectations, providing strong evidence that Sui's Delegated Proof-of-Stake System and Gas Mechanism will work as intended. In this blog, we'll dive into the details of our findings.

Validating Sui's Tokenomics Design

Sui recently conducted Testnet Wave 2 to validate its tokenomic model. The results exceeded expectations, as Sui demonstrated its ability to maintain stable and low gas prices even during peak traffic.

Sui designed its tokenomics to work harmoniously with its engineering design, encompassing everything from the Delegated Proof-of-Stake System to the Gas Mechanism and Storage Fund, which were built from the ground up. Testnet Wave 2 provided Sui with an excellent opportunity to validate this design.

However, testing tokenomics is a challenging task, especially when dealing with economic incentives before the SUI token goes live. Sui tackled this issue with the Validator Contest, which simulated an environment that resembled Mainnet’s economic conditions. This simulation provided Sui with an opportunity to analyze the validator's response and behavior.

The Validator Contest

During the Validator Contest, numbers for each validator's cost structure and the SUI token price were simulated in dollar terms. It is important to note that all numbers were fictitious and had no relation to future market prices of SUI token. The simulation was solely intended as context for the Validator Contest.

Sui incentivized validators to take these numbers seriously by setting up a scoring metric. In this simulated environment, Sui validators were able to gauge their business model's viability: $ profits = $ rewards - $ costs. This allowed Sui to study its tokenomics in a quasi-real environment, enabling it to make informed decisions moving forward.

Stable and Low Fees with Sui's Reference Gas Price

During the initial epochs of Testnet Wave 2, Sui utilized the opportunity to onboard validators onto its tokenomics and familiarize them with the staking and delegation mechanics. This trial and error period allowed the validators to gain practical experience and helped to refine the overall process.

As a result of this learning phase, the Reference Gas Price (RGP) started functioning smoothly like a well-oiled machine. By the start of the second week of Testnet, the RGP had reached a level of stability and predictability, which enabled Sui to deliver reliable and consistent services to its users.

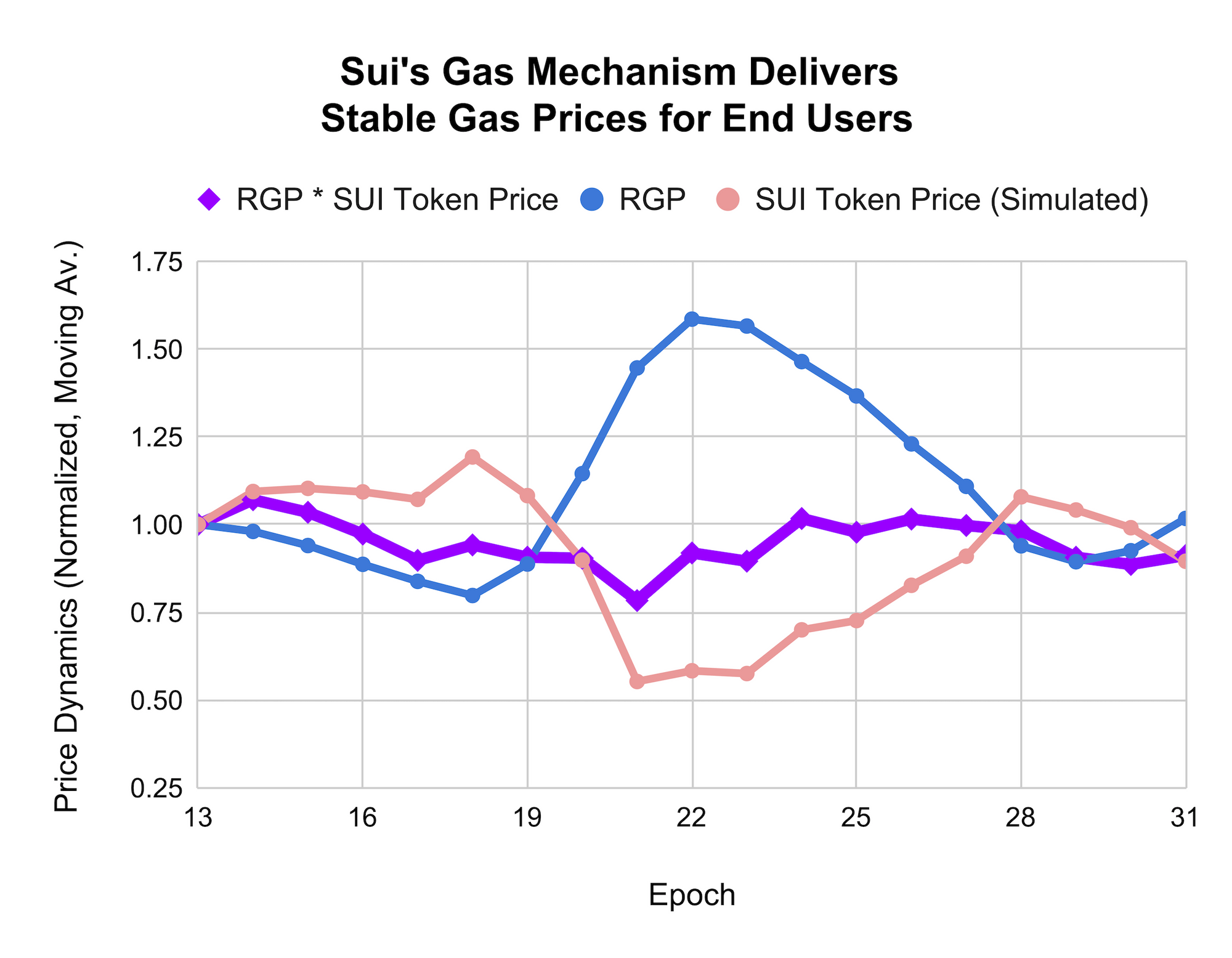

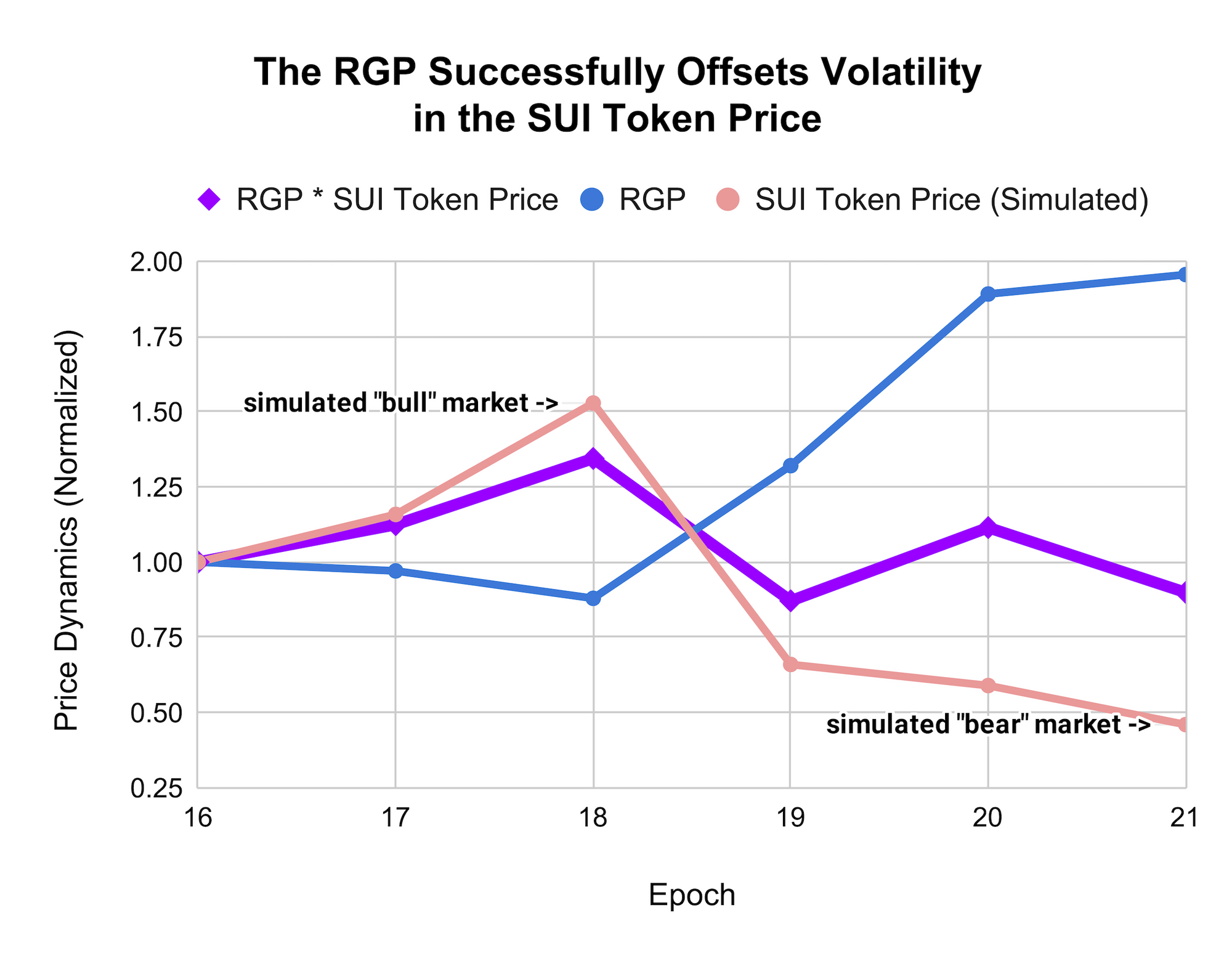

A mini case study shows that Sui's Gas Price helps to mitigate much of the volatility in the simulated SUI token price, which in turn cushions the impact on end users. Notably, these results were accomplished collaboratively by a diverse group of independent and decentralized validators.

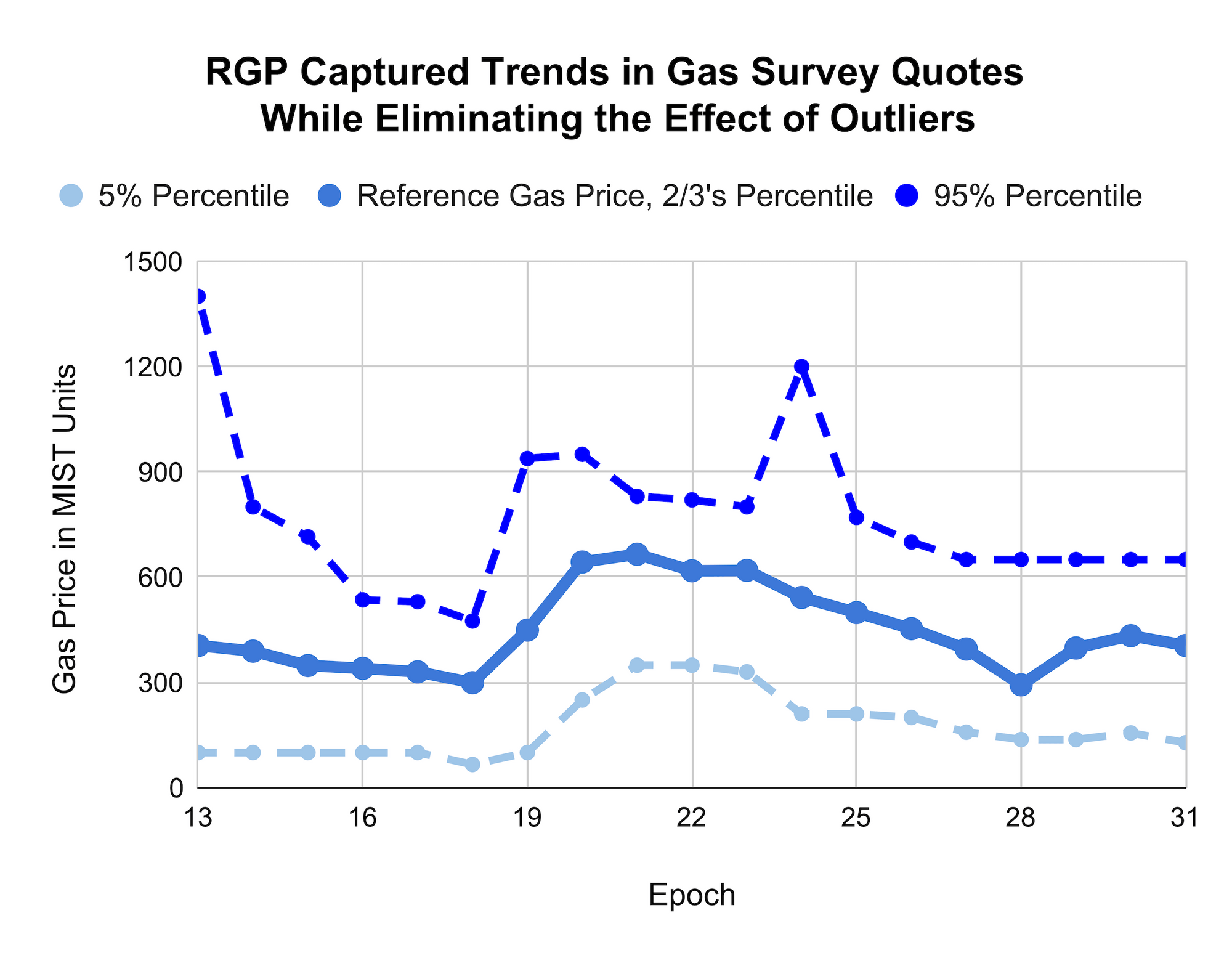

In addition, Sui's Gas Prices are set using a Gas Price Survey across the full validator set, eliminating the influence of outliers and further stabilizing the Reference Gas Price. These results were achieved jointly by a large set of independent and decentralized validators.

Decentralized and Resilient Network

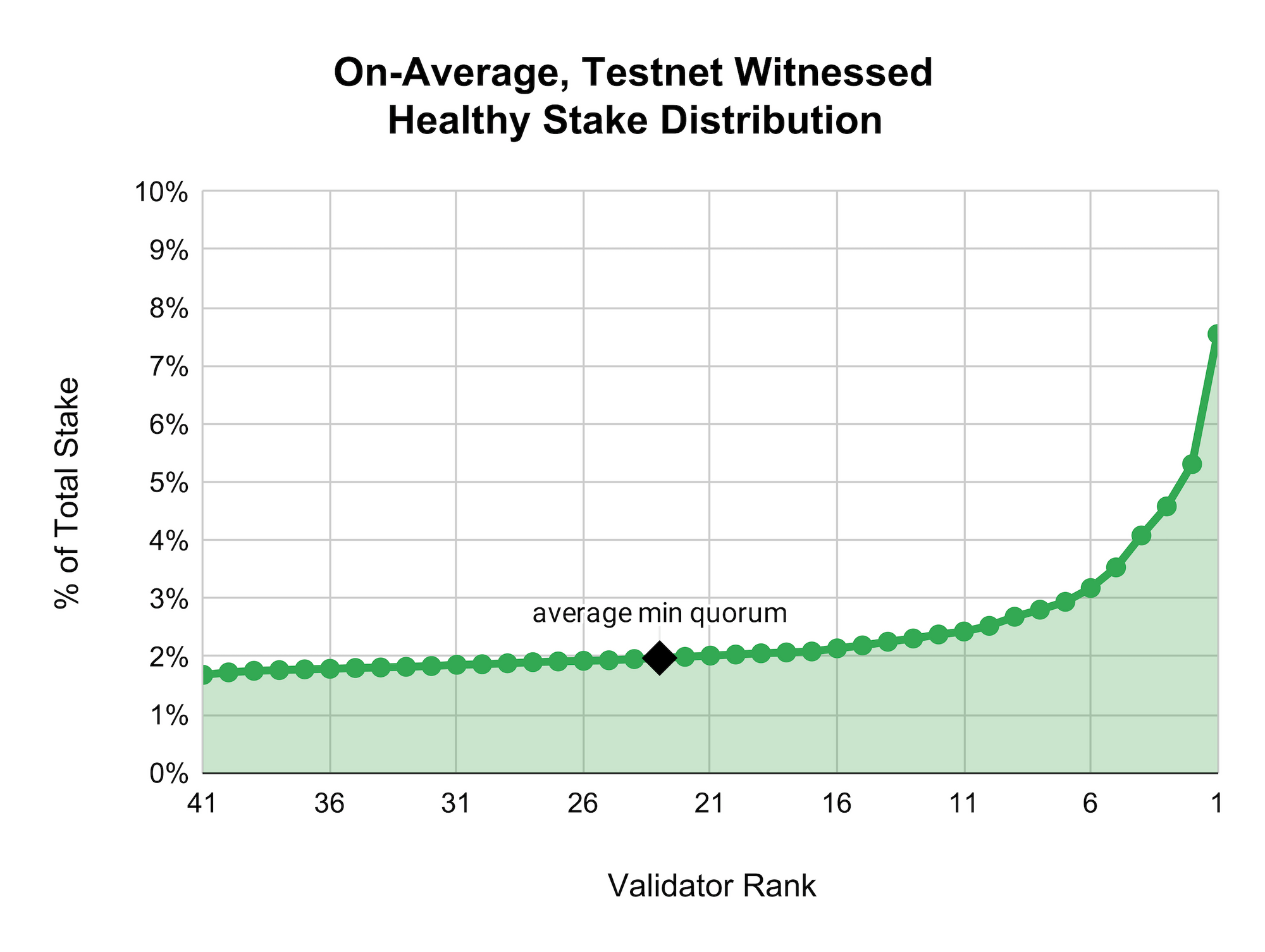

In addition to Gas Pricing, the Validator Contest served as a valuable tool for testing the Proof-of-Stake mechanism and evaluating how well Sui functioned in a widely distributed setting. The Testnet saw a fairly healthy distribution of stakes, with an average minimum quorum of 23 validators, which provided a good indication of the network's robustness and resilience. The Validator Contest helped to validate the Proof-of-Stake mechanism and demonstrated Sui's ability to operate effectively in a distributed environment, which is critical for ensuring the long-term success and sustainability of the network.

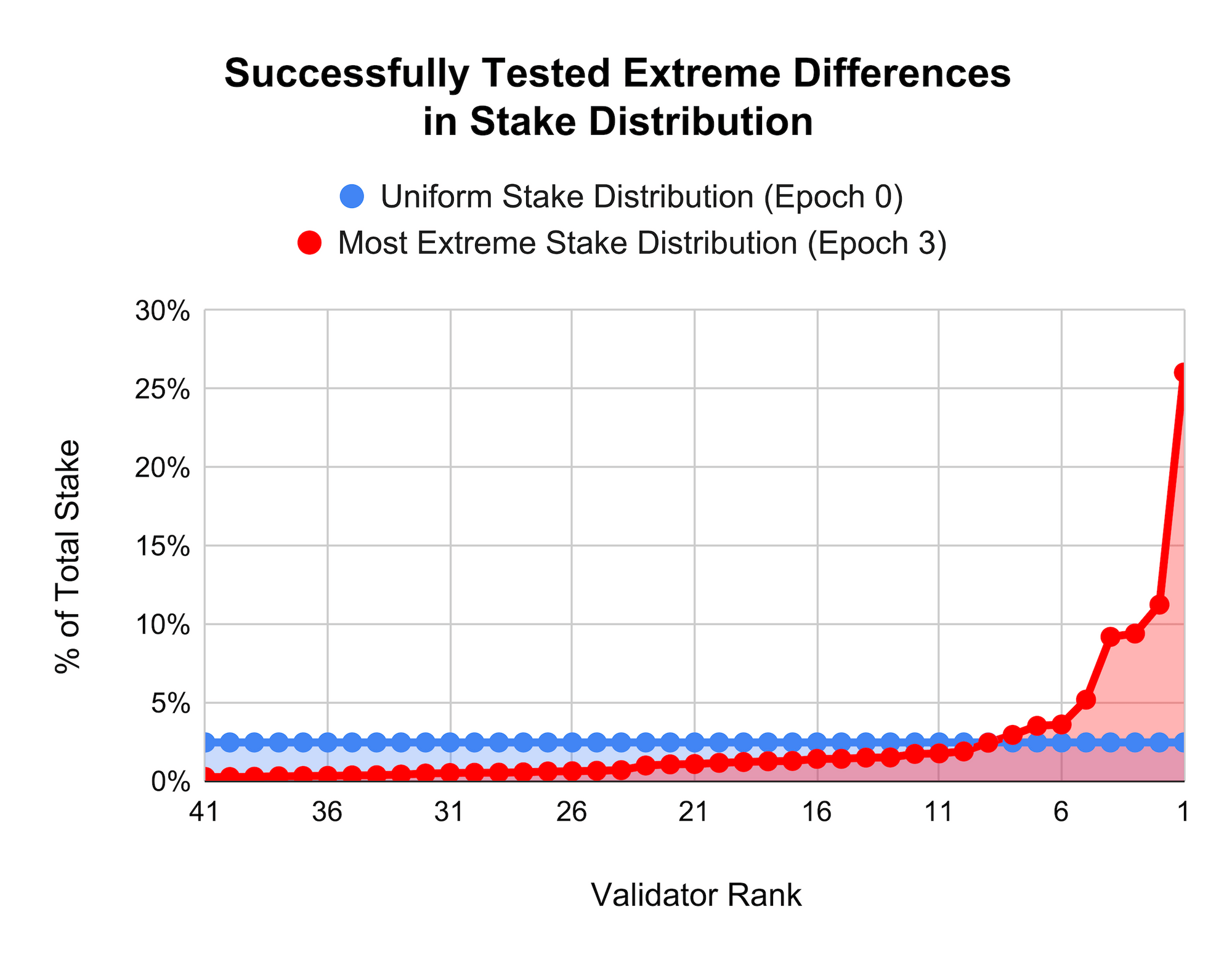

A crucial feature of the Sui Network is its resilience to significant changes in stake distribution. This ensures that network incentives remain intact even in the face of such changes, without disrupting the network's operations. This ability to support both decentralization and performance is a major advantage, as it allows for operational excellence and successful economic governance to be achieved simultaneously. This creates a win-win situation for all stakeholders involved in the Sui Network.

Big Supporter of Decentralization With Frenemies Game

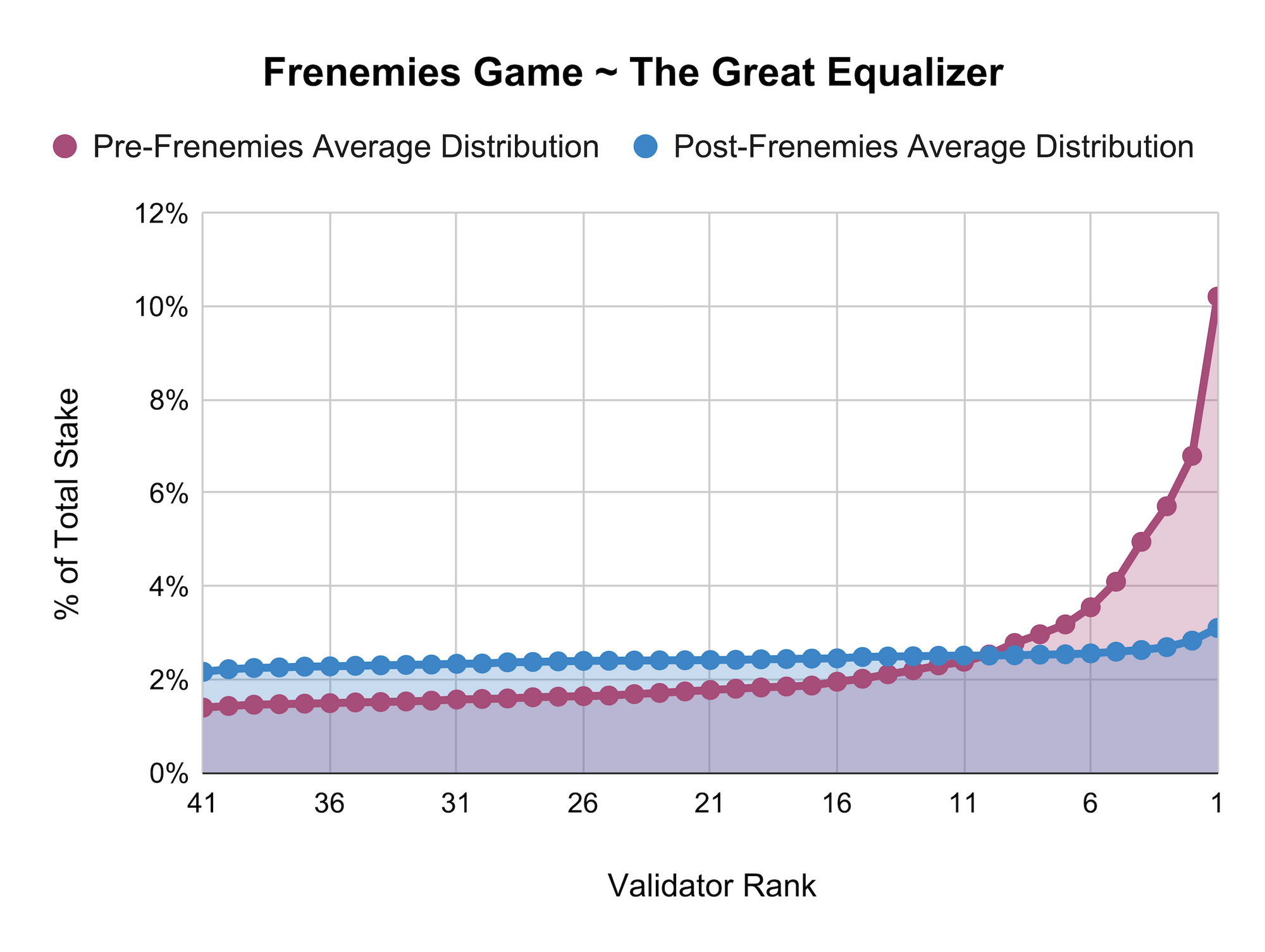

As Testnet approached its conclusion, the Sui community was invited to participate in a Frenemies game, which provided a fun and engaging way to test the network's resilience to random movements of tokens across validators. The game required stakers to shift their tokens across validators in random ways, providing a comprehensive evaluation of the network's ability to withstand such movements.

The Frenemies game turned out to be a great equalizer and a strong supporter of decentralization. By randomly shifting stakes, it became increasingly difficult for a single validator to accumulate a large share of stakes, resulting in a more even distribution of stakes across the network. This was a critical aspect of promoting decentralization, which is a key feature of the Sui Network.

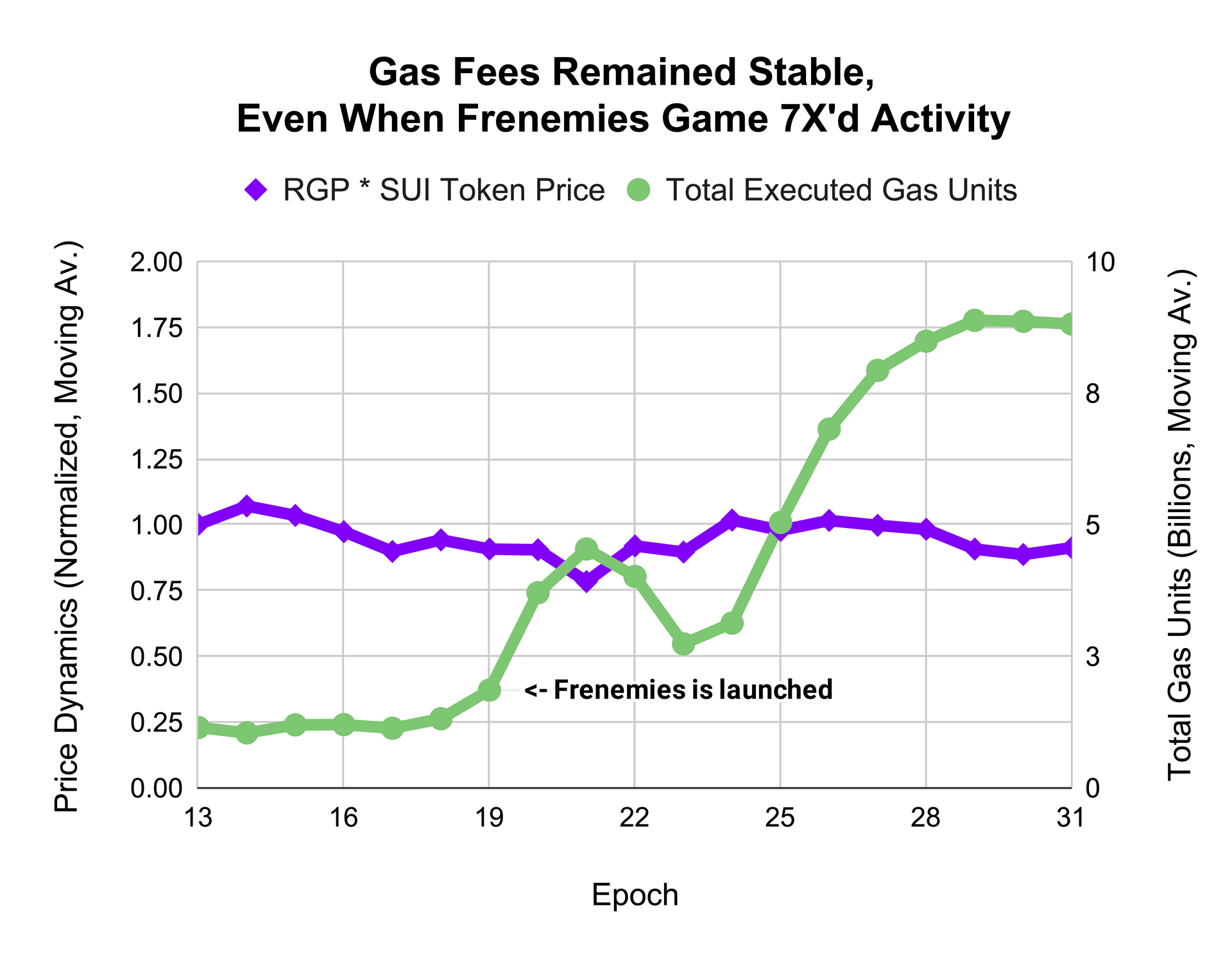

The Frenemies game had a significant impact on user engagement, resulting in a remarkable increase in Testnet's on-chain activity, which rose by over 700%. Despite this surge in activity, the Gas Prices remained stable, thanks to Sui's horizontal scalability, which allowed validators to parallelize transactions more efficiently as demand increased.

The ability to maintain stable Gas Prices even during periods of high demand is a crucial aspect of the Sui Network's functionality, and it highlights the network's robustness and resilience. The horizontal scalability of Sui's infrastructure and the ability of validators to parallelize transactions have proven to be highly effective in managing transaction volume while ensuring that users can enjoy a stable and reliable experience.

Check in details at: Testnet Wave 2 Recap – The Tokenomics Suinami

Wrapping up

Exciting early results for Sui's object-centric model, parallelizable architecture, and accessible programmability. The on-chain tokenomics model is now live, delivering performant financial services. Thanks to all who participated in Testnet Wave 2, and congrats to the top validators Stakin, DSRV, Passive Trust, Chain Node, and Staking Cabin. Pre-season testing was a resounding success, and we're eager for the next Testnet iteration and Mainnet launch. Looking forward to continuing collaboration with the Sui community and validators to take tokenomics to the next level. Stay tuned for Sui Testnet Wave 2 Recap Part 3 on the next blog.

Be sure to check out Suipiens website and social media channels to stay up-to-date on all things about Sui Blockchain!