Inside Suilend: Sui’s Leading Lending Platform

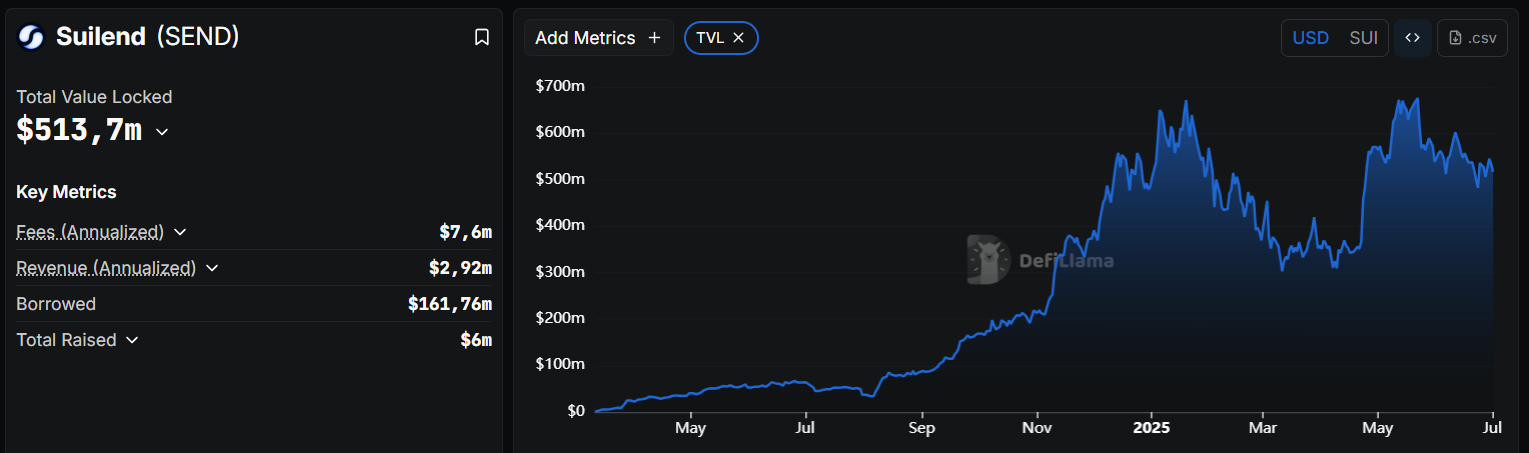

Explore how Suilend became Sui’s top DeFi protocol with $1B TVL, SEND token rewards, and a robust lending infrastructure.

Suilend: Powering Sui’s Lending Economy

Suilend isn’t just another DeFi lending protocol — it’s the largest, fastest-growing financial platform on the Sui Blockchain. With roots in Solana’s renowned Solend protocol and an ambitious roadmap ahead, Suilend is building a comprehensive financial layer for the next wave of Web3 users.

Backed by seasoned builders and deep industry support, Suilend brings a familiar money-market model into the Move-based Sui ecosystem, while innovating in areas like liquid staking (SpringSui), automated market making (STEAMM), and a novel token distribution method that rewards long-term participation.

What is Suilend?

Launched in March 2024, Suilend is a decentralized lending and borrowing protocol built on Sui — and it marks the first expansion from the team behind Solend. Led by the pseudonymous founder “Rooter,” the project carries over Solend’s expertise in DeFi lending and repackages it for Sui’s high-performance architecture.

Suilend enables users to earn yield on idle crypto assets or borrow against them without selling. By removing intermediaries and embracing decentralization, Suilend aims to deliver accessible, low-cost financial services to the masses.

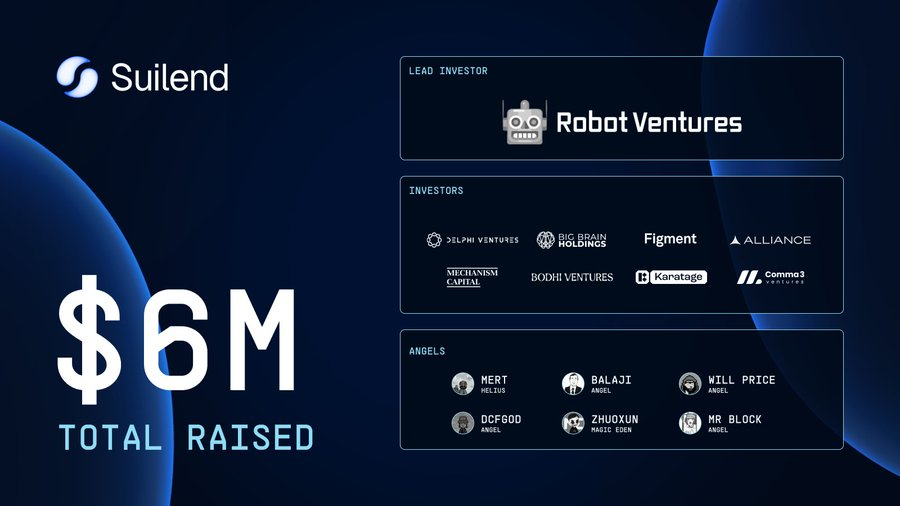

Backing and Early Growth

Suilend isn’t flying solo. In 2024, the team secured $6 million across two rounds from top-tier crypto investors — including Delphi Ventures, Robot Ventures, Mechanism Capital, DeFi Alliance, and Karatage. Influential figures like Balaji Srinivasan and DCFGod also backed the protocol early.

The results were immediate. By the end of 2024, Suilend had already claimed the top spot in Sui’s DeFi landscape with $470 million in TVL. Just a month later, in January 2025, it crossed the $1 billion mark — propelled in part by its liquid staking sibling, SpringSui.

Today, with over 50,000 monthly active wallets, Suilend is cemented as the Sui ecosystem’s flagship lending platform.

Under the Hood: How Suilend Works

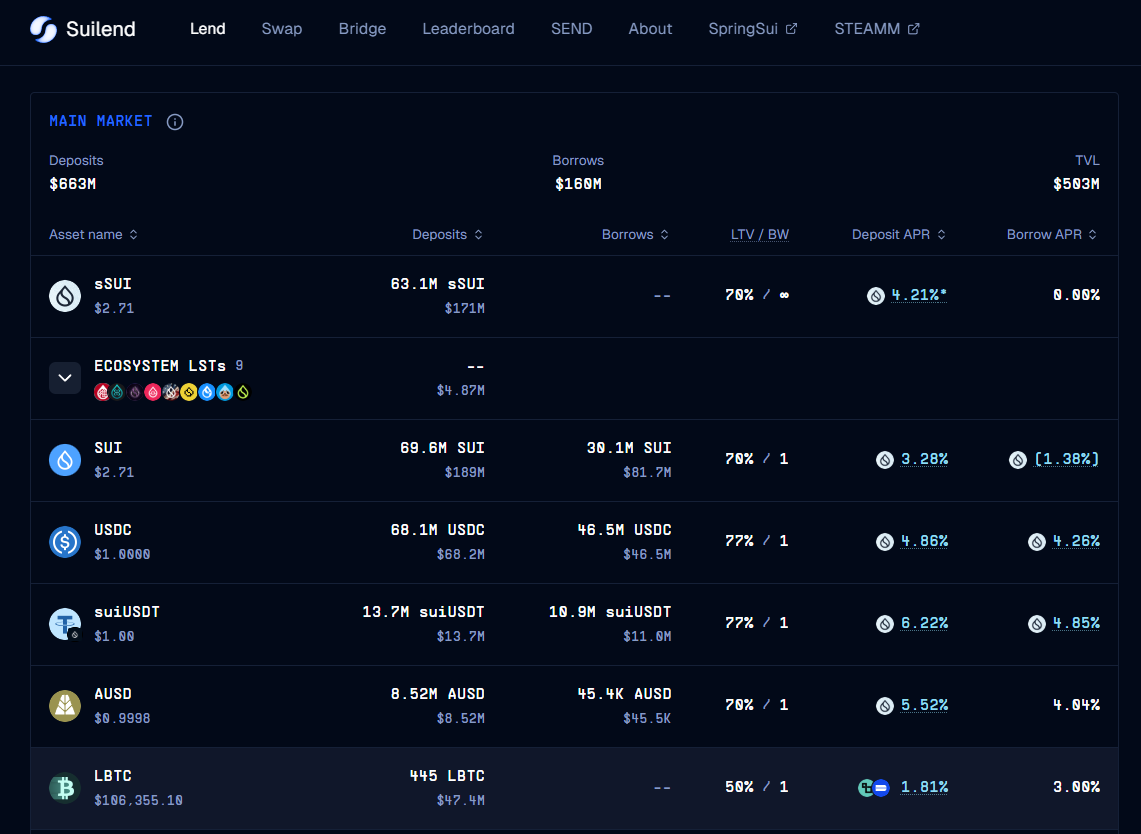

Suilend follows a familiar money-market design, similar to Aave or Compound. But its architecture is built from the ground up in Sui’s Move programming language, which allows for improved speed, security, and composability.

Here’s how it functions:

- Lending Pools: Each supported asset — like SUI or USDC — has its own reserve within a lending market. Users deposit into these pools to earn yield.

- cTokens: Depositors receive yield-bearing cTokens that represent their share of the pool, including interest.

- Obligations (NFTs): Each user’s lending/borrowing position is tracked via an Obligation NFT, which calculates borrowing power across all their positions.

- Collateral & Liquidations: Loans are over-collateralized. If a borrower’s collateral drops below a threshold, liquidators repay the debt and seize assets at a discount.

- Oracles: Asset prices are sourced via trusted oracles like Pyth and Switchboard to ensure accurate LTV and liquidation triggers.

The protocol’s design combines tried-and-true DeFi mechanics with Sui’s next-gen infrastructure, making it both robust and future-ready.

$SEND Tokenomics

SEND is LIVE on @SuiNetwork!$SEND is powering Sui’s DeFi Suite, with lending, infinite liquid staking via SpringSui, and a superfluid AMM via Steamm.

— Suilend (@suilendprotocol) December 12, 2024

Learn more about SEND ⤵️ pic.twitter.com/ViaN8SeVXf

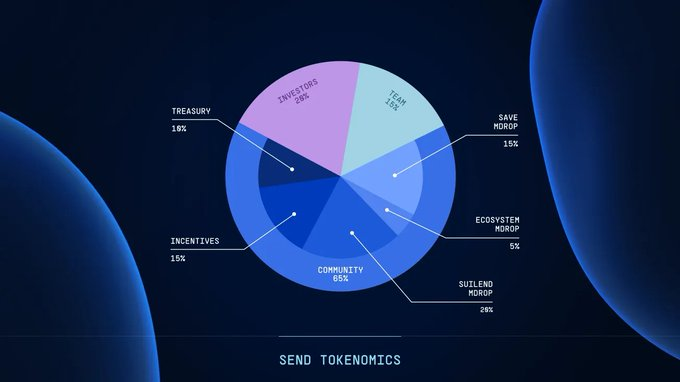

In December 2024, Suilend introduced its native token, SEND — a utility and governance token designed to align long-term incentives between users, builders, and the broader community.

Key Details:

- Total Supply: 100 million SEND

- Allocation:

- 65% to the community (airdrops, incentives, DAO treasury)

- 20% to early investors (2-year vesting)

- 15% to the founding team (4-year vesting)

This “community-first” model gives real ownership to users while rewarding long-term contributors and supporters.

Gamification & Community Engagement

Suilend cleverly gamified participation through:

- Points Campaigns: Users earned non-transferable Suilend Points by depositing assets. These later translated into SEND via Mdrop allocations.

- Capsule NFTs: Contributors (e.g. content creators, meme-makers) received NFTs that unlocked surprise benefits at launch — often extra SEND allocations.

This approach incentivized real engagement and rewarded the community in meaningful ways.

Utility of SEND

The SEND token serves several roles:

- Governance: Holders will soon steer the protocol via the Suilend DAO, voting on proposals like adding new assets or adjusting risk parameters.

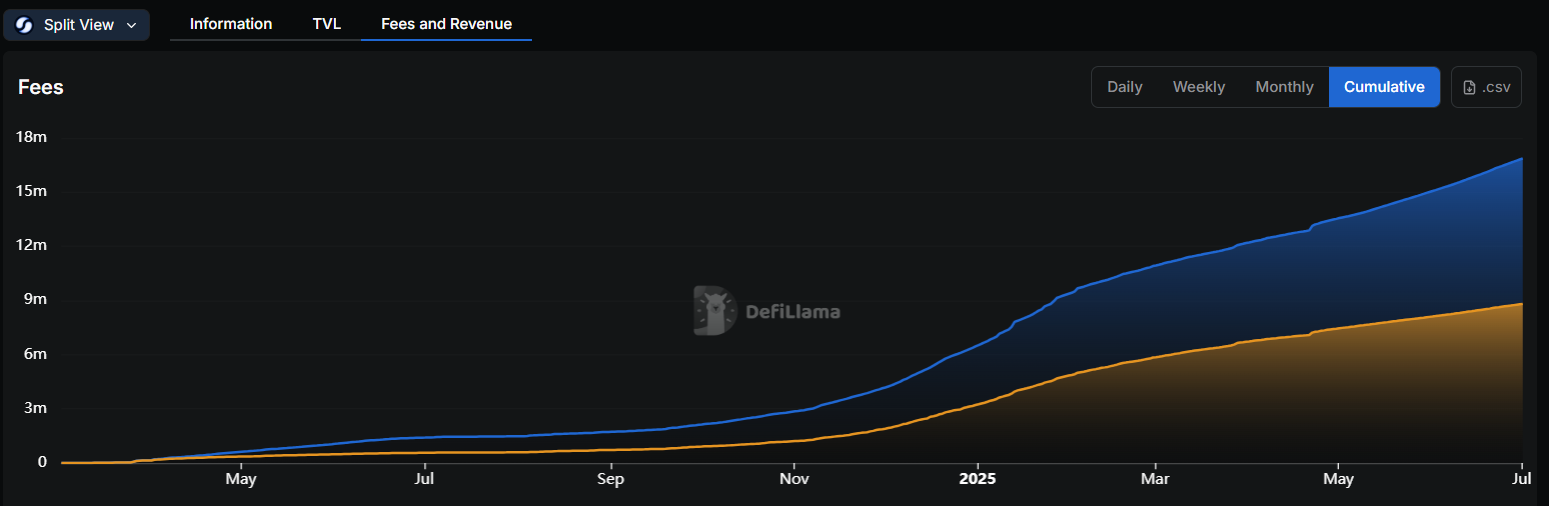

- Revenue Sharing: Suilend plans to share protocol earnings (interest rate spreads, STEAMM AMM fees, etc.) with SEND stakers — creating tangible value.

- Incentives: Liquidity providers, borrowers, and campaign participants can earn SEND as rewards, helping bootstrap the ecosystem.

At the start of 2025, Suilend’s annualized revenue was already nearing $16 million — and that’s just from lending. With STEAMM and other innovations, revenue sharing could make SEND one of the most compelling DeFi tokens on Sui.

The Road Ahead: Opportunities for Growth

Suilend stands at the forefront of Sui’s booming DeFi scene, which surpassed $2 billion TVL in early 2025. As new stablecoins and assets launch on the network, Suilend’s markets will only deepen.

Its design offers competitive interest rates, boosted APYs through SEND rewards, and a governance token that lets users shape — and profit from — the protocol’s future.

With a strong track record, early-mover advantage, and upcoming plans for new products like a perpetual DEX and a launchpad, Suilend is poised to become more than just a lender. It’s shaping up to be a full-spectrum DeFi hub on Sui.

Final Thoughts

Suilend isn’t just innovating within DeFi — it’s helping define what DeFi on Sui looks like. Backed by top investors, battle-tested builders, and a thriving community, it’s built to last.

For users looking to participate in the next evolution of on-chain finance, Suilend offers a compelling opportunity — not just to earn, but to build and own a piece of the ecosystem itself.

Be sure to check out Suipiens' website and social media channels to stay up-to-date on all things about Sui Blockchain!