An Overview of Perp DEXs on Sui Blockchain

Explore the leading perpetual DEXs on Sui—FlowX, Bluefin, ZO, and Typus—and how they shape the growing decentralized derivatives ecosystem.

Perpetual DEXs on Sui: The Builders of a New Derivatives Frontier

The Sui Blockchain is rapidly becoming a fertile ground for decentralized perpetual exchanges (Perp DEXs).

With its parallel transaction processing, low latency, and composable architecture, Sui offers a strong foundation for on-chain derivatives — where speed, execution quality, and capital efficiency matter most.

Today, four major players stand out: FlowX Finance, Bluefin, ZO Perpetuals, and Typus.

Each takes a distinct architectural approach to liquidity and user experience, contributing to the diversification of Sui’s trading landscape.

Below is an overview of how these platforms differ, followed by a closer look at each.

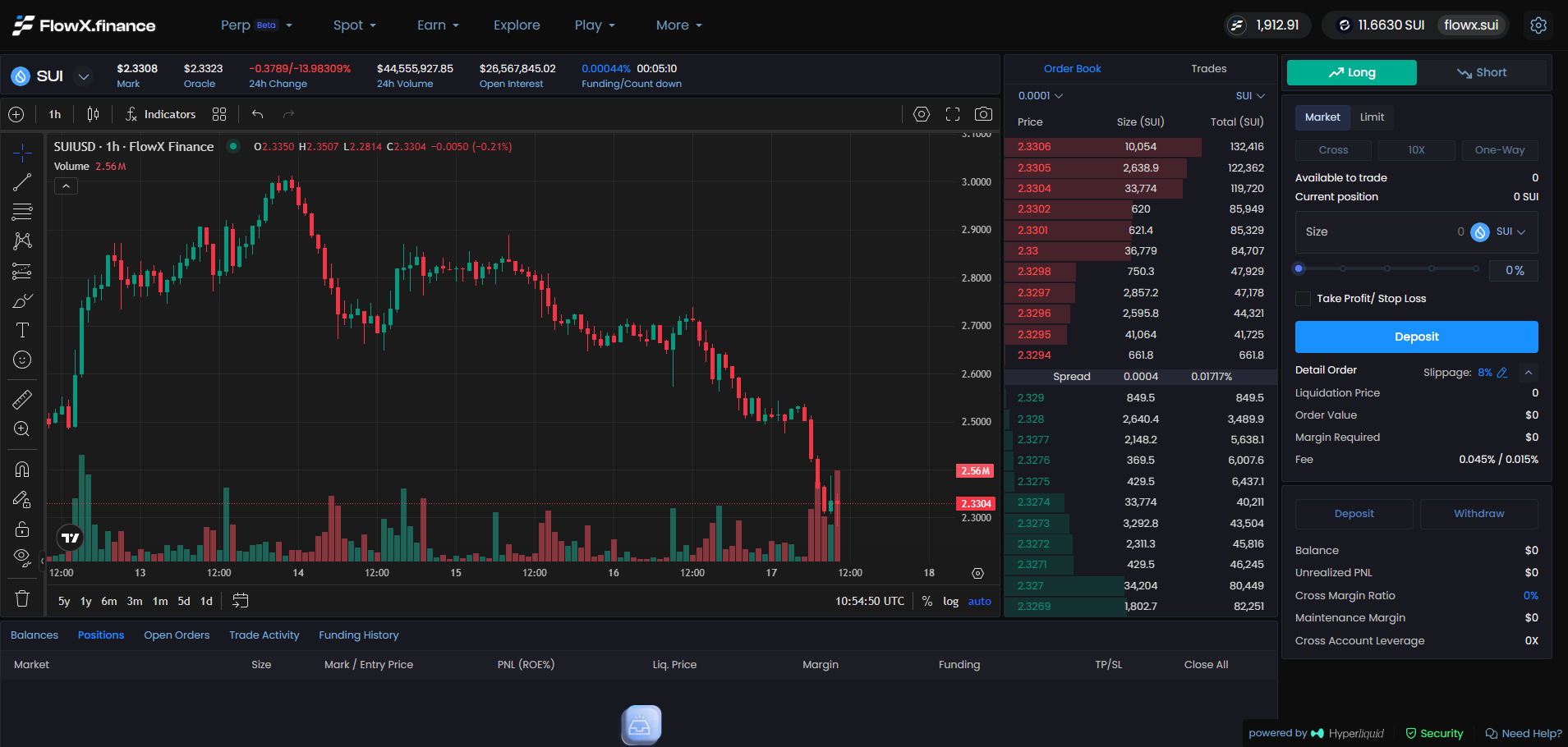

FlowX Finance

Built by FlowX Finance on top of Hyperliquid’s proven infrastructure, FlowX Perp brings centralized-exchange performance to Sui’s decentralized environment.

By leveraging Hyperliquid’s liquidity and market depth, FlowX offers one of the smoothest trading experiences currently available in the Sui ecosystem.

- Markets: 183+ perpetual pairs, the largest among all Sui Perp DEXs.

- Max Leverage: 40× for BTC

- Fees: 0.045% for taker order/0.015% for maker order. Rewarding active traders with progressively lower fees (depending on a 14-day trading volume)

FlowX’s architecture ensures low-latency execution and deep liquidity while retaining Sui native settlement for transparency and security.

The team also runs ongoing trading campaigns — including a $20,000 Perp Trading Competition — to attract professional and retail traders alike.

Share your PnL. Win Big with FlowX Perp 🦓

— FlowX Finance 🦓 (@FlowX_finance) October 14, 2025

Trade on FlowX Perp, share your best PnL card (check the Position tab), and post it on X with the hashtag #FlowXPerp, then drop your tweet link + Sui wallet address below.

20 random winners will share $500 USDC 🤑, and every valid… pic.twitter.com/GUJPowpQ1q

With its hybrid model of high performance and native Sui integration, FlowX represents a new generation of perp trading on Sui.

Try FlowX Perp here: https://flowx.finance/perp

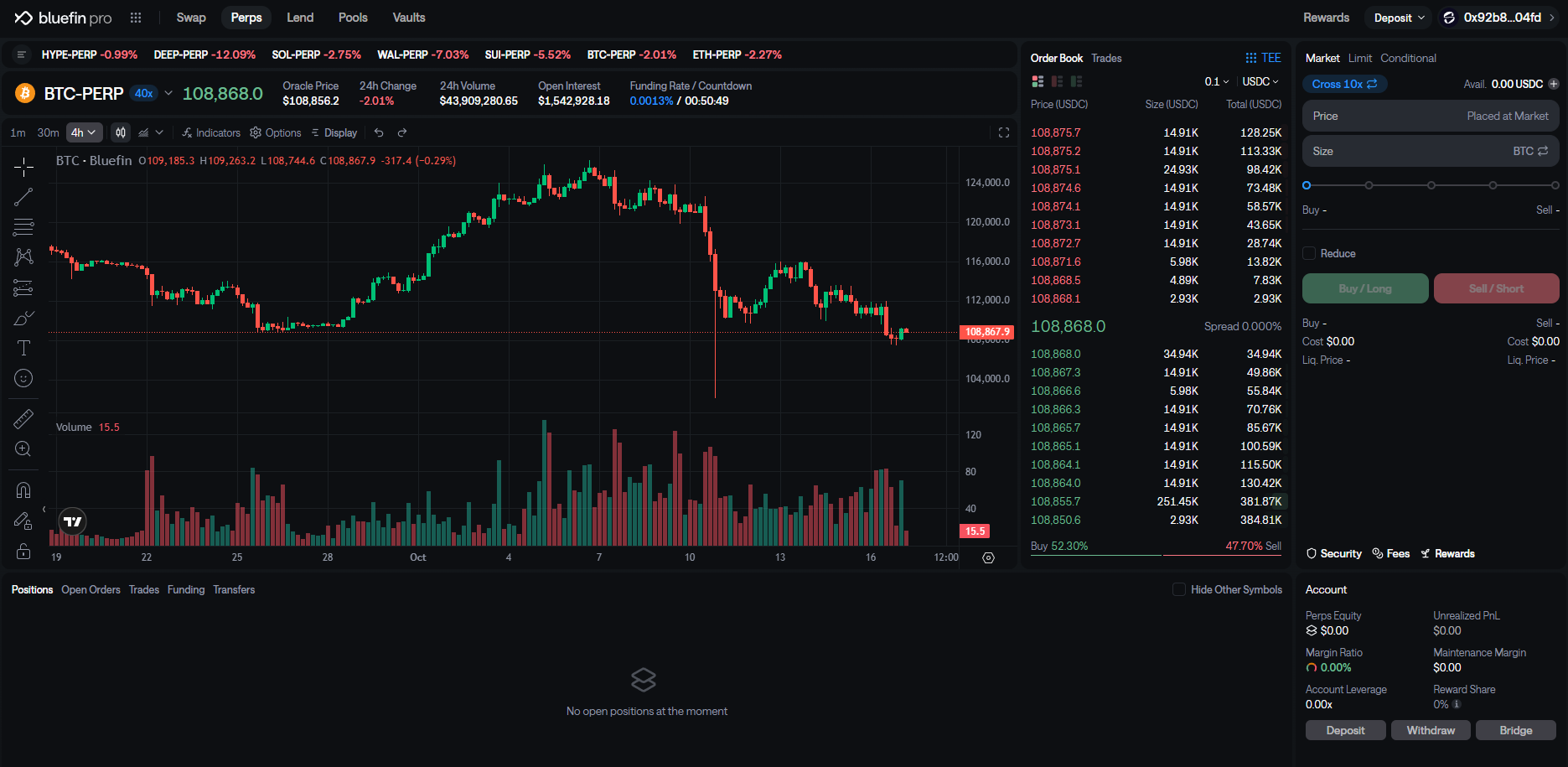

Bluefin

Bluefin has positioned itself as one of the most recognized perpetual DEXs on Sui.

It combines an off-chain order book for speed and efficiency with on-chain settlement for transparency and security — a structure similar to dYdX’s earlier architecture.

- Markets: Currently 7, including BTC, ETH, and SOL, as well as Sui-native assets such as WAL, DEEP, HYPE, and SUI.

- Max Leverage: Up to 40× for BTC-PERP.

- Fees: Maker 0.005% / Taker 0.035% for major markets; 0.1% for Sui-native pairs.

Bluefin delivers a smooth trading experience and has begun expanding into Sui-native derivatives, a move that strengthens its position within the ecosystem.

Its user interface and order execution quality make it appealing for traders who prefer near-CEX speed with on-chain reliability.

Try Bluefin Perp here: https://trade.bluefin.io/pro

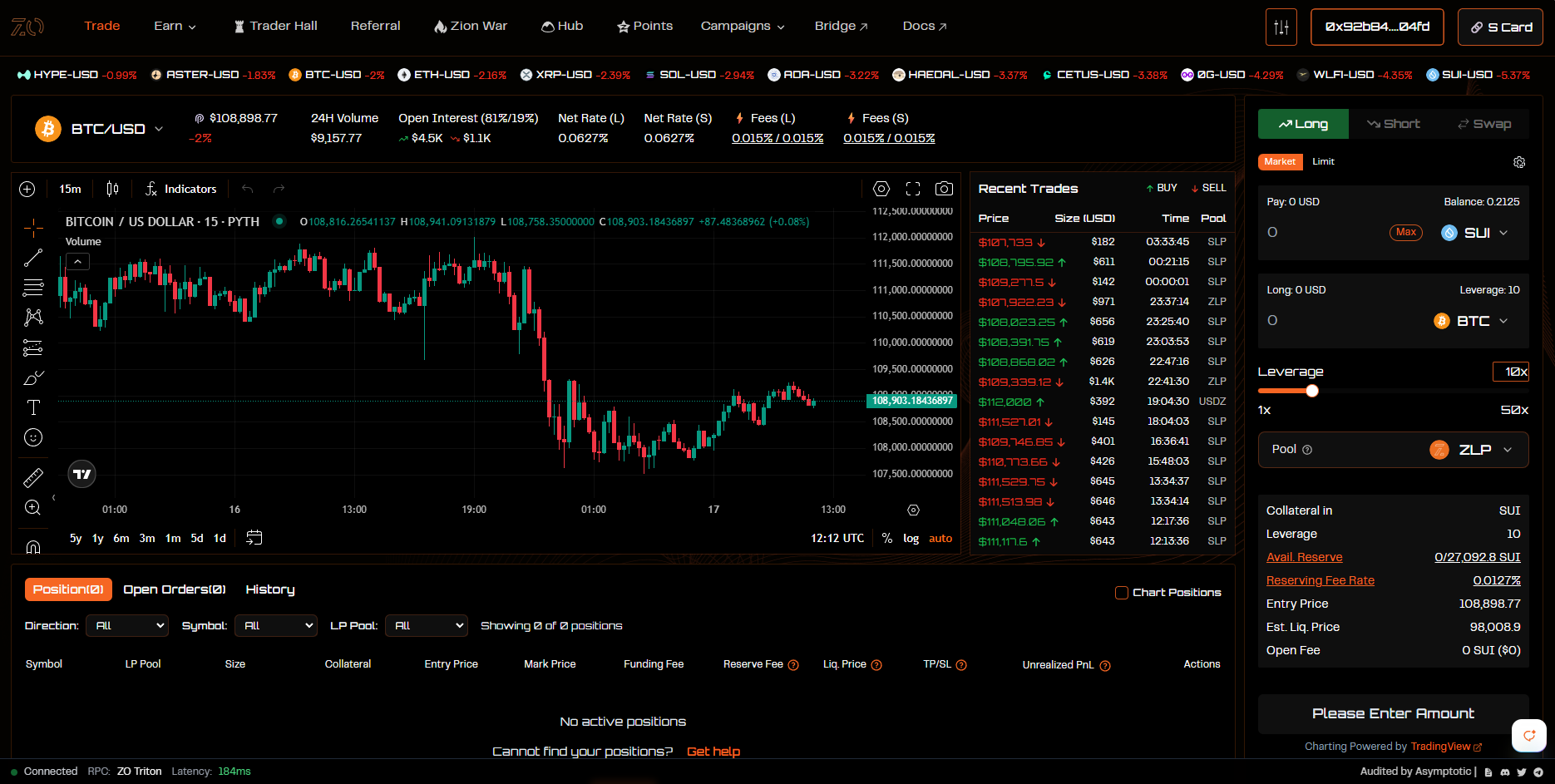

ZO Perpetuals

Developed by Sudo Finance, ZO Perpetuals is the first fully on-chain perpetual protocol on Sui, emphasizing transparency and MEV resistance.

It utilizes oracle-based pricing and executes trades with near-instant finality — around 300 milliseconds per transaction.

- Markets: 26, including both major and Sui-native assets such as DEEP, CETUS, HAEDAL, IKA, and NS.

- Max Leverage: 50×.

- Fees: 0.2%–0.5%, depending on the underlying index.

ZO is designed to eliminate front-running and slippage, offering traders reliable execution in volatile conditions.

While its fully on-chain structure may introduce slightly higher gas costs, it embodies the spirit of decentralization and transparency that many DeFi traders value.

Try ZO Perp here: https://app.zofai.io/trade

Typus

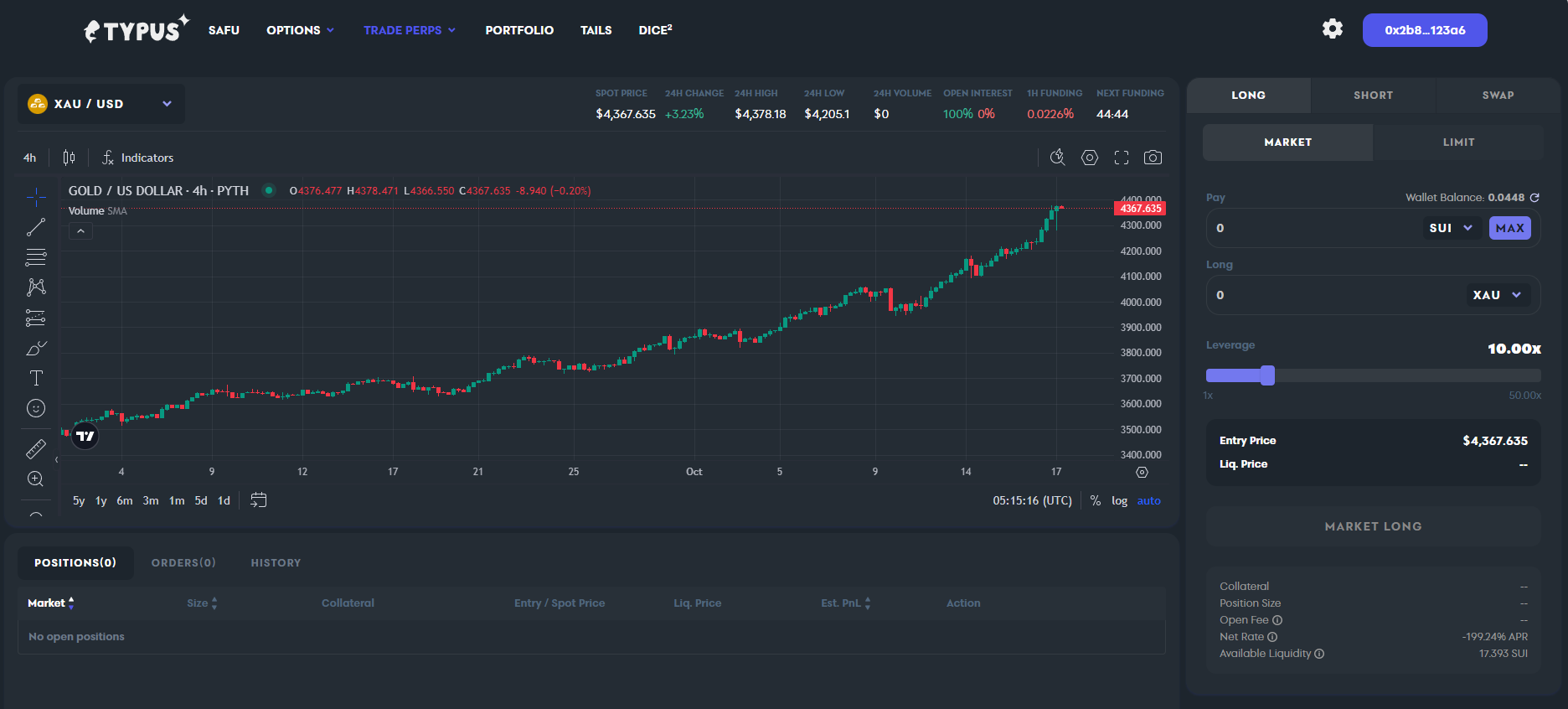

Typus Perps is a decentralized spot and perpetual exchange built natively on Sui.

It operates through the Typus Liquidity Pool (TLP) and relies on Pyth oracles for accurate pricing, delivering a slippage-free trading experience with leverage up to 50×.

- Markets: 13

- Max Leverage: 50×

- Fees: 0.05%–0.25% base and impact fee, plus 0.068% funding rate across markets.

Typus follows a hybrid fee model based on position size and market conditions, aiming for fair pricing and capital efficiency.

However, as of now, Typus Perps has temporarily paused trading due to a technical issue and is working on resolving it before reopening markets.

Despite the pause, Typus remains an important early builder on Sui, contributing to the ecosystem’s perp trading design space through its pool-based model.

🚨 Security Incident on Typus Perp@TypusFinance Perp was exploited via an oracle manipulation attack.

— Suipiens.sui 🦍💧 (@suipiens) October 15, 2025

- TVL dropped from $3.67M → $216K

- Currently, he team has temporarily paused all Perp contracts while investigating & fixing the issue.

⚠️ The $3.45M drop can be seen as… pic.twitter.com/Wxmjn2Lys0

Conclusion

Perpetual trading on Sui has entered an exciting phase.

Each of these four DEXs brings unique innovation to the table:

- FlowX Finance leads the pack with the widest market coverage (183+ pairs), deep liquidity sourced from Hyperliquid’s global network, and CEX-level execution while maintaining on-chain settlement.

- Bluefin emphasizes hybrid execution and established reliability.

- ZO prioritizes transparency and fairness through full on-chain design.

- Typus explores capital-efficient, pool-based simplicity.

Together, they are defining the foundation for what could become one of Web3’s most dynamic and efficient on-chain derivatives ecosystems.

As liquidity grows and integrations deepen, Sui is quietly positioning itself as a new frontier for decentralized perpetuals.

Be sure to check out Suipiens' website and social media channels to stay up-to-date on all things about Sui Blockchain!