ABEL Finance: The First MOVE Cross-Chain Lending Platform

In this article, we'll discuss information about the Abel finance project and ABEL token.

1. Introduction

The First Cross-Chain Lending Platform Build on Aptos and Sui network. It offers the following features:

- Coin and "AMM LP Coin" and NFT are supported for lending.

- Support cross-chain lending.

- Make awesome multi-chain assets liquidity.

- Official Treasury insurance.

- Fully decentralized community autonomy.

- Referenced an implementation of CompoundV2 and was implemented using the MOVE language.

2. Main features

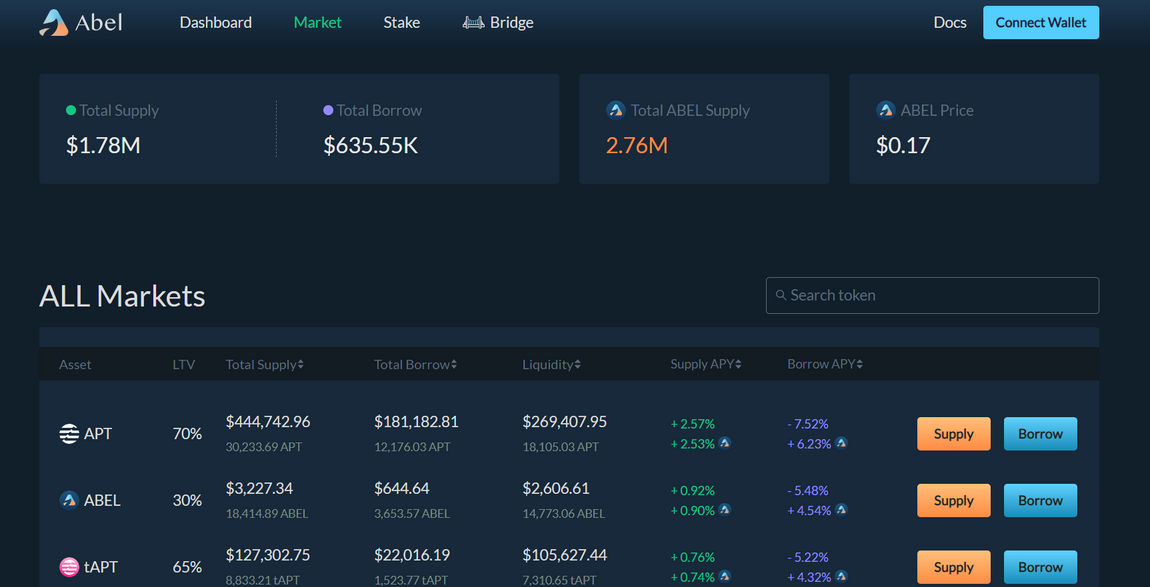

2.1 Lending

The platform allows users to engage in lending activities such as supplying coins, withdrawing, borrowing, repaying borrowed coins, and claiming rewards.

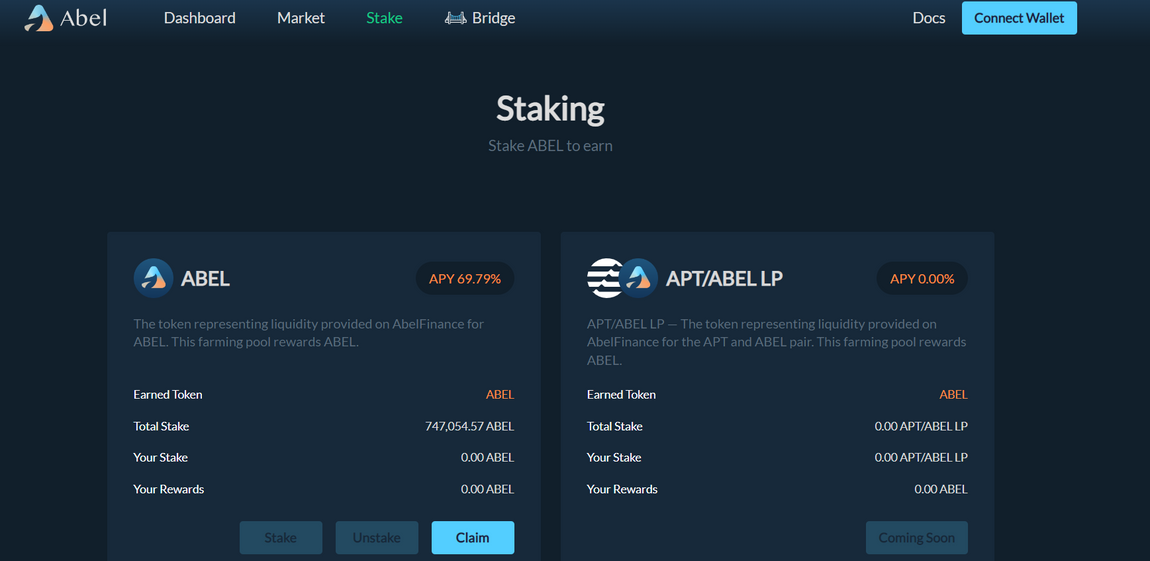

2.2 DAO

In addition, the platform offers a DAO component through staking ABEL and APT/ABEL LP. This provides users with the ability to not only access lending services, but also play an active role in the governance of the platform. The integration of both lending and DAO features creates a comprehensive financial ecosystem for users, offering them a wide range of services and opportunities to grow their investments.

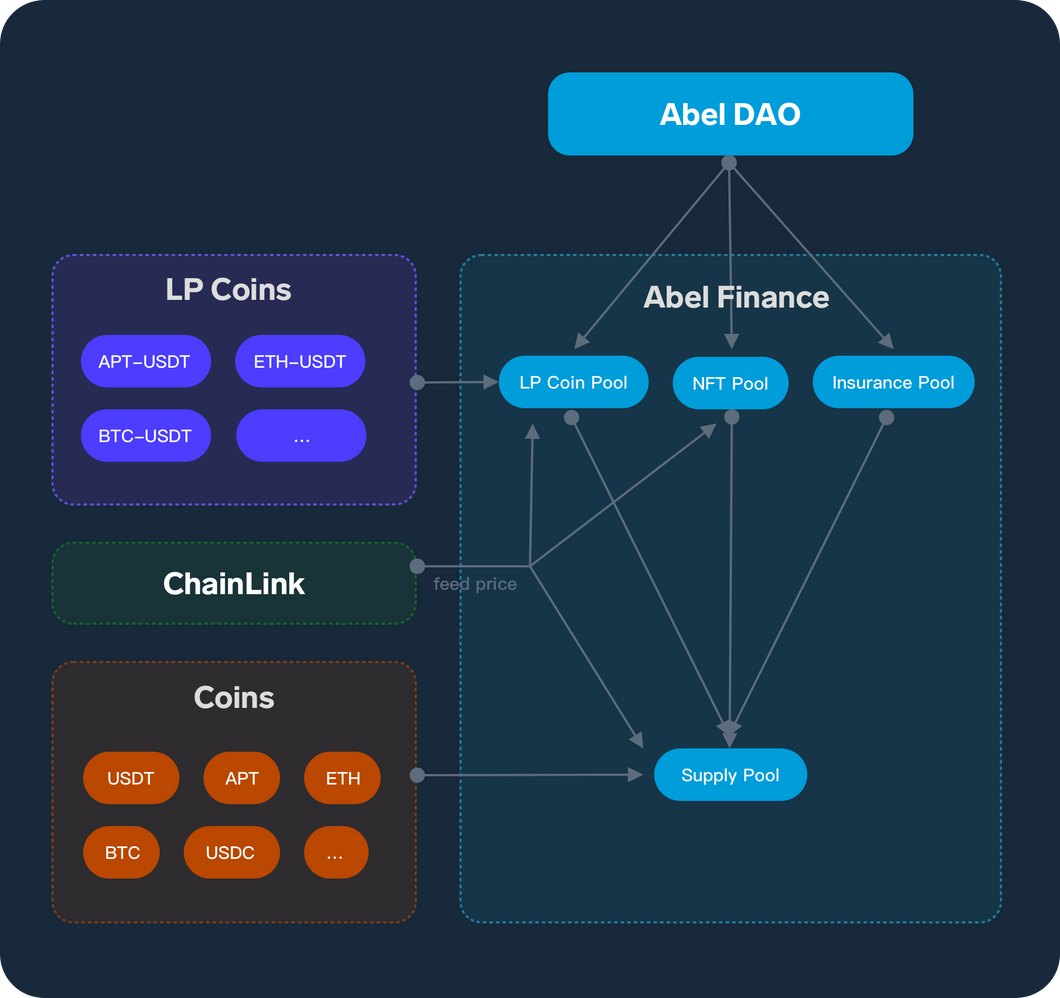

3. Protocol Overview

The launch of a new financial platform is making waves in the cryptocurrency space with its four distinct capital pools:

- LP Coins pool

- Supply pool

- Insurance pool

- NFT pool

→Each pool offers unique benefits to both borrowers and lenders.

LP pledgers, also known as borrowers, have the opportunity to deposit LP coins in order to obtain credit and access assets. This credit can be used for governance voting and comes with dynamic excess borrowing rates and pledged airdrop incentives. By pledging their LP coins, borrowers have the ability to obtain credit and take advantage of new LP coin currency options.

Liquidity providers, on the other hand, play a crucial role in the platform by depositing tokens to provide liquidity in the market. This not only supports mainstream coins, but also offers liquidity providers the chance to earn interest income and receive additional incentives for their contributions.

The platform also has a safety mechanism in place in the form of liquidators. If a borrower reaches the liquidation line, the liquidator repays the borrower in exchange for a discounted rate of 8% on the collateral. This not only protects the lender's investments but also provides an opportunity for the liquidator to earn a profit.

Abel Finance takes on a crucial role in the project as the community operator and project maintainer. They are responsible for the operation of the Insurance pool, which is funded by the Abel finance treasury.

⇒ In summary, the new financial platform offers a unique solution for borrowers and lenders in the cryptocurrency space. The combination of LP Coins pool, Supply pool, Insurance pool, and NFT pool provides a comprehensive financial ecosystem that offers benefits to all parties involved. Whether it's the opportunity for borrowers to access credit and assets, or the chance for liquidity providers to earn interest and incentives, the platform is poised to make a significant impact in the world of cryptocurrency finance.

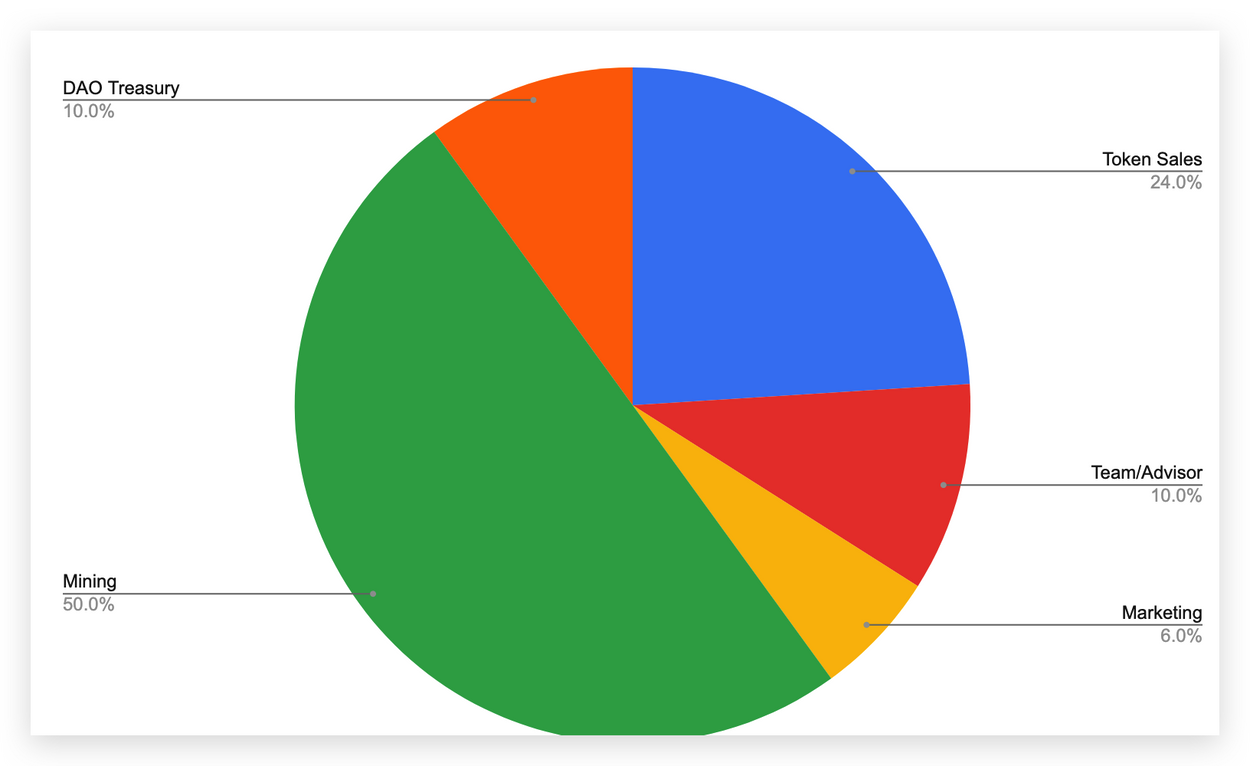

4. Tokenomics

- Token Name: Abel Finance

- Ticker: $ABEL

- Total supply: 100 million ABEL Coin

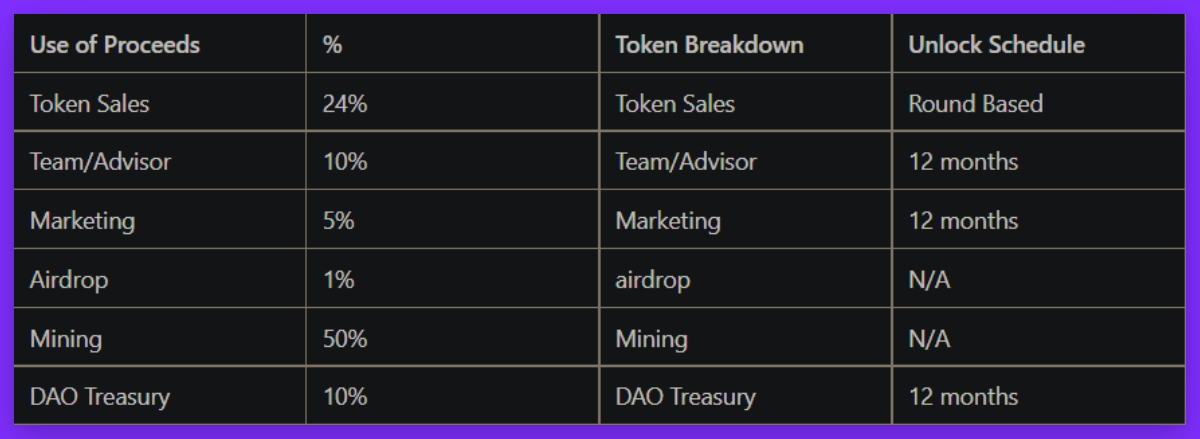

5. Token Allocation

The unlocking rules for Team/Advisor

- 10% will be unlocked on the day of Mainnet launching

- The rest will be unlocked in 12 months (7.5% each month)

The unlocking rules for Marketing

- 10% will be used for beta activities airdrops

- The rest will be unlocked in 12 months (7.5% each month)

Mining of Early Bird

Early bird mining rules:

- Mining lasts for 7 days (Jan 15th – 22th, 2023 13:00 UTC)

- Total 30,000 ABEL coins

- 20,000 ABEL coins allocated to ABEL coin staking pool

- 10,000 ABEL coins allocated to the lending market

6. Token Use Case

ABEL coin is used for several purposes, including:

- Distributing proceeds to holders.

- Conducting governance voting for adjusting parameters and listing coins.

- Whitelisted IDO for cooperation projects.

- Pre-emptive right to issue NFTs.

7. Team

The ABEL team consists of 8 people, including:

- Jack - experienced blockchain developer with 6 years of experience, focused on Ethereum community development and expertise in cross-chain, smart contracts, and lending agreements.

- Kewei - experienced in R&D of EVM-compatible chains and has more than 5 years of experience leading business development and managing team objectives.

- Galen - experienced in DeFi, GameFi P2E, and NFT's Metaverse across ETH, BSC, and SOL ecosystems.

8. Roadmap

Stage 1

- Complete the overall plan of product

- Development of related protocols

- Official website launched

- Internal testing of protocol

Stage 2

- The launch of beta version Abel in APTOS testnet

- Airdrop plan for beta activities

- Lending and Borrowing

- Develop and test LP pool

- Develop IDO platform

- Design the model of the DAO

- Preparation for launching APTOS mainnet

Stage 3

- Complete ABEL IDO

- Initial APT-ABEL liquidity pool

- Deployment of the APTOS mainnet (Abel V1.0)

- The distribution of beta airdrops

- Support LP lending

- Deployment of the SUI mainnet (Abel V1.0)

Stage 4

- Launch of ABEL V2.0 support NFT lending

- Voting for support more coins

- Improve the user experience

- More open community autonomy

- Cross-chain lending

- More features - Charts

- Move all asset price oracles to Chainlink

Stage 5

- Launch of ABEL V3.0 support Cross-chain lending and borrow

- Personal dashboard

- Faster website

- Customized user profile

9. Wallet support

- Martian: @Martian_Wallet

- Blocto: @BloctoApp

- Petra: @PetraWallet

- Pontem: @PontemNetwork

- Fewcha: @FewchaWallet

- Rise: @rise_wallet

- BitKeep: @BitKeepOS

10. Official links

- Website: https://abelfinance.xyz

- Twitter https://twitter.com/abelfinance

- Medium https://medium0.com/@abelfinance

- Github https://github.com/abelfinance

- Discord https://discord.gg/AbelFinance

11. Summary

Here is all the information about the project. Abel Finance is run by a team with a lot of experience and skills. Currently, the project is in the process of finalizing products and functions.

Abel Finance will be a fully independent community project, so there will be no schedule. Instead, there will be a to-do list, which Abel finance will divide into stages. The work sequence and subsequent evolution within the stage will be determined by the community autonomy once the community and voting mechanism have been upgraded.

Above is all information about the project, you can refer to and experience before making your investment decision.

Be sure to check out Suipien's website and social media channels to stay up-to-date on all things about Sui Blockchain!