Top 10 DeFi Protocols On Sui Blockchain (Part 2)

Discover the top 10 DeFi protocols on Sui Blockchain in Part 2 of our series. Don't miss out on the latest decentralized finance trends!

Welcome to the second part of our series on the top 10 DeFi protocols on Sui blockchain. In this article, we'll be exploring some of the most innovative and promising decentralized finance projects built on Sui Blockchain, which is quickly emerging as a major player in the DeFi space. These protocols offer users a range of financial services, from lending and borrowing to trading and yield farming, all while leveraging the security and transparency of blockchain technology. Join us as we dive into the exciting world of DeFi on Sui Blockchain.

YouSUI

YouSUI is a unique launchpad platform that offers a range of exciting features for investors and project founders alike. It serves as a social platform that showcases a variety of games, NFTs, DeFi, and Metaverse projects running on Sui Blockchain to the public through IGO and INO. YouSUI has collaborated with several game development partners and supported projects beyond Sui Blockchain, including Polygon, Binance, Klaytn, Solana, and Ethereum, to enter the Sui Blockchain ecosystem. The XUI token is a utility token used on the Launchpad platform, enabling users to participate in fundraising rounds and earn rewards.

One of the key reasons for YouSUI's growing popularity is its commitment to performing due diligence on behalf of users and investors. This platform has stringent screening processes and enlists a third party to conduct Know Your Customer (KYC) verification on new users, ensuring a secure and transparent environment for all participants.

YouSui official links: Twitter | Website | Discord

Ballast

Ballast is a DeFi infrastructure initiative that offers a complete trading suite solution on Sui, an upcoming and scalable L1 solution. Founded in November 2022, Ballast is one of the first products to provide a CEX-competitive experience to DeFi users on Sui. The suite model provides a better user experience than a simple AMM, with flexible liquidity, easy access for institutional traders, secure and transparent on-chain verification, and the opportunity to price different types of instruments, and trading robots interoperability.

The Ballast infrastructure unlocks a range of opportunities in the DeFi space, enabling the trading of various types of assets with different levels of complexity, including perpetual & quarterly futures, power perpetuals, floor perpetuals, options, exotic options, everlasting options, options vaults, basis trading, fixed yield, structured products, and RFQ. With a mission to extend DeFi services offered on Sui and other blockchains, Ballast aims to onboard the CeFi audience to on-chain trading and investments.

Ballast official links: Twitter | Website | Discord

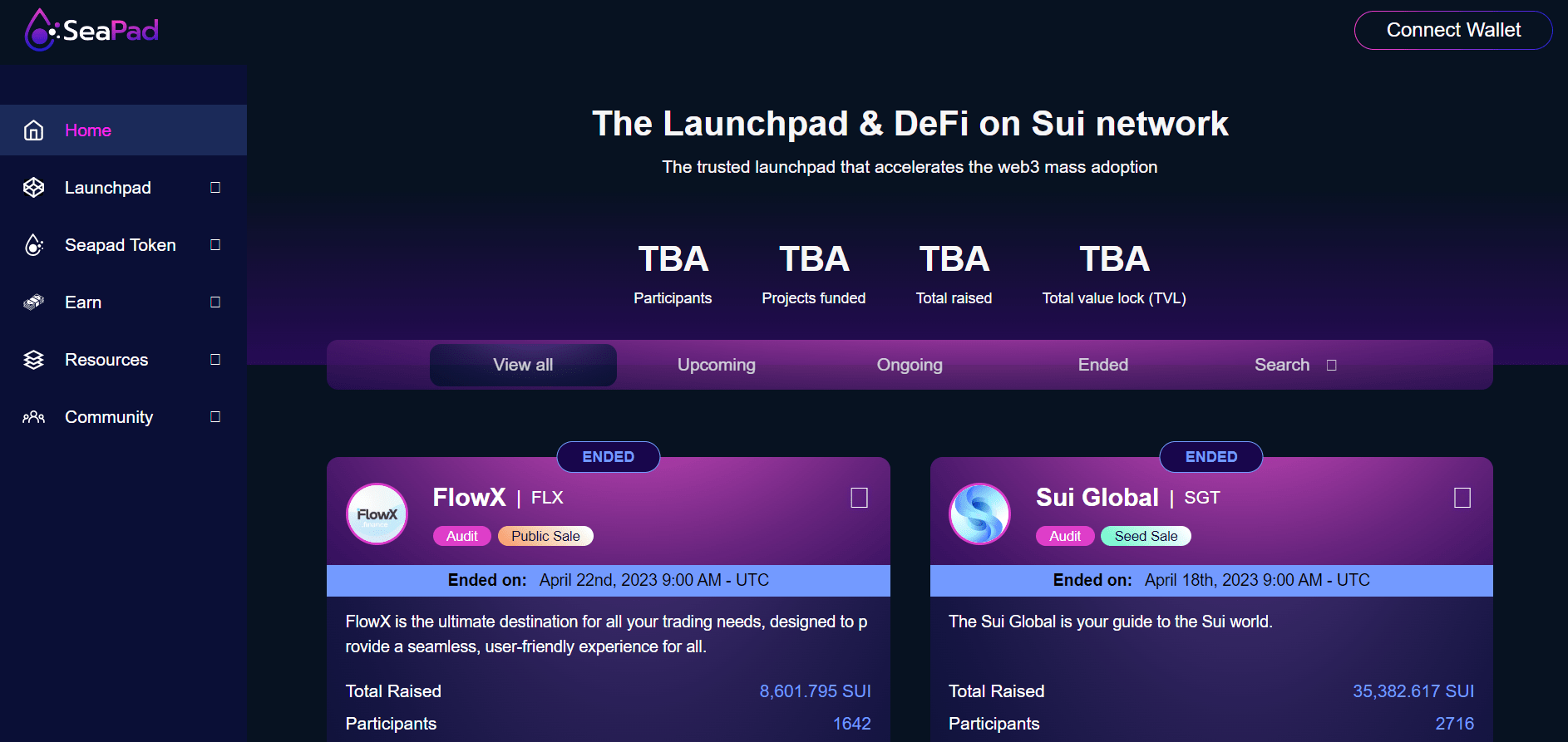

SeaPad

SeaPad is a trusted launchpad platform on the Sui network that empowers innovative ideas and brings projects to life. Its main goal is to support projects in the long term, not just for fundraising but throughout the entire life cycle, from idea to post-launch and beyond. SeaPad also focuses on removing barriers to investment and creating long-term revenue and benefits for all users, including both Web3 and Web2 users.

SeaPad integrates various DeFi functions such as swapping tokens (Dex), staking tokens, and marketing tools, as well as on-chain referential mechanisms and DAO governance to provide convenience to both projects and investors. It aims to be a one-stop platform where users can access everything they need without having to switch to other platforms.

To help projects get listed on the SeaPad platform, it provides many categories for projects to apply, including Incubator, seed/private sales, public IDO or post IDO, depending on the project's situation. The DAO committee, consisting of various parties such as Security (audit), Technology, Community, VCs, among others, verifies the projects and decides if they get listed on the platform. If a project is selected to join the incubator, the DAO committee will help and accelerate the project, and they also act as the project's angel investors and share benefits.

SeaPad official links: Twitter | Website | Discord

ShylockFi

ShylockFi is a revolutionary DeFi lending platform on the Sui blockchain that introduces a new concept to the NFT world: instant liquidity through a dynamic orderbook. This lending platform aims to provide instant liquidity for NFT collections by allowing lenders to provide liquidity, and borrowers to take out a loan using their NFTs as collateral.

One of the main advantages of ShylockFi is that borrowers can keep a wrapped version of their NFT in their wallet while using it as collateral, meaning they can still benefit from the potential value appreciation of their NFTs even while using them as collateral. Borrowers can quickly take out a loan by putting up their NFTs as collateral and setting the terms of the loan, including the interest rate, duration, and minimum offer they are willing to accept.

For lenders, ShylockFi offers an opportunity to browse NFT collections and name their own price, with the current best offer shown to borrowers. This creates a dynamic order book that allows for efficient price discovery and liquidity provision for NFT collections. If a borrower defaults, the lender gets to keep the NFT, which serves as a form of collateral. At the end of the loan period, lenders receive the total loan amount, including interest.

ShylockFi official links: Twitter | Website

NAVI Protocol

NAVI Protocol is an all-in-one liquidity platform on the Sui blockchain that offers users the ability to participate as liquidity providers or borrowers in the ecosystem. Liquidity providers earn passive income through yields by supplying assets to the market, while borrowers have the flexibility to obtain loans for different assets. The protocol features Automatic Leverage Vaults and Isolation Mode, which allow users to leverage their assets and access new trading opportunities with minimized risks. Navi's advanced security features ensure user fund protection and systemic risk mitigation. The protocol's offering includes a decentralized liquidity protocol that allows users to lend and borrow cryptocurrency assets without intermediaries, using a shared liquidity pool system.

Navi's liquidity pools are created for each supported asset, and users can deposit their assets into these pools to receive Navi receipt tokens in return, which represent their share of the pool. These tokens can be used as collateral to borrow other assets from the pool, with the collateralization ratio dynamically adjusted based on supply and demand. Navi also has a governance system that allows Navi token holders to vote on proposals and changes to the protocol, including setting interest rates, adding new assets, and changing the collateralization ratio. With its focus on providing essential DeFi infrastructure, Navi aims to be a key player in the rapidly evolving world of DeFi on the Sui ecosystem.

NAVI Protocol official links: Twitter | Website | Discord

Patronus

Patronus is a composable DeFi Liquidity Protocol built on Move, designed to meet the increasing capital flow needs safely and efficiently. As a DAO Managed Composable Decentralized Liquidity Protocol, it offers advantages such as true continuous compound interest, position-isolated tools, and an optimized liquidation mechanism.

With Patronus, users benefit from continuous compound interest calculation, which ensures a perfect match between actual interest and borrowing period. The protocol also provides a convenient tool for managing borrowing position risk through sub-accounts, allowing users to manage multiple risk-isolated positions with one single address. Additionally, Patronus' optimized liquidation mechanism calculates a dynamic and reasonable liquidation ratio for each account, ensuring that high-quality collateral is not subject to unnecessary discount treatment.

Patronus official links: Twitter | Website | Discord

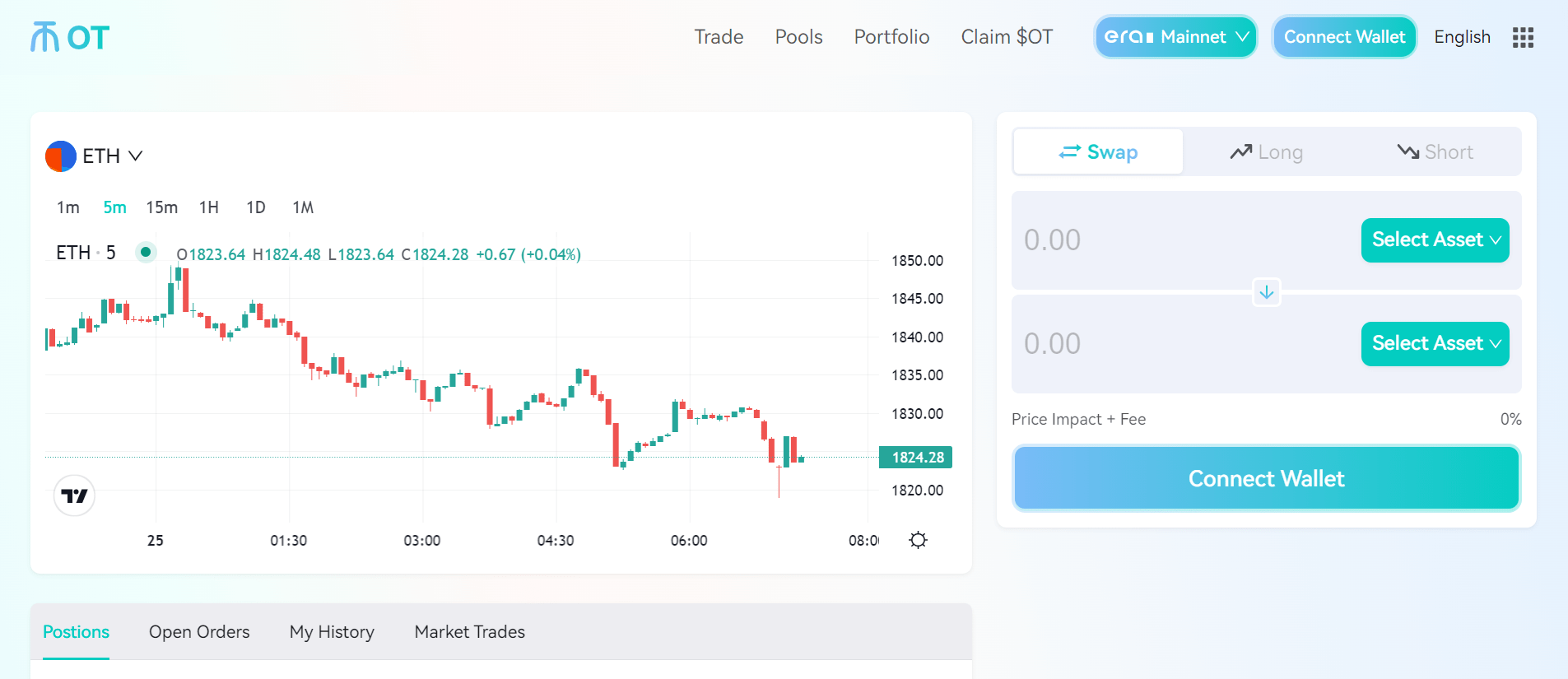

OnchainTrade

OnchainTrade (OT) is a cutting-edge DeFi protocol that enables single token liquidity pools, resulting in a more optimized experience for all participants. Unlike traditional AMMs that require two-sided liquidity provision, projects can launch tokens with zero extra capital on OT, and liquidity providers only have to deposit one token to the liquidity pool.

OT solves several problems in the DeFi space, including high capital costs for project launches, high slippage on traditional AMMs, inefficient capital usage, and convoluted smart contract routing resulting in high trading costs for indirect pairs. OT's innovative approach allows LPs to receive fees for both swaps and borrowing, while borrowers can borrow directly from swap pools.

Additionally, all non-OSD assets can be traded through OSD, which is virtually paired with all assets on OT, resulting in lower gas fees and slippage. With its integrated DeFi user experience, OT addresses the overall fragmentation status in DeFi, allowing users to seamlessly swap, borrow, and trade within one platform.

OnchainTrade official links: Twitter | Website | Discord

NojoSwap

NojoSwap is a DeFi platform designed to support Sui projects by providing them with visibility and liquidity. It is also a platform for DeFi users to discover and invest in new projects on Sui while earning rewards. The platform offers an automated market maker (AMM) for users to swap between tokens in their wallets, a liquidity farming system for liquidity providers to receive NOJO tokens as rewards, and reward pools for staking NOJO and earning other tokens without the risk of impermanent loss.

In addition to these features, NojoSwap plans to add more functionalities after its initial release. With NojoSwap, Sui projects will have access to the liquidity they need to grow and attract users, while DeFi users will have a streamlined experience for discovering and investing in new projects. The platform's focus on supporting Sui projects and providing a seamless user experience makes it a valuable addition to the DeFi ecosystem on the Sui blockchain.

NojoSwap official links: Twitter | Website | Discord

Typus Finance

Typus Finance is a cutting-edge DeFi platform on the Sui Blockchain that is making waves with its real yield infrastructure. The platform is designed to help users obtain superior risk-to-reward returns with just one click, thanks to its innovative combination of swap, lending, and derivatives protocols.

One of Typus' most exciting products is the DeFi Option Vaults (DOVs), which offer a simplified decision-making process for retail users through the implementation of a Dutch Auction mechanism. This option marketplace is specifically designed for long-tail assets, providing enhanced risk rewards for Liquidity Providers (LPs) while deepening liquidity in the DeFi ecosystem.

With Typus Finance, LPs can hedge their gamma risks using Typus Vaults and auto-rebalance based on price ranges determined by volatility discovery. This approach leads to an improved risk-adjusted return for LPs and deepens liquidity in the DeFi space, creating a win-win situation for all stakeholders involved. As Typus continues to develop new products and features, it is quickly becoming a key player in the DeFi ecosystem on the Sui Blockchain.

Typus Finance official links: Twitter | Website | Discord

RyuFinance

RyuFinance is an all-in-one DeFi platform built on Sui Blockchain that includes a Decentralized Exchange (Dex), LaunchPad, GameFi, and RyuDao. With higher Annual Percentage Rates (APR) and faster transactions, the Dex provides a seamless trading experience for users across the globe, with support for multiple different national languages and a smooth and professional user interface.

The LaunchPad on RyuFinance is community-driven, offering lots of high-quality and creative projects for users to participate in. The platform also includes a GameFi feature, which allows users to participate in the upcoming mysterious miner and earn rewards.

In addition, RyuDao is a project driven by the community, allowing users to stake and vote on important decisions with RIPs proposals. The platform is designed to involve the community in decision-making, making it a true community-driven DeFi platform. Whether you're a trader, investor, or gamer, RyuFinance offers a variety of features to explore and participate in.

RyuFinance official links: Twitter | Website | Discord

Wrapping up

The Sui Blockchain ecosystem is home to some of the most innovative DeFi protocols in the market. The projects we've covered in this article are just a small sample of what the platform has to offer. As decentralized finance continues to disrupt traditional financial services, Sui Blockchain is well-positioned to play a significant role in this new economy. With its robust security, low transaction fees, and innovative features, it's no surprise that more and more DeFi developers are flocking to the platform. We can't wait to see what new and exciting projects emerge from this vibrant community in the future.

Be sure to check out Suipiens website and social media channels to stay up-to-date on all things about Sui Blockchain!