Bluefin Brings High-Frequency Trading to Sui-Based DEXs

Bluefin introduces institutional-grade high-frequency trading to its Sui-based DEX, narrowing the gap with centralized exchanges.

Bluefin Brings High-Frequency Trading to Sui-Based DEXs

Decentralized exchanges (DEXs) have steadily gained ground in the global crypto landscape, now accounting for roughly 25% of spot trading volume. Yet, despite this growth, DEXs still lag behind centralized exchanges (CEXs) in key areas—particularly execution speed, latency, and reliability.

To address these challenges, Bluefin, a decentralized perpetuals exchange, has introduced high-frequency trading (HFT) capabilities on its upgraded Bluefin v2, also known as Bluefin Pro, built on the Sui Blockchain. This move signals a significant step toward closing the performance gap between decentralized and centralized platforms, particularly for institutional traders.

1/ The Great Migration is here. Bluefin pioneered perps trading on @SuiNetwork, and over the past 648 days, Bluefin Perps Beta has processed over $55 billion in trading volume.

— Bluefin (@bluefinapp) July 3, 2025

With Bluefin Pro, we introduce a completely rebuilt perps exchange and are excited to take perps… pic.twitter.com/wCQg3TZSYs

A Shift Toward Institutional-Grade Infrastructure

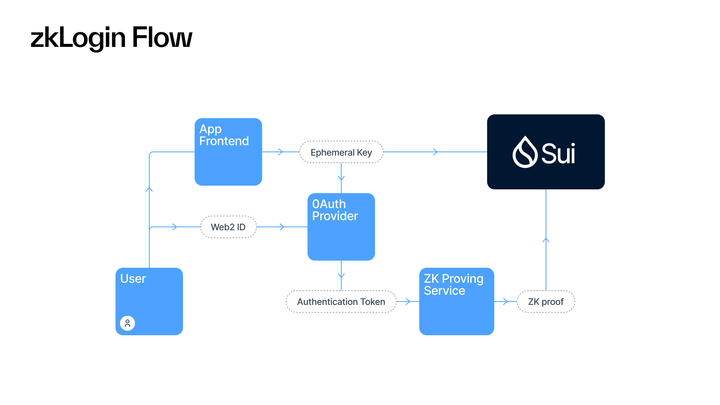

Originally launched in 2020 by the Jawaid brothers as a derivatives exchange on Arbitrum, Bluefin underwent a strategic migration to Sui in September 2023. The transition was driven by Sui’s high throughput, low latency, parallel execution, and user-friendly features like zkLogin, which allows passwordless authentication via OAuth providers.

With Bluefin Pro, the platform is now targeting professional and institutional traders who require performance standards closer to those found in traditional finance. High-frequency trading in particular requires millisecond-level order acknowledgments, minimal latency, and robust risk isolation—all areas where DEXs have historically fallen short.

Architectural Enhancements for HFT on Sui

Bluefin Pro leverages multiple layers of technical innovation to enable HFT within a decentralized framework:

Nautilus Trusted Execution Environment (TEE)

A key component of Bluefin’s architecture is Nautilus, a trusted execution environment designed to ensure that trade logic—such as price-time priority and order matching—executes securely and without external interference. TEEs are especially critical in maintaining integrity for latency-sensitive operations, offering confidentiality and verifiability even in adversarial conditions.

Sui’s Parallel Execution and Mysticeti Consensus

Sui’s unique parallelized execution engine and the Mysticeti consensus protocol allow Bluefin to offer sub-30ms order acknowledgments and ~550ms settlement finality. This matches or exceeds the latency thresholds demanded by institutional-grade HFT strategies, something previously unattainable on most blockchain-based trading platforms.

Risk Management for Institutional Traders

Alongside speed, Bluefin Pro introduces cross-margining and isolated sub-accounts—two critical features for institutional risk management. These allow traders to segregate capital across strategies, reduce exposure, and manage risk across multiple positions without jeopardizing account-wide solvency.

This level of granularity is especially important for automated HFT systems, which are susceptible to frontrunning and sandwich attacks common in public mempools. By integrating confidential order processing with verifiable integrity, Bluefin aims to protect strategic alpha from external threats.

Are DEXs Ready to Rival CEXs?

While DEXs continue to gain market share in spot trading, perpetuals trading remains heavily dominated by centralized platforms. According to recent market data, Hyperliquid captured over 80% of decentralized perpetuals volume in Q1 2025, with approximately $158 million traded during that period.

Still, platforms like dYdX, GMX, Jupiter, and now Bluefin are steadily building the infrastructure needed to support more competitive performance. Much of this growth has been catalyzed by the recent boom in memecoin activity and DeFi experimentation, especially on ecosystems like Solana, Base, and Sui.

With continued innovations in execution architecture and risk management, DEXs are increasingly well-positioned to attract a broader range of trading strategies, including institutional-grade HFT. The emergence of platforms like Bluefin Pro marks a notable inflection point in this evolution.

Conclusion

Bluefin’s integration of high-frequency trading infrastructure on the Sui blockchain represents a pivotal step in narrowing the functional divide between DEXs and CEXs. By combining sub-second execution, trusted trade logic, and robust account isolation, Bluefin Pro offers a blueprint for what next-generation decentralized derivatives platforms might look like.

As infrastructure matures and user demand continues to shift toward greater transparency and self-custody, it is likely that more institutional traders will begin to view decentralized platforms not just as alternatives—but as viable competitors.

Be sure to check out Suipiens' website and social media channels to stay up-to-date on all things about Sui Blockchain!